Households Have a Good Sense of Their Retirement Preparedness

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

And, unfortunately, more than half are not prepared.

In a recent study we used the National Retirement Risk Index (NRRI), which measures the percentage of working-age households who are “at risk” of being financially unprepared for retirement, to see whether people know if they are at risk.

The NRRI calculates for each of today’s working households in the Federal Reserve’s Survey of Consumer Finances (SCF) a replacement rate – projected retirement income as a percentage of pre-retirement earnings – and compares that replacement rate with a target replacement rate. Those who fail to come within 10 percent of the target are defined as “at risk.” The Index shows that even if households work to age 65 and annuitize all their financial assets, including the receipts from reverse mortgages on their homes, 52 percent will be at risk of being unable to maintain their standard of living in retirement.

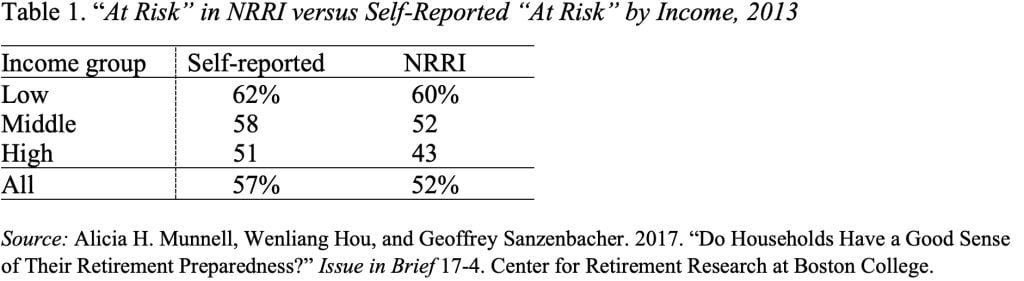

To some critics, the NRRI finding that more than half of households are at risk in retirement seems alarmingly high. One way to gauge whether the Index is capturing an accurate picture of the situation is to compare it to households’ own perceptions of their retirement preparedness. The SCF asks each household to rate the adequacy of their anticipated combined income from Social Security and pensions, the two main sources of retirement income for the vast majority of households. As shown in Table 1, their self-assessment of retirement preparedness is relatively consistent with the NRRI calculations.

Even if aggregate perceptions match the NRRI, it does not mean that individual households have a correct assessment. For example, all of the individual households could get it wrong, but their errors could offset – i.e., 50 percent of households could incorrectly think they are at risk while the other 50 percent incorrectly think they are not at risk.

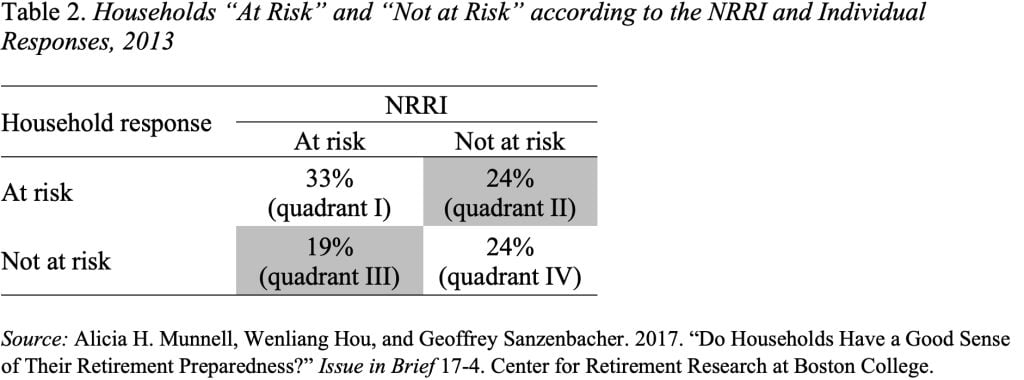

So, we undertook a second exercise to examine how well individual households perceive their retirement risk. Quadrants I and IV in Table 2 show that the self-assessments of 57 percent of households agree with the NRRI – they report not having enough to maintain living standards and the NRRI says they are at risk, or they report being adequately prepared and the NRRI says they are not at risk.

Forty-three percent of households get it wrong. Twenty-four percent (Quadrant II) are overly concerned – they report being inadequately prepared, but the NRRI says that they are not at risk. This “too worried” group appears to not fully recognize the value of potential income from owning a home, being covered by a defined benefit plan, and being eligible for a 50-percent spousal benefit from Social Security.

Nineteen percent of households (Quadrant III) are less worried than they should be. The key drivers are having a defined contribution plan and being in the high-income group. These households may either suffer from “wealth illusion,” not recognizing how little income can be derived from their 401(k) balances or not understanding how much wealth accumulation is required to maintain their standard of living.

The key message, however, is nearly three-fifths of households have a good gut sense of their financial situation, and in the aggregate, households’ self-assessments closely mirror the results produced by the NRRI. These findings suggest that inadequate retirement preparedness is indeed a widespread problem.