How Big a Social Security COLA Can Retirees Expect in 2023?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Highly likely that benefits will increase by more than 9 percent.

The time has come to speculate about Social Security’s cost-of-living adjustment (COLA) for 2023. Automatic indexing of benefits to keep up with rising prices is a wonderful feature of our Social Security program.

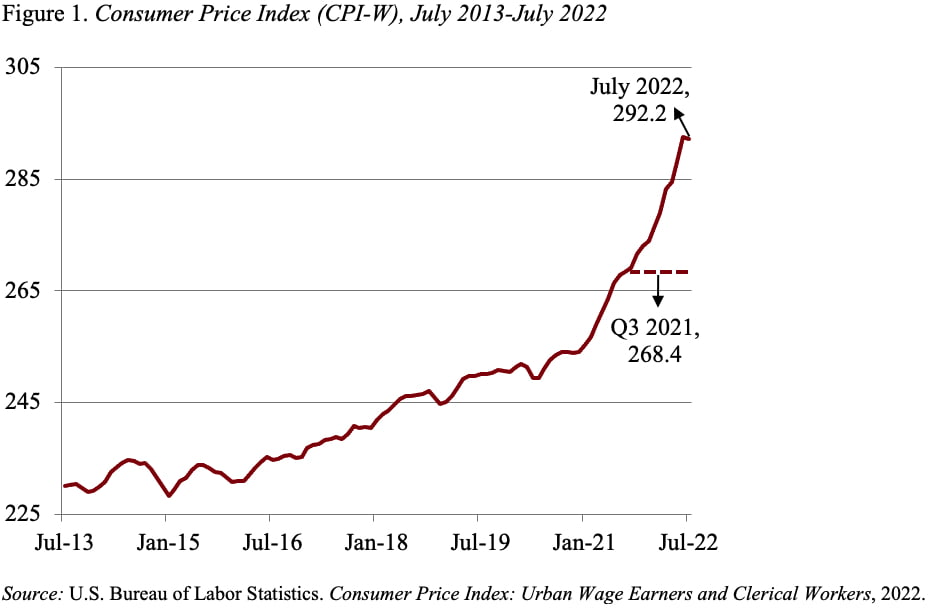

Since the COLA first affects benefits paid after Jan. 1, Social Security needs to have figures available before the end of 2022. As a result, the adjustment for 2023 is based on the increase in the CPI-W for the third quarter of 2022 over the third quarter of 2021. We know the 2021 number (see Figure 1), but we need data for July, August, and September to calculate the third-quarter average for 2022. All we have so far is the July number.

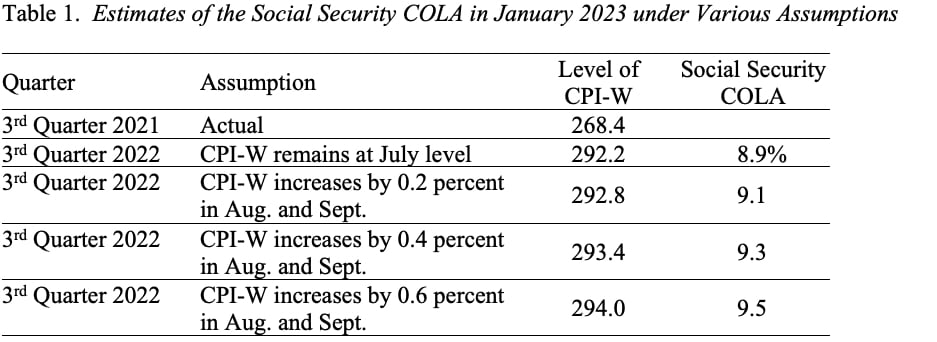

The only option is to make some assumptions. As a starting point, Table 1 shows that the COLA for 2023 would be 8.9 percent if the CPI-W remained at its July level in August and September. At the other extreme, if the CPI-W rose by 0.6 percent in August and another 0.6 percent in September, the 2023 COLA would be 9.5 percent.

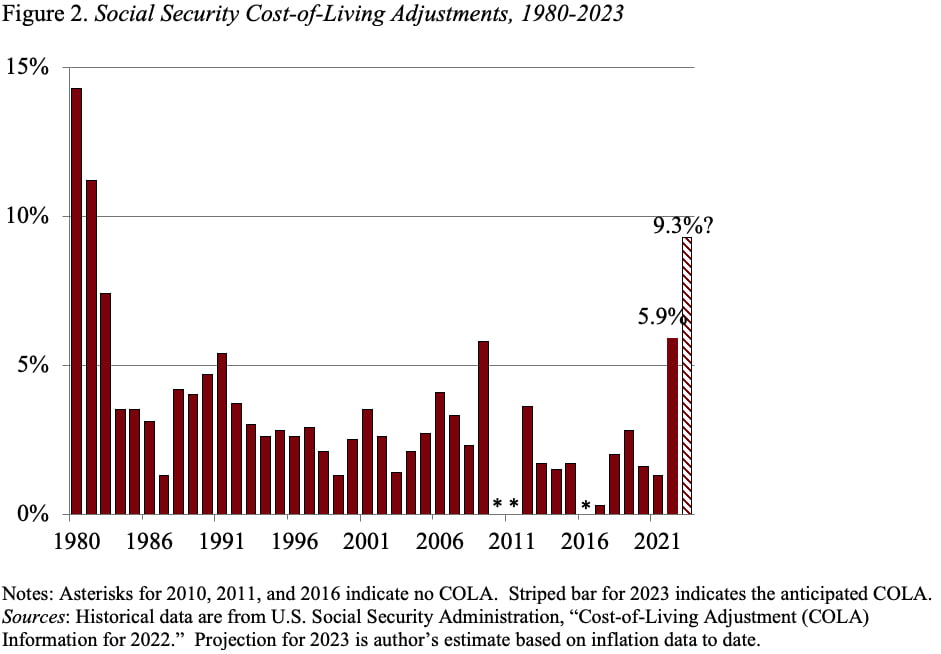

Regardless of the precise outcome, a COLA in the range of 8.9-9.5 percent would be the largest since the 11.2 percent increase in 1981 (see Figure 2).

My best guess is that such a large COLA will be more than retirees need to keep up with rising prices in 2023. The combination of declining energy prices, some improvement in supply chains, and the effects of Fed tightening is likely to slow inflation. Too small a COLA as inflation heats up and too large a COLA as inflation slows is the inevitable result of a backward-looking calculation. But it makes perfect sense to base the COLA on actual data rather than a forecast, which could involve constant corrections for over- or under-predicting. And most importantly, over the whole inflation cycle, retirees receive an appropriate increase.