How Does Raising Children Affect Retirement Risk?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Kids moderately increase the risk of falling short for households in their 50s.

We just released a study that looks at the relationship between children and retirement security. Kids are expensive. Parents divert considerable resources to their children – both time out of the labor force when the kids are young and direct expenditures on food, clothing, education, etc. as they grow.

But those child-related expenditures do not mean that parents will end up less well prepared for retirement. For example, if households cover the costs of child-rearing by spending less on themselves, they can remain on track for retirement. However, households may not behave in this optimal way, instead raising their total spending when they have kids and then trying to maintain this higher spending path even after the kids are gone. These households may be headed for trouble in retirement.

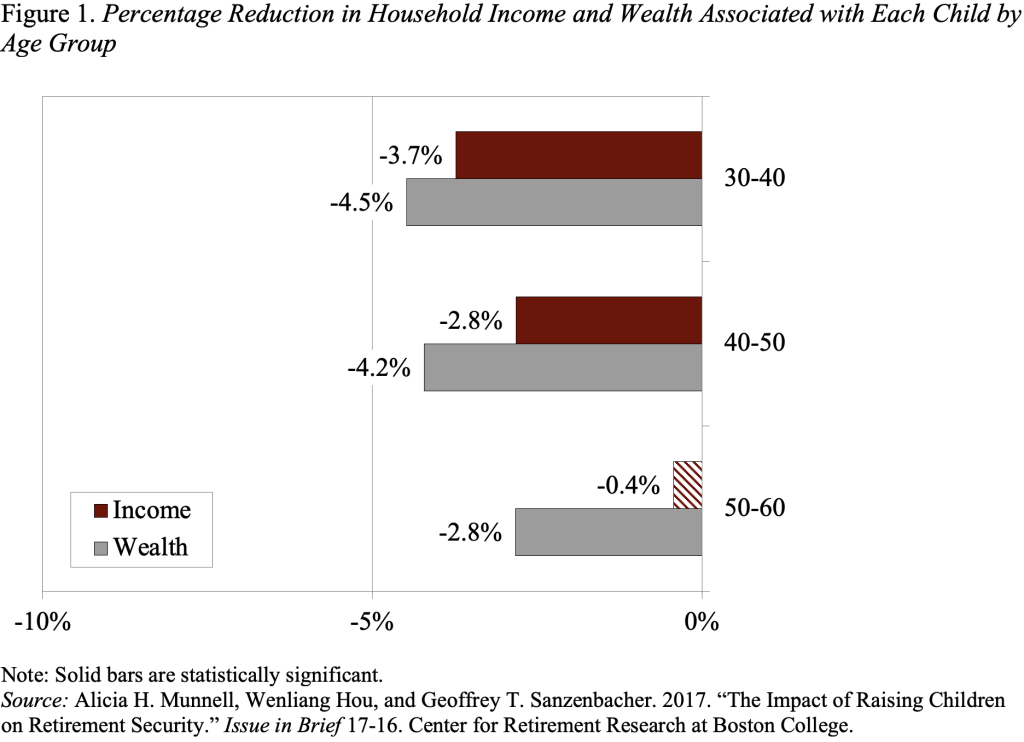

In order to determine the impact of kids on well-being in retirement, we estimated three equations that relate the existence of children to: 1) household income at various ages; 2) household wealth at various ages; and 3) the probability of being at risk as calculated in the National Retirement Risk Index (NRRI). We defined wealth comprehensively to include financial wealth, assets in defined contribution plans, net housing wealth, and the pro-rated value of defined benefit and Social Security wealth. The equation also contained variables controlling for being a two-earner household, educational attainment, coverage under a defined benefit or defined contribution plan, and the presence of college saving.

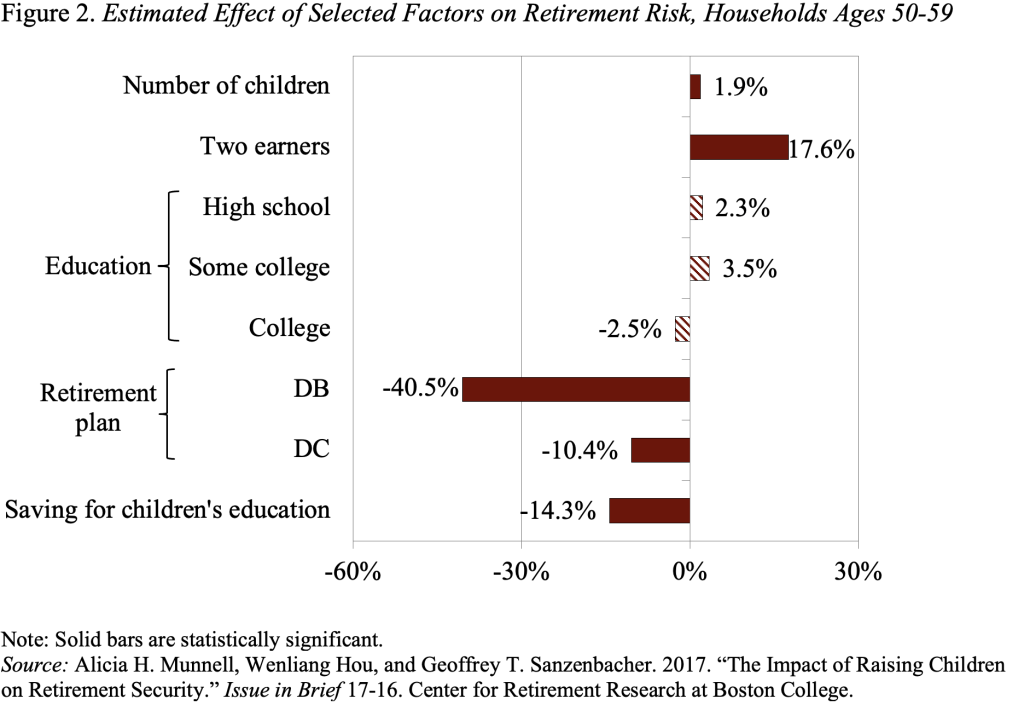

Figure 1 shows that households with kids generally have lower wealth and income, with some differences by age. Each kid reduces household income by about 4 percent for households in their 30s, but the percentage reduction declines to virtually zero for older households. This pattern is consistent with the notion that mothers of young children reduce their labor force effort for a time and then return to work. In terms of wealth, each kid is associated with roughly 3-4 percent less wealth.

Given that more children means less wealth, one would expect that, for households in their 50s, having kids would make them more likely to be at risk. The regression results show that, by the time households are in their 50s, each child increases the share of households at risk by two percentage points. This finding means that the NRRI for households with two kids should be 4 percentage points higher than for a household with no kids. To help put the size of this effect in context, it is helpful to compare it to the effects of the control variables (see Figure 2). Kids have a considerably smaller impact on a household’s retirement risk than several of the controls. In short, the regression results suggest that children moderately increase a household’s prospects of being at risk.