Higher Medicare Premiums Will Eat Up More than 25% of Social Security’s COLA

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Too much of our national and personal resources are being used to pay for healthcare.

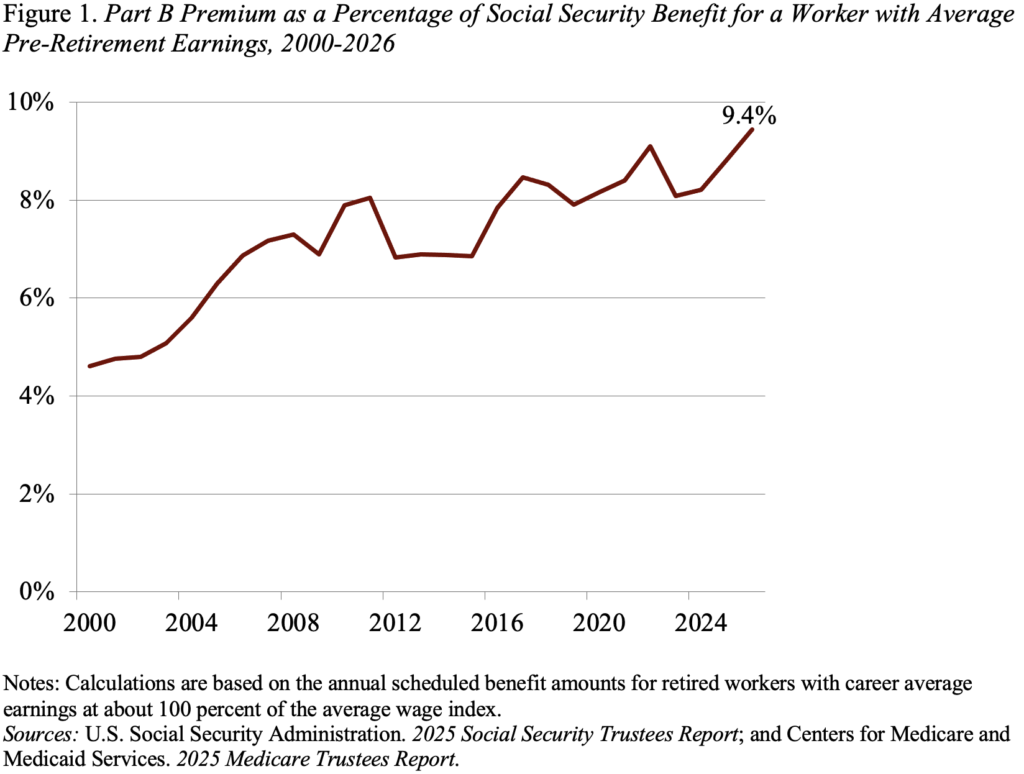

In November, the Centers for Medicare & Medicaid Services announced that the Part B premium will rise from $185 in 2025 to $202.90 per month in 2026. This 10-percent increase means that the base premium will exceed $2,400 next year. Moreover, Part B premiums as a share of annual Social Security benefits – defined as the benefit for the retired workers with average pre-retirement earnings – will reach an all-time high of 9.4 percent (see Figure 1). The increase in 2026 will also eat up over a quarter of Social Security’s 2.8-percent cost-of-living adjustment.

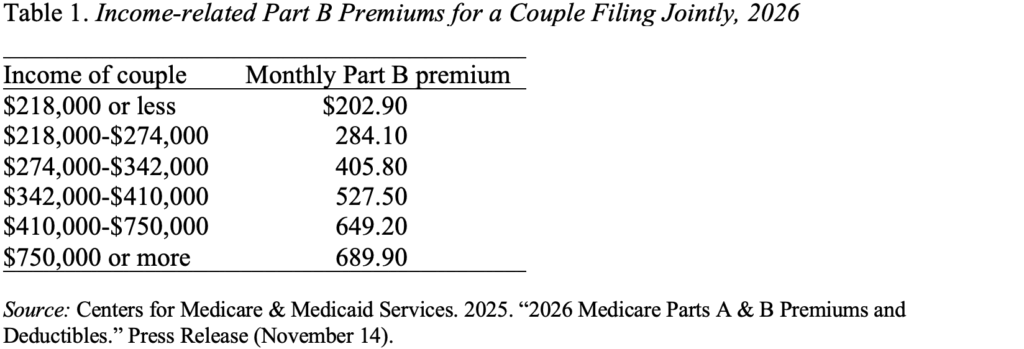

Moreover, a beneficiary’s monthly premium is related to income. For 2026, the required amount rises from $202.90 for a couple with annual income of $218,000 or less to $689.90 for a couple with $750,000 or more (see Table 1).

The increase in Part B premiums reflects the increase in the cost of Medicare’s outpatient services, such as physician visits, hospital outpatient services, diagnostic tests, and physician-administered drugs. Premiums are set to cover 25 percent of estimated total outlays.

Of course, Part B premiums are not the only healthcare-related retiree costs. Under Part A, which covers inpatient hospital care and is financed primarily by the payroll tax, beneficiaries will face a deductible of $1,736 in 2026. Medicare Part B beneficiaries, in addition to the monthly premium discussed above, will face a deductible of $283. Finally, in Part D, which covers drugs, beneficiaries face another premium, which varies by plan, and an income-related premium, which is deducted directly from their Social Security benefit. Because Medicare’s out-of-pocket costs can be quite high, many enrollees buy supplemental insurance, which can involve yet additional premiums.

And, finally, Medicare does not cover an array of health-related costs, such as dental, vision, and hearing. Most importantly, except for some time in a skilled-nursing facility after a hospital stay, Medicare does not cover long-term care expenses.

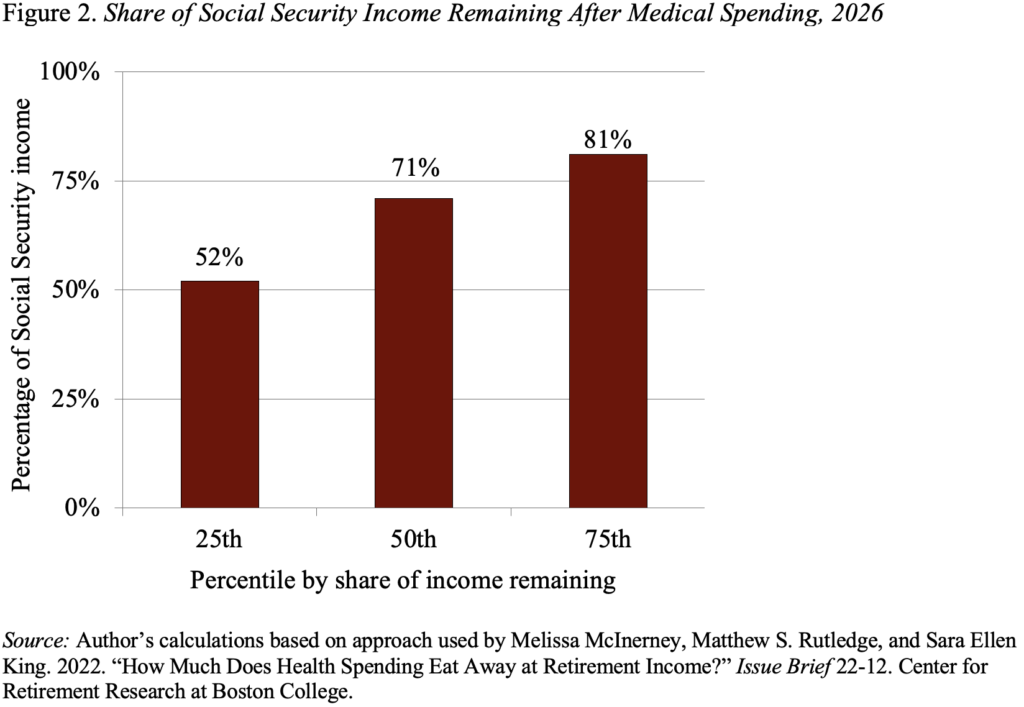

Ignoring these large omissions from Medicare coverage, it is still interesting to know how much Social Security income retirees have for other expenditures after paying their medical costs. My colleagues made this type of calculation using data from the 2018 Health and Retirement Study. Figure 2 presents a rough update of their findings to account for the fact that the Part B premium as a percentage of the average Social Security benefit will be 9.4 percent in 2026 compared to 8.3 percent in 2018. While this ad hoc adjustment will probably make the authors cringe, the results show that the share of Social Security income remaining after out-of-pocket medical spending is 71 percent for the median beneficiary. For those at the 25th percentile in terms of Social Security income, the share remaining for non-medical expenditures is only 52 percent, and for those at the 75th percentile in the distribution, the remaining share is 81 percent.

The bottom line here is not new – we’re using too much of our national and personal resources to pay for healthcare.