Government Announces Surprising Hike in Medicare Part B Premiums

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The decision whether or not to cover Aduhelm, the new Alzheimer’s drug, has huge implications.

Yikes. As I was extolling the virtues of Social Security’s 5.9 percent-COLA, the Centers for Medicare and Medicaid Services (CMS) announced that they were increasing the premium for Medicare Part B by 14.5 percent.

As a reminder, Medicare is composed of two programs. Part A, Hospital Insurance (HI), which covers inpatient hospital services, skilled nursing facilities, home health care, and hospice care. HI is financed primarily by a 2.9-percent payroll tax, shared equally by employers and employees. The second and larger program is Supplementary Medical Insurance (SMI), which consists of two separate accounts: Part B, which covers physician and outpatient hospital services, and Part D, which covers prescription drugs. SMI is financed by a combination of general revenues and participant premiums. The Part B premium is set at 25 percent of projected program costs.

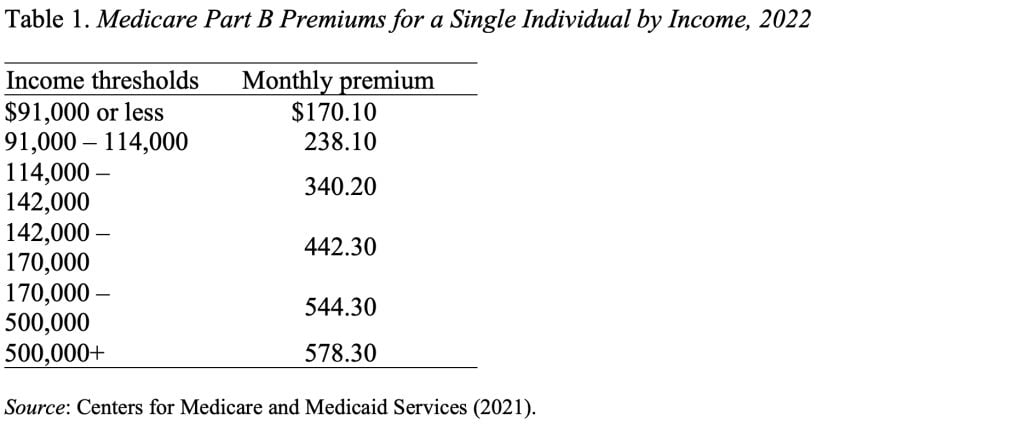

With a 14.5-percent increase, the Part B premium for a single individual – with income less than $91,000 – is slated to rise from $148.50 in 2021 to $170.10 in 2022. And since Medicare premiums increase with income, individuals with income of $170,000 to $500,000 will see their premium increase from $475.20 to $544.30! (See Table 1 for 2022 premiums.)

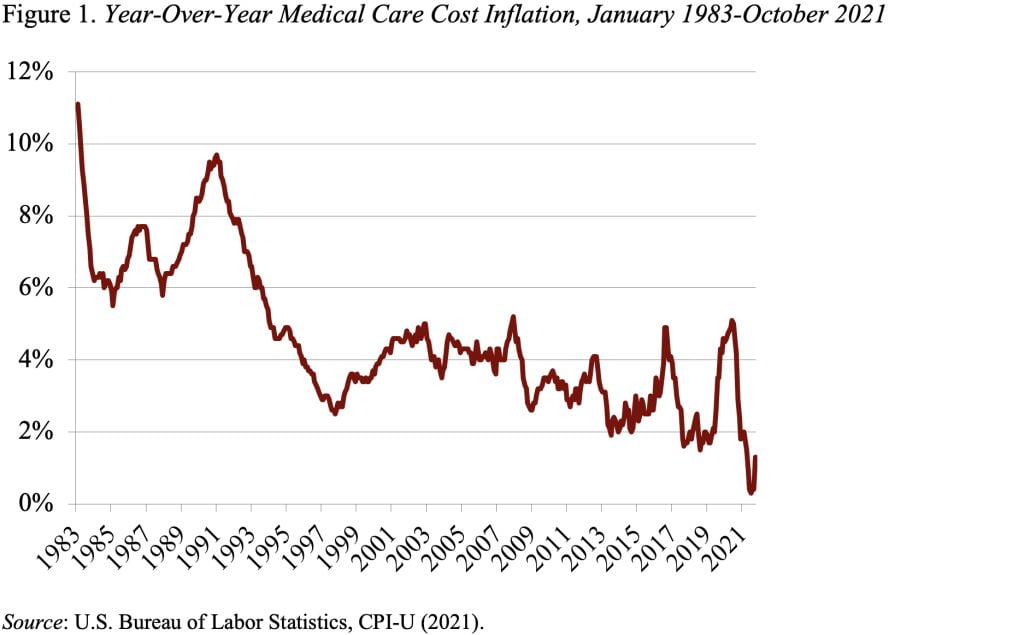

How did this happen when health care costs grew by only 0.4 percent in the past year (see Figure 1)? And the announced increase was also significantly higher than the 6.7 percent predicted by the CMS Trustees in August.

Apparently, the increase was due to three factors – two fairly routine and one horrifying! The routine factors include: 1) projected rising prices and increases in intensity of care; and 2) making up for a cap in Part B premium increases in 2020.

The horrifying source of the increase relates to Aduhelm, the new Alzheimer’s drug estimated to cost $56,000 a year. While the process is still underway to determine whether and how Medicare will cover Aduhelm, CMS decided to increase “contingency reserves” to cover possible significantly higher expenditures in the future.

As an aside, the reason that Aduhelm falls under Part B instead of Part D is that it is administered in physicians’ offices rather than purchased at a pharmacy. One implication of being under Part B is that traditional enrollees have to pick up 20 percent of the cost of most Part B medications, which would translate into about $11,200 in out-of-pocket costs for those prescribed Aduhelm.

So where does this enormous increase in premiums leave Social Security beneficiaries after they pay the higher premium? An individual currently receiving $1,600 (the approximate average retiree benefit) will see benefits go up by $94 from the COLA, but pay $22 more in Medicare premiums, resulting in a net increase of $72 or 4.5 percent of the original benefit amount. Thus, while the Part B increase does not eliminate the COLA, it seriously erodes its inflation protection.

But the thing that really scares me is that a decision to cover Aduhelm could lead to spiraling Medicare costs and premium increases that swamp Social Security COLAs in the future, eroding the purchasing power of benefits. And, from reading press accounts, it’s not even clear that Aduhelm is particularly effective. I hope somebody makes smart decisions here!!