How Can Smart People Argue for a Tax Cut?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

We need to get our fiscal house in order, not make matters worse.

In this new world, I have expanded my podcast listening to try to understand the other team. High on my list is “All In” – originally a group of four high-tech venture capital hosts, so clearly smart guys and very rich. Right now, they are three, because one of their group, David Sacks, has become “White House A.I. & Crypto Czar.” Their angle seems to be that less regulation and more support for AI and other technological advances will lead to a bigger economic pie and more stuff for the middle class. They don’t seem like ideologues, and they don’t like it when Trump does mean stuff.

Interestingly, this group has “discovered” that the U.S. faces a major issue with regard to the federal budget and appears to support the efforts by Musk and his DOGE minions to cut spending to avoid a meltdown. What seems astonishing to me is that: 1) the fiscal situation should come as “news” to this otherwise well-informed group; 2) the group does not seem to understand how the government spends its money; and 3) they never question the wisdom of a major tax cut that will increase deficits and debt even further.

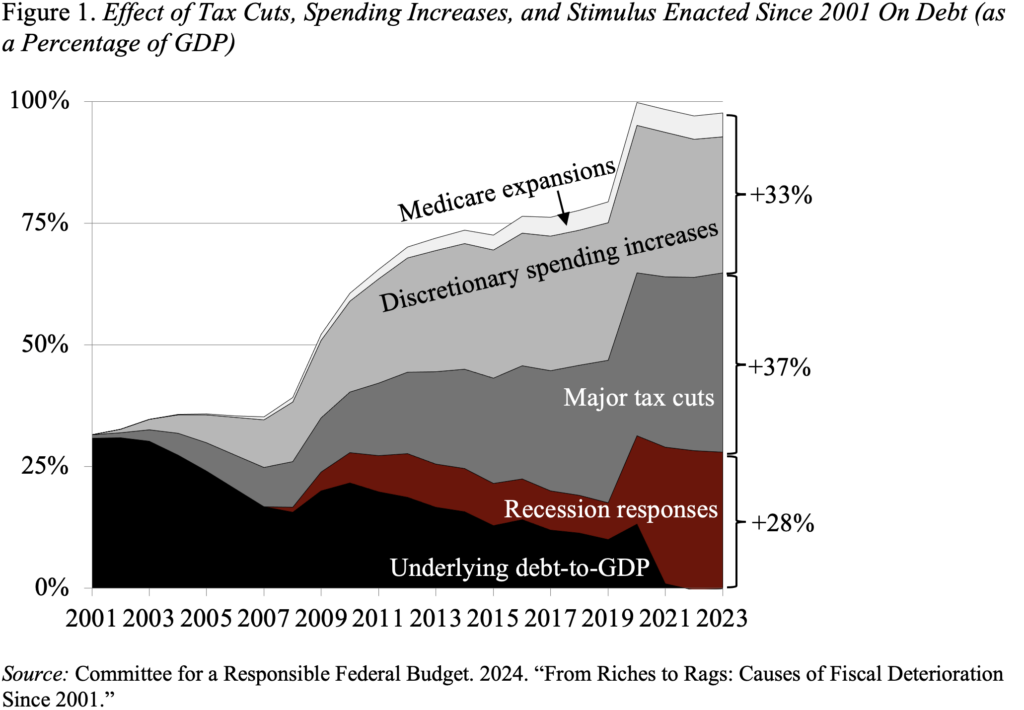

Our current fiscal situation did not emerge overnight. We have moved steadily from riches to rags since 2001, when the government ran a surplus and was scheduled to pay off the national debt by 2009. The bi-partisan Committee for a Responsible Federal Budget has done a wonderful analysis of the policy changes that have contributed to the nation’s fiscal deterioration (see Figure 1). And indeed, the deterioration has been a bipartisan effort of major tax cuts and spending increases that has moved us from paying off the federal debt to having a deficit equal to about 100 percent of GDP. Of course, debt becomes more burdensome when interest rates rise, but there’s really no news here.

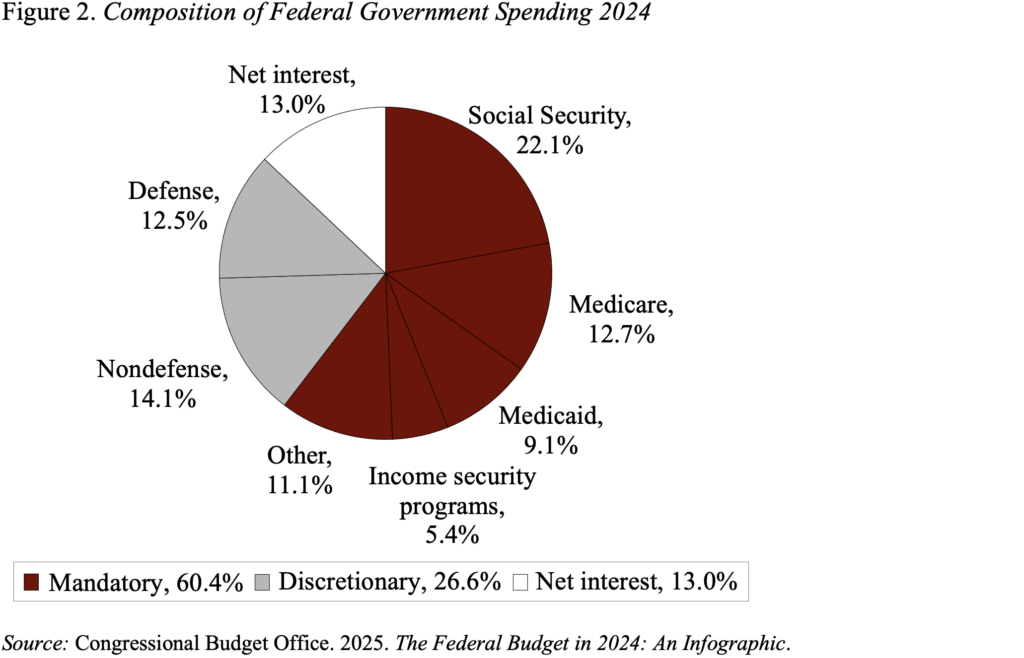

In terms of how the federal government spends its money, personnel costs are a tiny, tiny fraction of the total. Basically, the federal government has been described as an insurance company with a standing army. We spend our money on retirement and health benefits for the aged and those with disabilities (Social Security and Medicare) and on programs to provide those in need with health care (Medicaid) and income support (see Figure 2). The two other major components are defense spending and interest on the debt. Personnel costs consist of about 4 percent of total outlays. Randomly firing government employees is not going to solve anything, and will only cause disruption in services to the public.

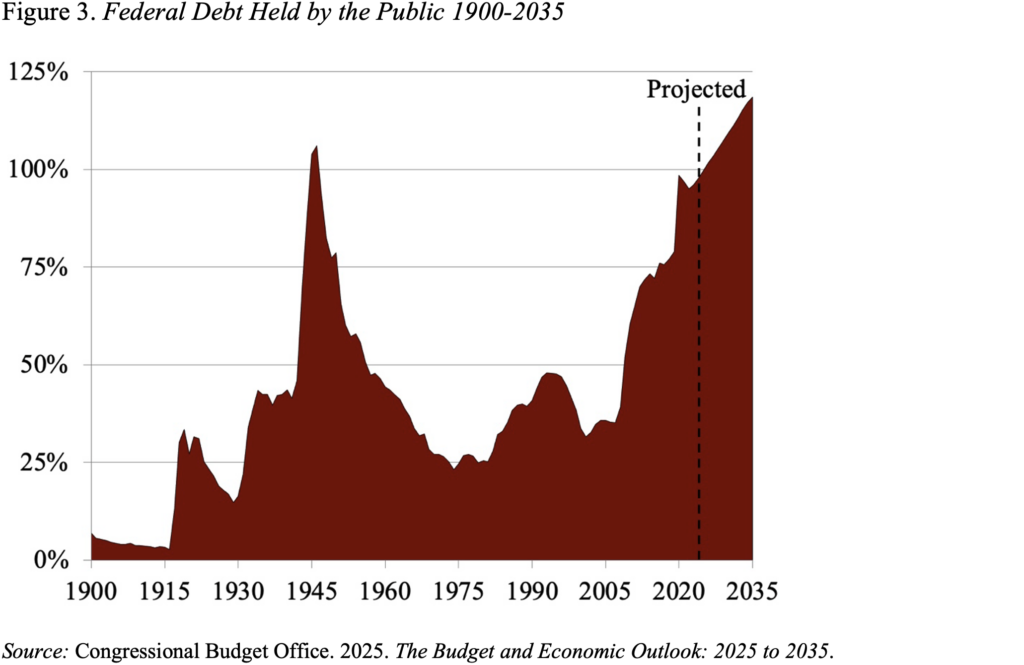

Finally, how can anyone who pretends to be concerned about the nation’s fiscal situation want to enact a major tax cut? According to the Congressional Budget Office (CBO), the government is currently slated to run a deficit equal to 6.2 percent of GDP in 2025. Without corrective action, deficits of roughly that size are projected throughout CBO’s projection period. As a result of these persistent deficits, debt swells. Federal debt in the hands of the public rises from 100 percent of GDP this year to 118 of GDP in 2035, greater than at any point in our nation’s history (see Figure 3). Importantly, these projections assume that most of the tax cuts in the Tax Cuts and Jobs Act of 2017 expire as planned at the end of 2025. If these tax cuts are not allowed to expire, the ratio of debt to GDP would increase even more. How can people who claim to worry about the nation’s fiscal situation argue for a major tax cut?

In short, I like listening to the other team, but when they get in my lane they don’t make any sense at all.