Do Stock Holdings Reflect Individual Risk Preferences or the Growing Use of Target Date Funds?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

I suspected most financial assets were in 401(k) plans and most 401(k) holdings were directed by target-date funds, but the data told a somewhat different story.

When trying to figure out people’s taste for risk by looking at the share of equities in their financial portfolio, I was wondering in a world of 401(k)s about the extent to which this share would all be determined by the pattern of target date funds. Candidly, my prior was that, for all except the very rich, most household financial assets were in 401(k)s and that most 401(k) assets were in target date funds. It is always useful, however, to look at a little data. It turns out that my scenario is not quite where we are now, but might describe where we are headed.

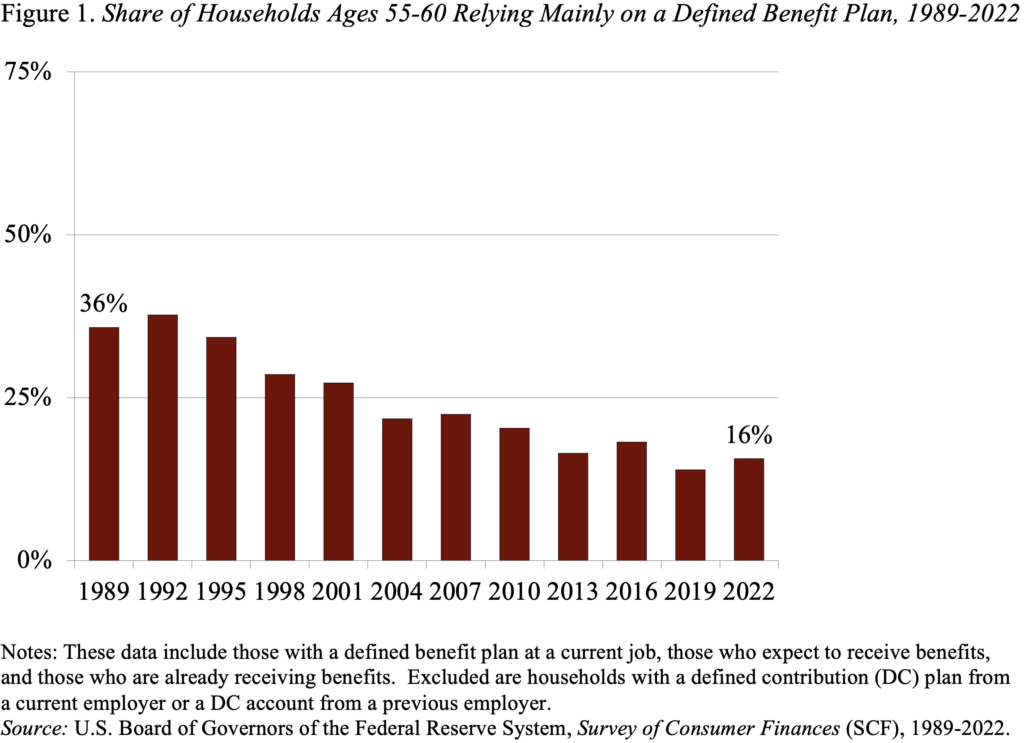

The notion was not a crazy one in that the 2020s represent the first time that workers could have spent an entire career covered by a 401(k) plan. Indeed, only about 16 percent of households approaching retirement in 2022 are relying mainly on a defined benefit plan (see Figure 1). That evolution suggests that most retirement saving may now be in 401(k)s or Individual Retirement Accounts (IRAs).

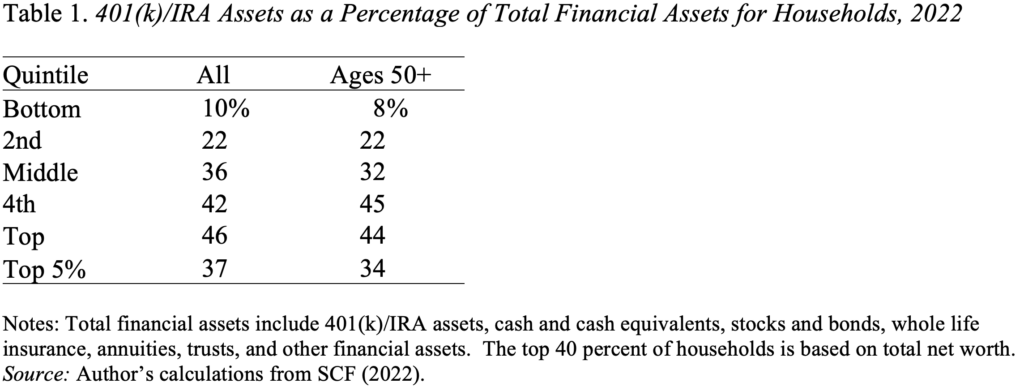

So, the question is what share of financial assets are 401(k)/IRA balances? Those percentages for 2022 by net worth quintile show that for the top two quintiles – the top 40 percent, who hold most of the 401(k) assets – retirement assets account for about 45 percent of total financial assets (see Table 1). The richest 5 percent reduce the percentage for the top quintile as a whole because they hold so much in non-retirement assets. Nevertheless, the percentages are substantially less than I had hypothesized.

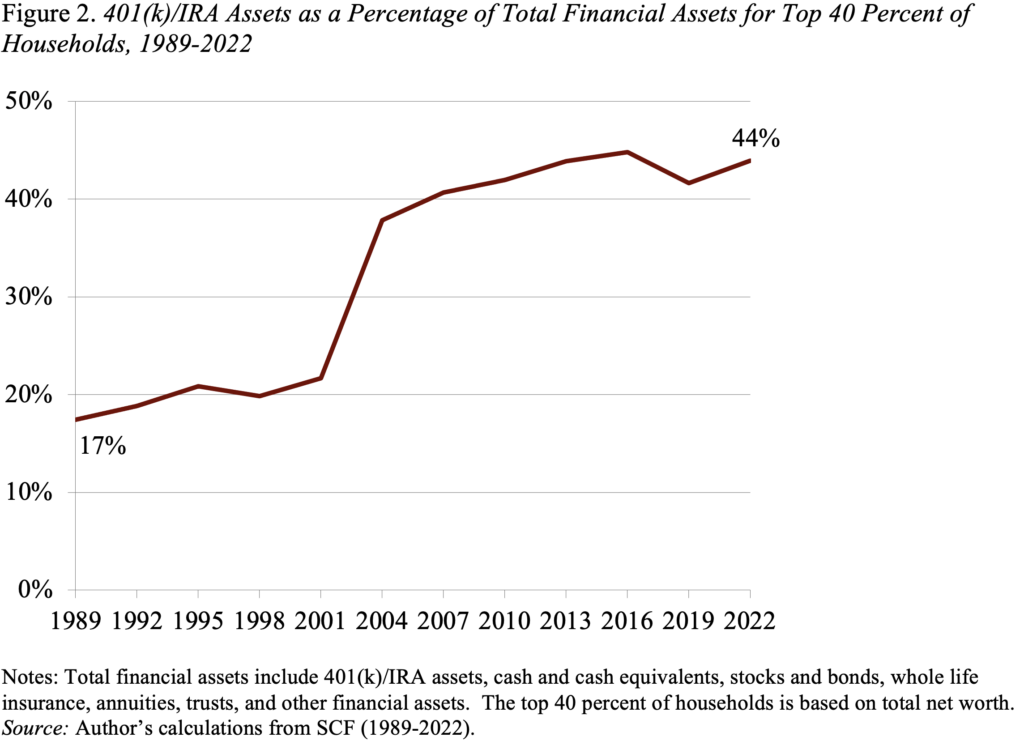

If the situation was not exactly what I thought, are we at least trending in that direction? Indeed, the percentage has increased sharply over time, albeit it’s not clear where it’s going from here (see Figure 2).

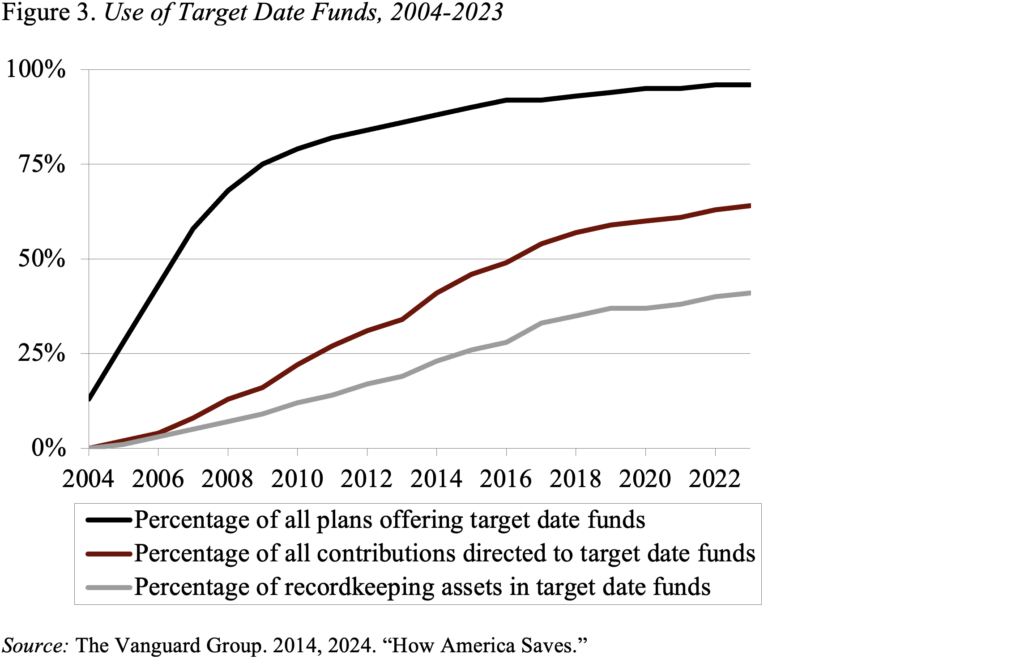

It seems like I was also a little ahead in terms of the role of target date funds (TDFs) – funds that automatically reduce equity holdings as participants age – within 401(k)s. It is not surprising given that the big change came when the Pension Protection Act of 2006 allowed plan sponsors to automatically enroll employees using TDFs as the default investment. Since then, the percentage of plans offering, the percentage of contributions directed toward, and the percentage of assets in TDFs have all been increasing rapidly (see Figure 3).

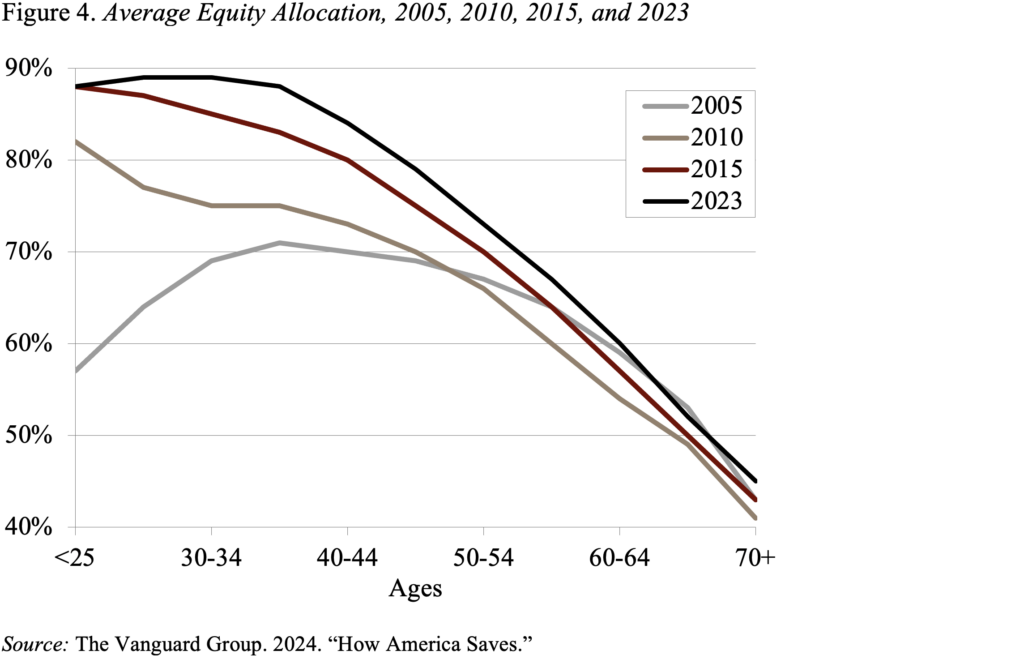

Investment in TDFs has changed the profile of asset allocation and increased holdings in equities (see Figure 4). In 2005, the allocation of equities was hump-shaped; younger participants were more conservative, middle-age participants held the most equites and older participants sharply reduced their holdings. In 2023, the equity allocation of participants sloped downward by age, starting at 88 percent for young workers, declining to 73 percent for those ages 50-54 and then to 45 percent for those 70+. Not only is the pattern very different, but the share of 401(k) assets in equities has also increased markedly.

So, the story wasn’t as clear as I had thought. For those in the top 40 percent of the wealth distribution, retirement assets are only about 45 percent of total assets and the percentage seems stable. Within 401(k) plans the importance of target date funds has been increasing over time and is likely to be even more important in the future. On the other hand, people tend to move their assets out of 401(k) plans into IRAs and may change their allocations. So, I guess that people exercise more discretion over their equity holdings than I thought.