CBO’s Social Security Projections Redux

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

CBO’s “taxable ratio” assumption is a big contributor to high long-run deficit.

It turns out that the Congressional Budget Office’s assumption about a big decline in the share of earnings subject to taxation is a major driver of the agency’s very high projection of Social Security’s 75-year deficit.

Let me explain exactly what the taxable share is, explain why it’s important, and finally compare CBO’s assumption to that of the Social Security Trustees and the 2015 Technical Panel.

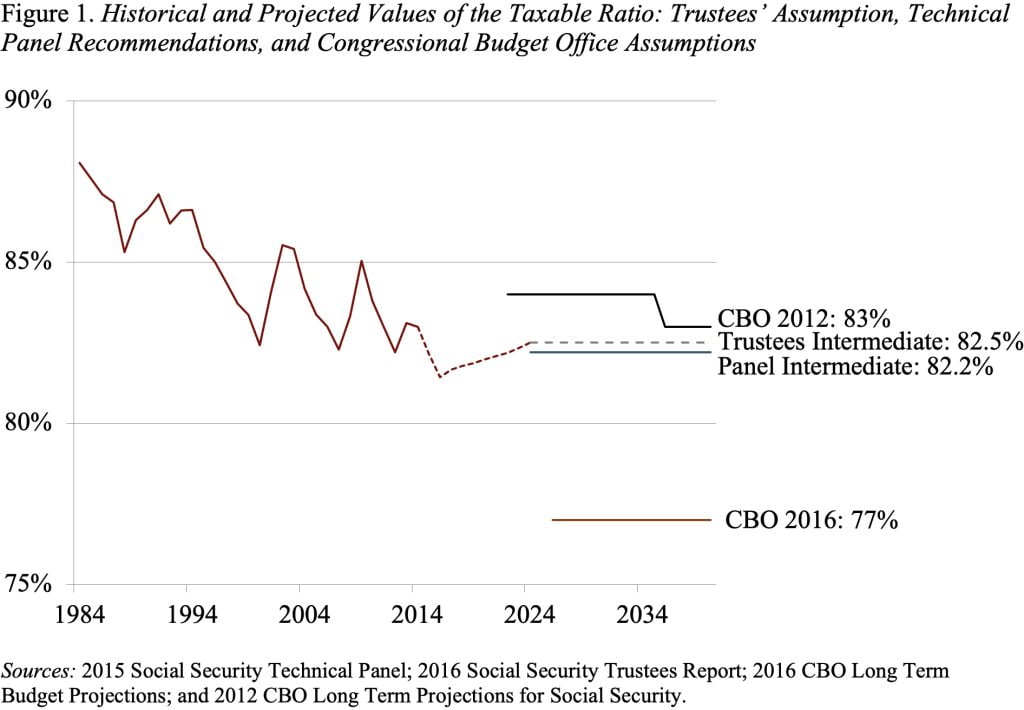

Only earnings below Social Security’s contribution and benefit base of $118,500 per year in 2016 are subject to the program’s payroll taxes and count toward benefits. The fraction of total earnings below this threshold is the taxable ratio. As wage inequality has increased, the percentage of total earnings subject to tax has declined (see Figure 1).

A decline in the taxable ratio raises Social Security costs for two reasons. To understand the effects of both channels, assume that average wage growth for workers overall is constant, but that the growth shifts to the upper end of the income distribution.

The first channel is through the progressivity of the Social Security benefit formula – that is, Social Security provides higher benefits relative to earnings for low-earners than for high-earners. Consequently, a rise in the share of covered earnings above the taxable cap means relatively lower earnings growth for workers of modest means. This slower earnings growth means less tax revenue for Social Security, but – because of the progressive benefit formula – future benefits do not decline by a commensurate amount.

A second channel by which rising earnings inequality erodes Social Security’s finances is through the Average Wage Index (AWI). The AWI is based on all covered earnings, both below and above the taxable maximum. A rise in the AWI that is driven by growth in earnings above the taxable maximum generates no additional tax revenue. But such a rise does increase benefits because the AWI is used to inflate workers’ prior earnings when calculating their benefit levels.

Thus, projections of Social Security finances depend crucially on assumptions about future earnings inequality and the ratio of taxable to total earnings. As recently as 2012, the CBO projected that the taxable ratio would stabilize around 83 percent (see Figure 1). Since then, CBO has dropped its projection by more than a percent each year, so that its 2016 projection has the taxable ratio declining to below 78 percent by 2026 and then dropping further to an average of 77 percent for the following decade. How does CBO come up with such a number? What has its analysts learned in the last few years that would lead to such a big change? Do they believe this trend can go on indefinitely?

The assumption about the taxable ratio makes a big difference. If CBO adopted the Social Security Trustees assumption about the taxable ratio, its deficit projection would be about 0.5 percentage points smaller.