Finally Retired? Now What?

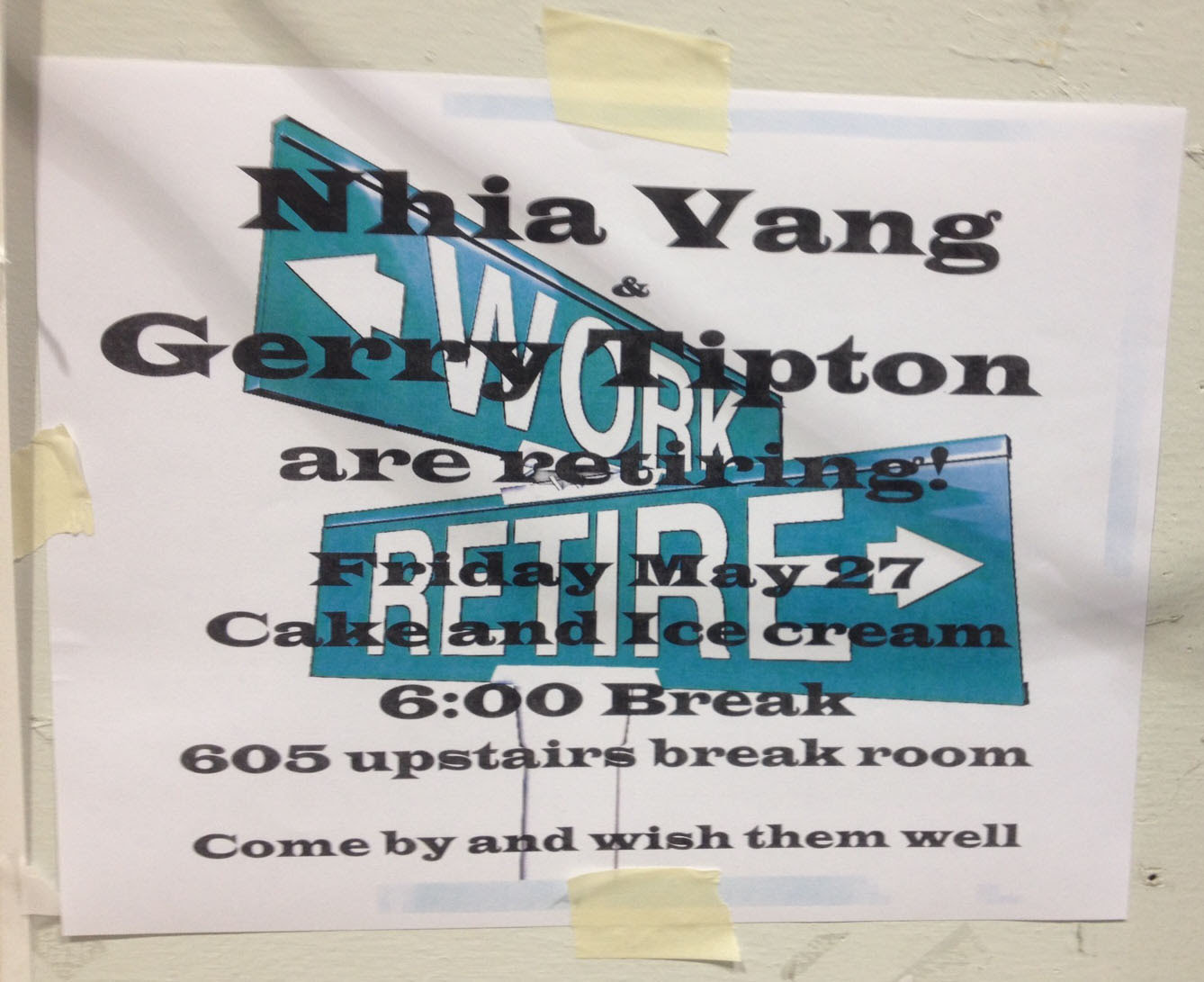

It was Gerry Smythe’s final confirmation he had never quite felt at home working in the Oklahoma airplane manufacturing plant. When well-meaning coworkers bought a cake to celebrate his and another person’s retirement, they got Smythe’s name wrong on the sign inviting everyone to the break room.

It was Gerry Smythe’s final confirmation he had never quite felt at home working in the Oklahoma airplane manufacturing plant. When well-meaning coworkers bought a cake to celebrate his and another person’s retirement, they got Smythe’s name wrong on the sign inviting everyone to the break room.

At age 63, he until recently was one of the nation’s 10 million older Americans working in physically demanding jobs in difficult conditions. He felt worn down by the factory noise, carbon dust, and standing all night on collapsed arches to assemble cabin floor beams for Boeing 777s. His requests for a transfer away from the hard floor never went anywhere, he said.

“It wasn’t really the job – I kinda liked the job,” said Smythe, who retired on May 27. “I didn’t want to stick in that environment in which I was dealing with air pollution and chemicals and decided I’d had enough.”

Now retired, Smythe savors his freedom. He’s playing more golf, has maintained his obsession with the Sunday crossword puzzle, and might volunteer at an animal shelter. But he also admits to something others have learned upon retiring: it’s a lot to get used to.

“You’re transitioning to a new phase of your life, and you’re not sure where to go. It is sorta scary,” he said in a telephone interview on a sizzling summer day at his home in Tulsa.

Everything is up in the air. He likes Tulsa but might move back to Tennessee – he once worked at the Memphis airport – or to Houston, where his mother’s family hails from. Or maybe he’ll find another job. The aviation industry is booming, so a few recruiters have called him.

One thing is certain: his financial situation. In contrast to many baby boomers, he feels well-prepared for retirement. He is vested in two different company pensions, and he and his wife have a hefty balance in their retirement accounts. Their house is paid for. While his pensions won’t kick in until 65, his financial adviser ran the numbers and believes he has enough money to bridge the 1.5-year gap.

The job Smythe retired from was his first factory job. It capped a 32-year career in the airline industry that he very much enjoyed, starting when he was 20 years old at Hughes Airwest, which morphed, through mergers, into Northwest. In his last job at Northwest, he said he ran the crew at the Memphis airport charged with troubleshooting and repairing the planes’ electronic and hydraulics systems and flight controls.

But at age 52, he was forced out during a 2005 mechanics strike at Northwest and, for the first time in his life, had no full-time employment. He got his real estate license, briefly worked for American Airlines – and was laid off – and eventually landed the airplane factory job in 2011.

How did he go from troubleshooting to assembly line work? “Getting laid off and filing out resumes, and this company calls you. When you’re out of the street looking for a job, you’re willing to expand your horizons,” he said.

So he was more than ready to retire as soon as he could. In the run up to retirement, Smythe treated himself by taking off every Monday, and he gleefully ticked off the days.

On his last night working, a water main ruptured and flooded the factory, he said. “All I could do was throw my badge to my supervisor and say, ‘Here you take care of it.’ ”

To stay current on our Squared Away blog, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

Preparing for retirement is so important. Save and live below your means the last 20 years. IRA and 401k or Roth for the new guys.

Then pay off your house as — or before — you retire is critical.

Finally, enjoy a trip or two, but still watch your spending until you reach age 70 1/2 and you start the RMD from your IRA.

Oh yes — get your regular checkups — prostate exam, colonoscopy, and heart check ups. Take care of your teeth.

It has worked for Janice and I.

— Ray Mixon age 68, almost 69

Ray,

Exactly what my wife & I are doing. I’m 70, still working but collecting. Love my job but most likely one more year will do it. Got all the exams, shots, etc. Nothing left to do but help the grandkids with college. Feeling very comfortable financially — how much money do you need at 80? Biggest problem will be to get it out of my name.

After all the sad tales of not having enough, it is refreshing to hear about some people who probably have sufficient funds to retire with some choices.

Hopefully I am sailing in that same boat.

I especially espouse the information about taking care of teeth.

I am really feeling charged after reading about the experiences these people had; its great to see that they are happily enjoying their retirement life without any regrets.