How Does the Social Security Claiming Process Vary by Race?

The brief’s key findings are:

- The Social Security Administration’s (SSA) online tools could help meet the growing demand for SSA services.

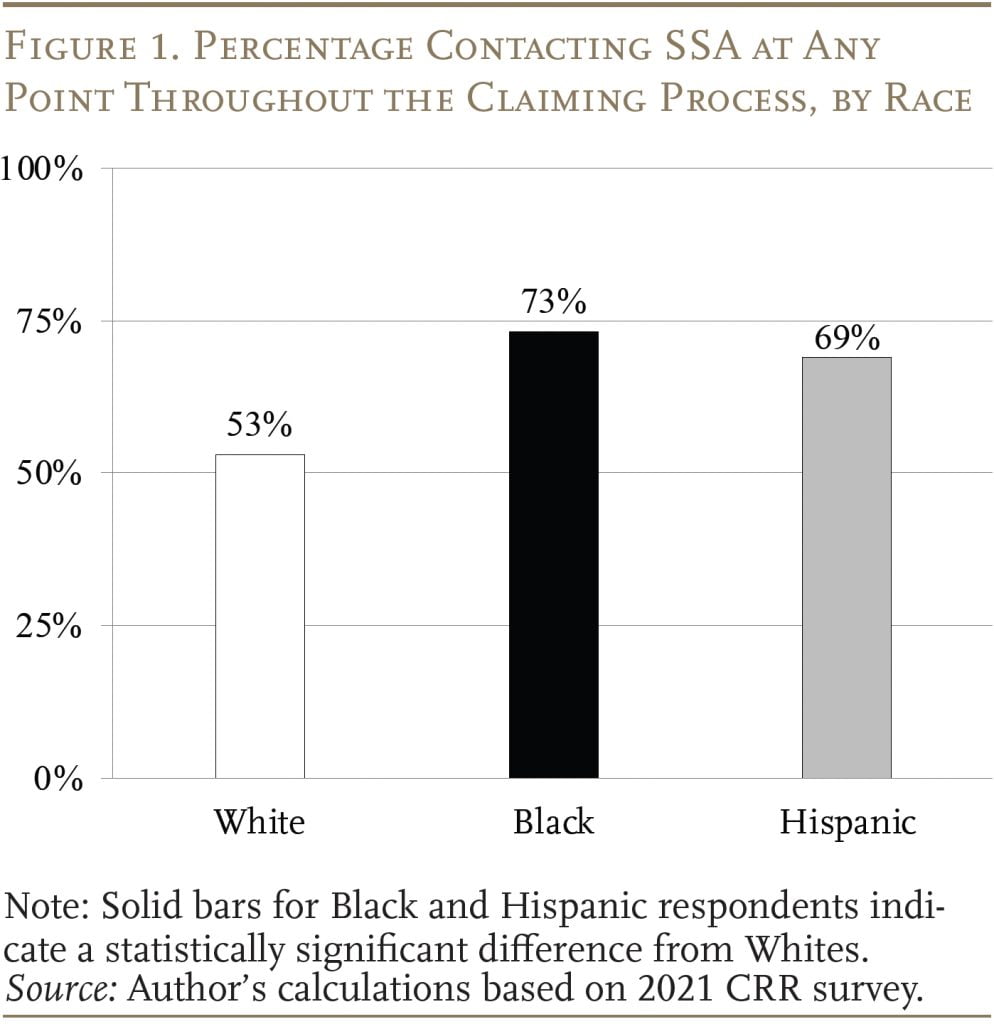

- But a 2021 CRR survey suggested about two-thirds of retirees still contact an SSA representative, with non-White people more likely to do so.

- Using the same survey data, this study explores whether racial differences exist in when and why people contact SSA.

- It does find some racial variations, but they are relatively modest overall.

- That said, policies that make it easier to get basic information or correct data errors online could also reduce racial differences in contact rates.

Introduction

Retiring baby boomers are increasing the demand for services from the U.S. Social Security Administration (SSA) at a time when budget constraints and retiring staff are limiting the agency’s capacity to deliver them. Using online services – rather than contacting a representative – offers a way for SSA to meet increased demand with fewer resources. However, prior CRR survey research suggests that almost two-thirds of retirees contact SSA in person or by phone during their claiming process and non-White individuals are more likely to do so than White individuals. Using these same survey data, this brief explores whether racial differences exist in when and why individuals contact SSA.

The discussion proceeds as follows. The first section reviews the CRR’s 2021 survey on individuals’ claiming process. The second section examines whether the survey data show any racial differences in when people reach out to SSA representatives. The third section explores any racial differences in the reasons why people contact the agency. The fourth section looks at the racial impact of policies designed to reduce the need to interact with SSA. The final section concludes that the racial differences in the timing and reasons for reaching out to SSA are small compared to differences in the share that choose to contact SSA at all. That said, policies that reduce the need to contact SSA to obtain basic information or correct data errors could reduce racial differences in contact rates.

Data and Prior Research

In 2021, the CRR surveyed roughly 2,600 older individuals about their recent or intended process for claiming Social Security retirement benefits.1Specifically, the CRR survey was administered to older individuals in NORC’s AmeriSpeaks Survey Panel from May to June of 2021. The survey targeted individuals ages 62-70 who claimed retirement benefits in the last five years and those ages 57-70 who intended to apply within the next five years. In total, the survey contained about 1,600 recent retirees and 1,000 near retirees. Importantly, the survey sample adequately reflects the national demographics for older individuals (based on a comparison to the 2020 Current Population Survey). For more details, see Aubry and Wandrei (2021). The survey includes questions on the overall claiming process of respondents, including their interactions with SSA before, during, and shortly after claiming. As a result, it provides a comprehensive picture of the claiming experience of respondents: the claiming path taken, the obstacles encountered, the self-reported reasons for their chosen path, overall satisfaction with the process, and suggestions for improvement.2For example, the survey captures whether a respondent communicated with SSA online, on the phone, or in-person before, during, and/or after claiming their benefit, and the specific reasons why. Also, if a respondent claimed online, the survey asks whether they did so at home, at a field office using an SSA desktop or kiosk, or at a public location (e.g., a library). And, for those who did not claim online, the survey prompts respondents for specific reasons – such as an error involving their name, age, and/or work history in the SSA system or simply a lack of awareness of the online option – as well as allowing for open-ended responses.

The CRR’s initial analysis of the survey responses found that almost two-thirds of respondents contacted (or intended to contact) SSA and that those who contacted SSA were more likely to be non-White (see Figure 1). The solid bars for the Black and Hispanic categories indicate a statistically significant difference from Whites. This brief uses the same survey to focus on whether racial differences exist in when and why individuals contact SSA.

Patterns of SSA Contact During the Claiming Process

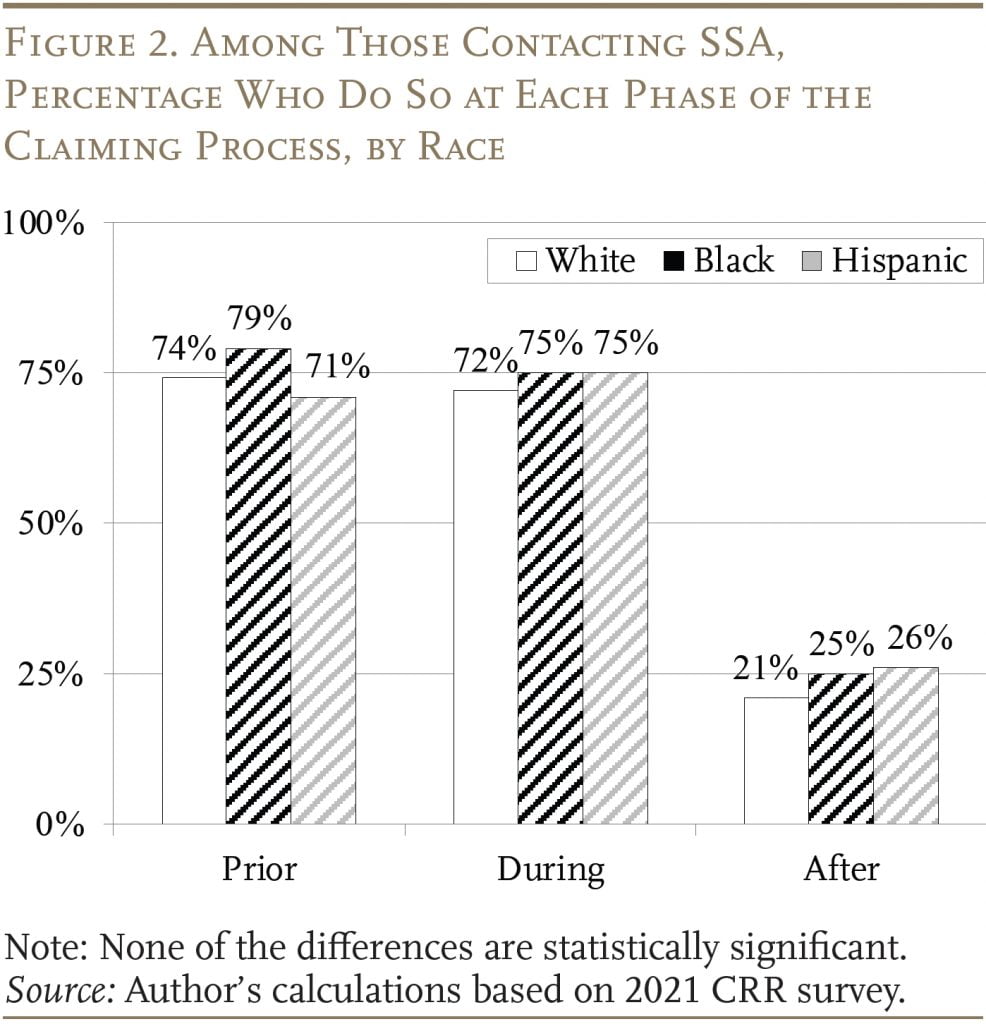

While non-White individuals are more likely than Whites to contact SSA at least once during their claiming process, it is not clear whether the patterns of contact differ by race/ethnicity.3Multiple studies in the last 10 years have highlighted racial differences in sources of information about Social Security and knowledge of Social Security rules that would contribute to differences in when and why individuals contact SSA during their claiming process. See Carman, Atshan, and Williams (2023); Knapp and Perez-Arce (2022); Peterson, Smith, and Guan (2019); Rabinovich, Peterson, and Smith (2017); and Yoong, Rabinovich, and Wah (2015). Figure 2 shows that – among those who contact SSA – the likelihood of interacting with SSA during each phase of the claiming process is quite similar across race. While Black individuals are a bit more likely to contact SSA during each phase than Whites, none of the differences are statistically significant. Similarly, although the pattern for Hispanics is also a bit different from Whites, none of the differences are statistically significant.

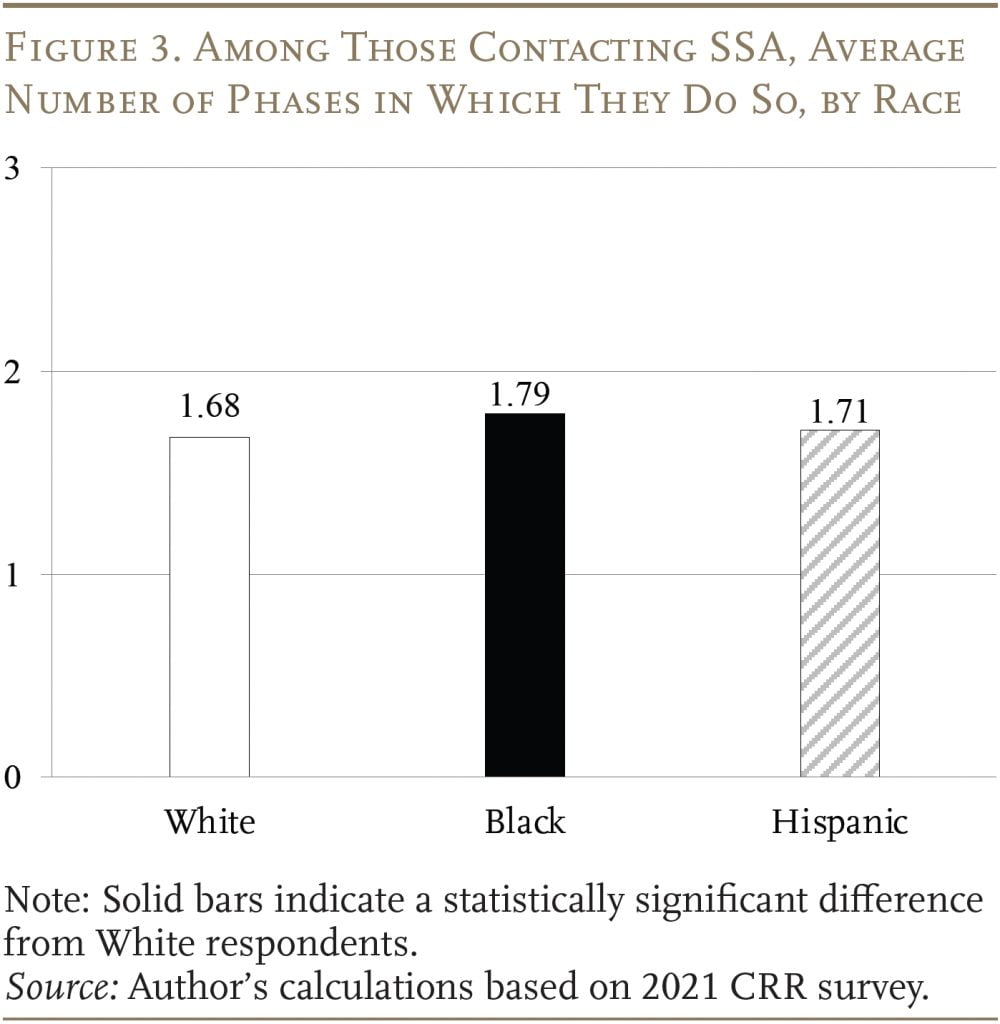

Figure 3 shows that, among those who interact with SSA during claiming, the frequency of contact is also about the same across race. However, the small difference between Black and White contacts is statistically significant, as it seems that the slightly higher propensity for Black individuals to contact SSA at each phase accumulates over the whole claiming process.

In short, this analysis finds no substantial differences by race in the patterns of SSA contact or in the frequency of contact over the entire claiming process.

Reasons for Contacting SSA

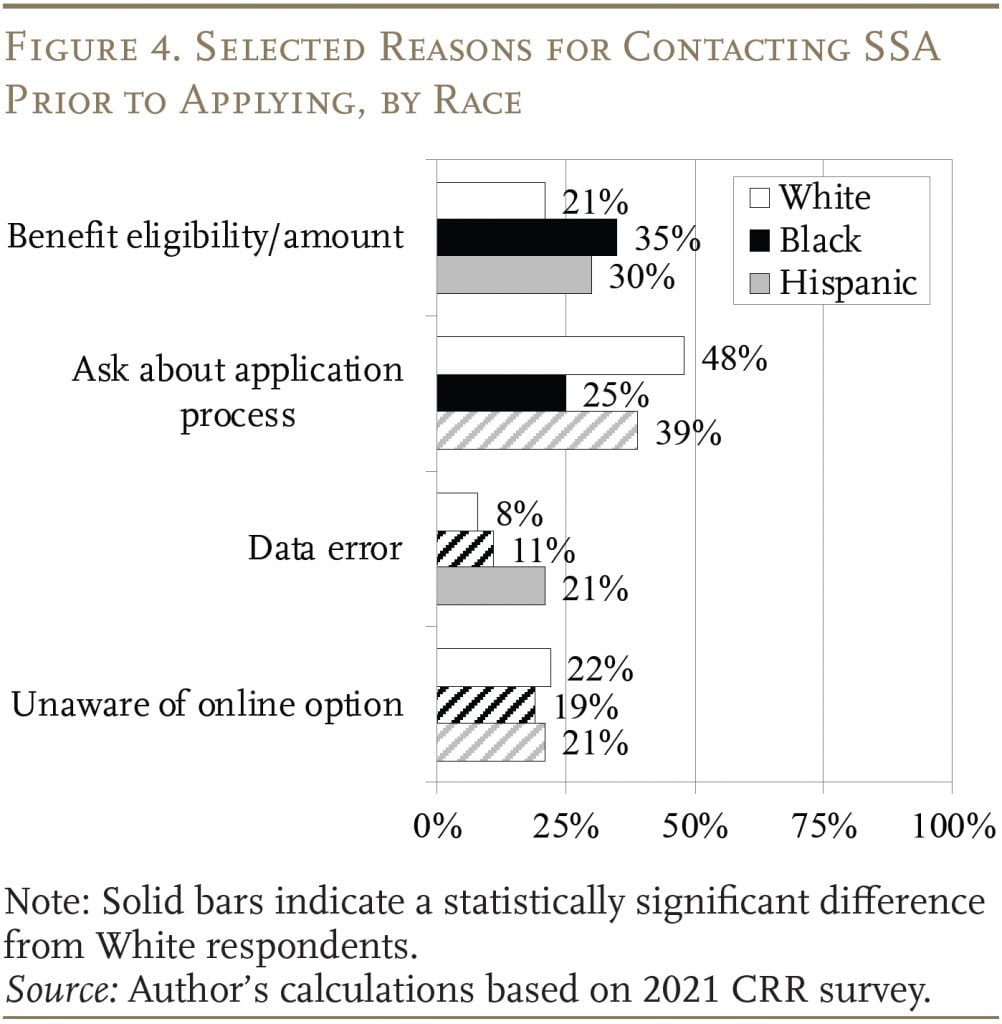

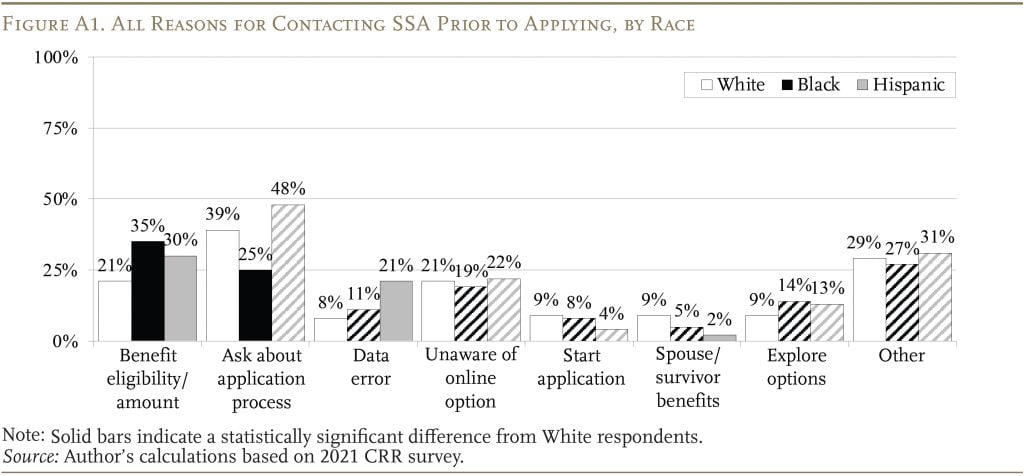

The next issue is whether the reasons for interaction before and during the application process differ by race. Figure 4 highlights some of the most common reasons that individuals contact SSA prior to applying.4For the survey results covering the full list of reasons why individuals contact SSA before the application process, see Appendix Figure A1. These results show that, compared to White respondents, Blacks contact SSA more about their benefit eligibility/amount and less about the application process. Hispanic respondents also contact SSA more than Whites to learn their potential benefit eligibility/amount; in addition, they are more likely to contact the agency about data errors. No statistically significant racial differences exist among those who contact SSA because they are unaware of the online option.

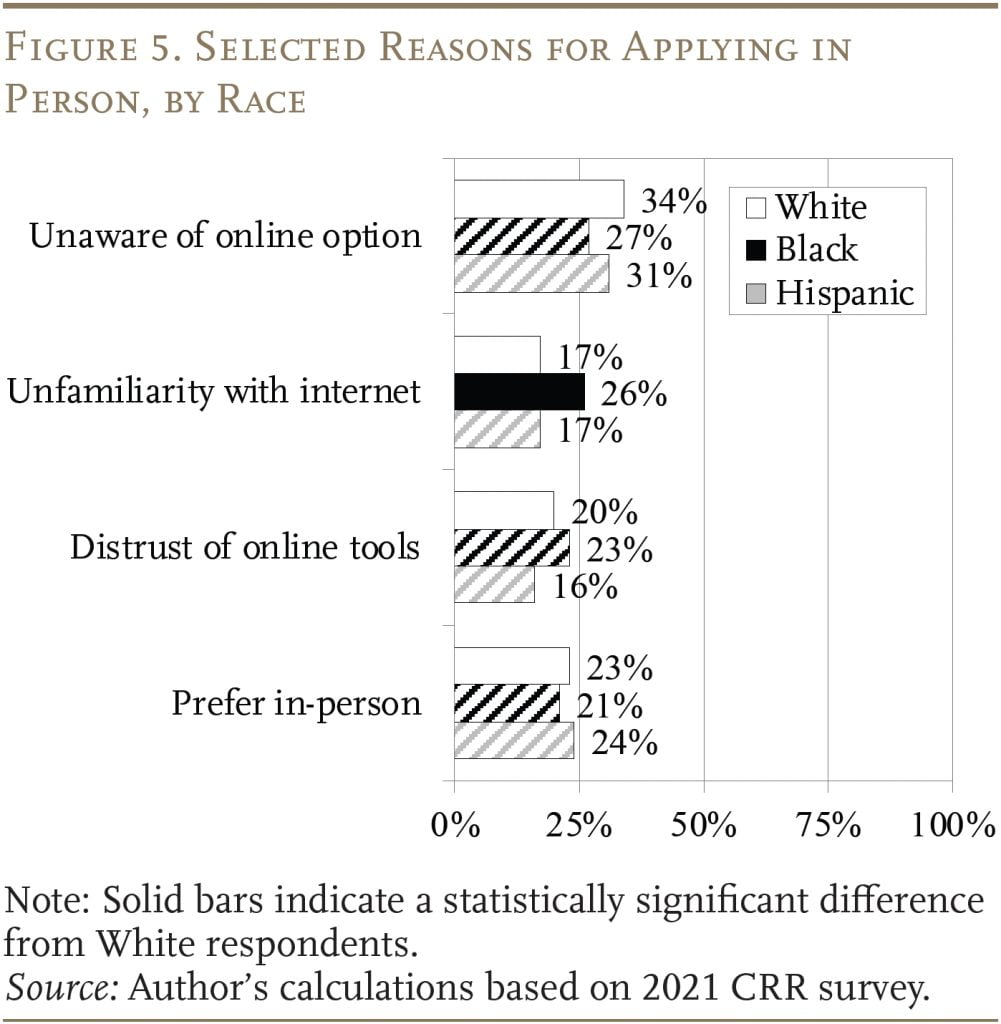

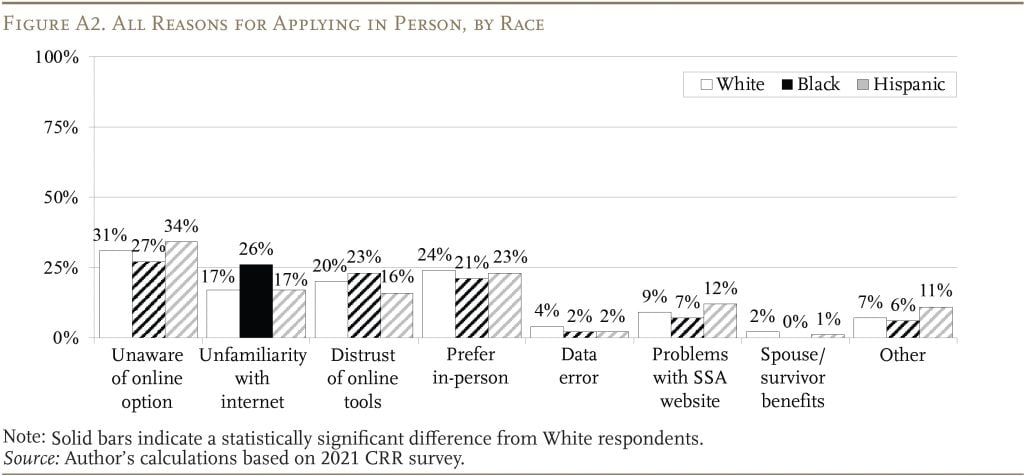

Shifting from pre-application to the actual application, the results show that Blacks are more likely than Whites to cite unfamiliarity using the internet as a reason for applying in person (see the second cluster in Figure 5). In contrast, little variation exists for other reasons, such as an unawareness of the online claiming option, a distrust of online services, or a preference for in-person contact.5For the survey results covering the full list of reasons why individuals contact SSA during the application process, see Appendix Figure A2.

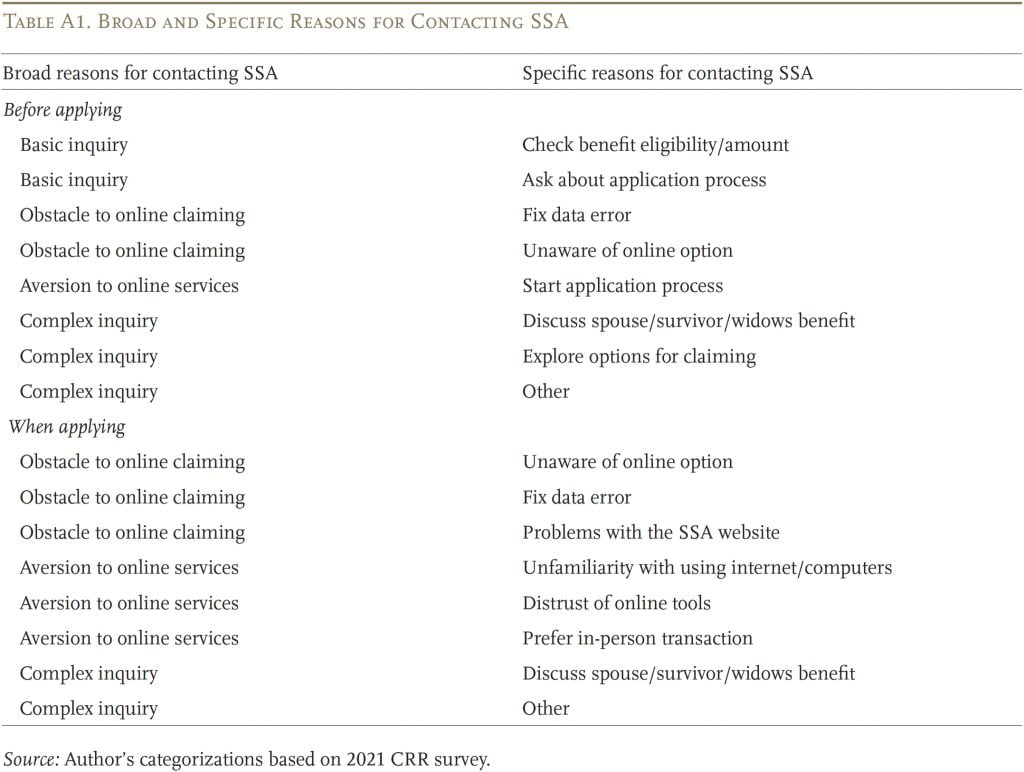

Racial Impact of Policies that Reduce Need to Contact SSA

The most common reasons that individuals contact SSA either before or during the application process can be divided into three broad categories: 1) basic inquiries, such as benefit eligibility/amount or how the application process works, most of which could probably be handled online; 2) obstacles to using SSA’s online services, such as data errors or an unawareness of the online option; and 3) an aversion to online services, such as unfamiliarity with the internet, a distrust of online tools, or a preference for in-person interactions. A less common type of reason for contacting SSA involves more complex topics such as understanding how spousal or survivor benefits work.6For a full list of the specific reasons included under each of the four broad categories, see Appendix Table A1.

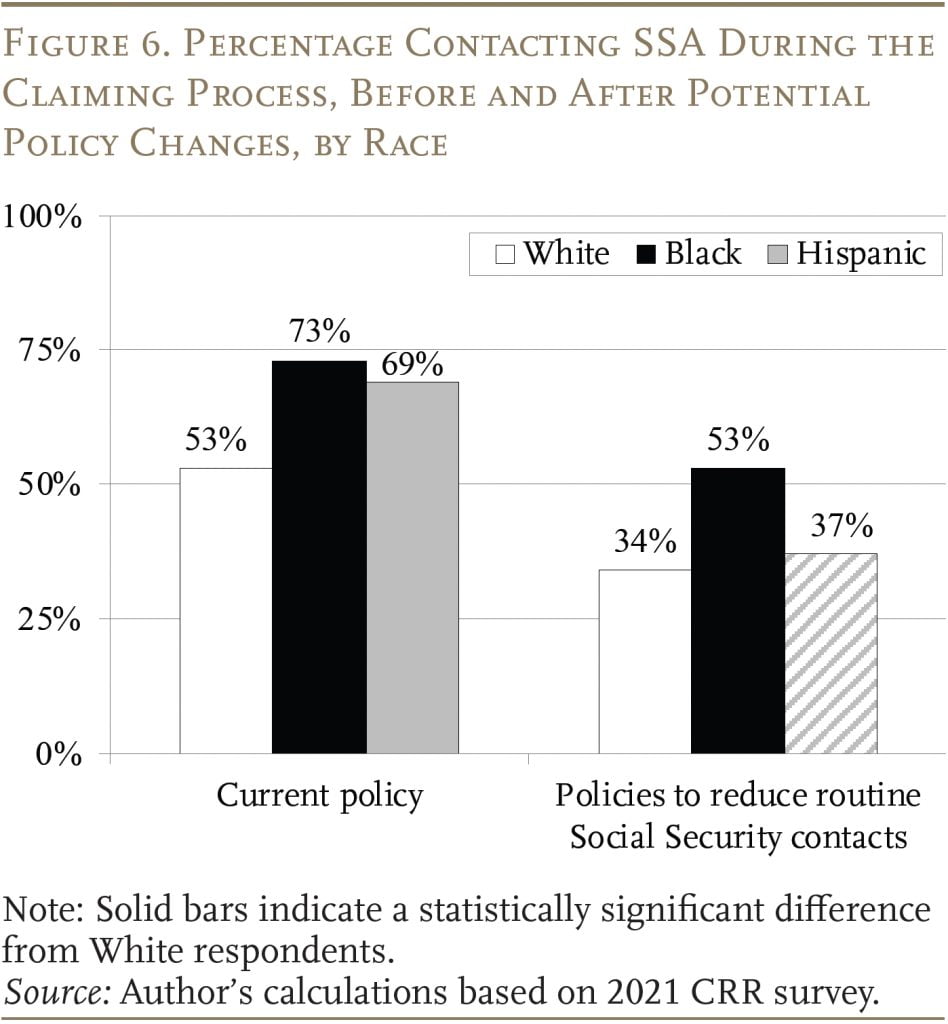

CRR’s prior research found that policy changes to address the first two categories – basic inquiries and obstacles – could reduce the overall share of those who contact SSA from about 60 percent to about 40 percent. Focusing on the impact by race shows that the decrease for Hispanic applicants is largest, bringing the share of Hispanic respondents who contact SSA in line with Whites (see Figure 6). This pattern reflects the fact that Hispanics are statistically more likely than Whites to contact SSA to learn about their benefit eligibility/amount and to correct data errors – reasons that fall under basic inquiries and obstacles.

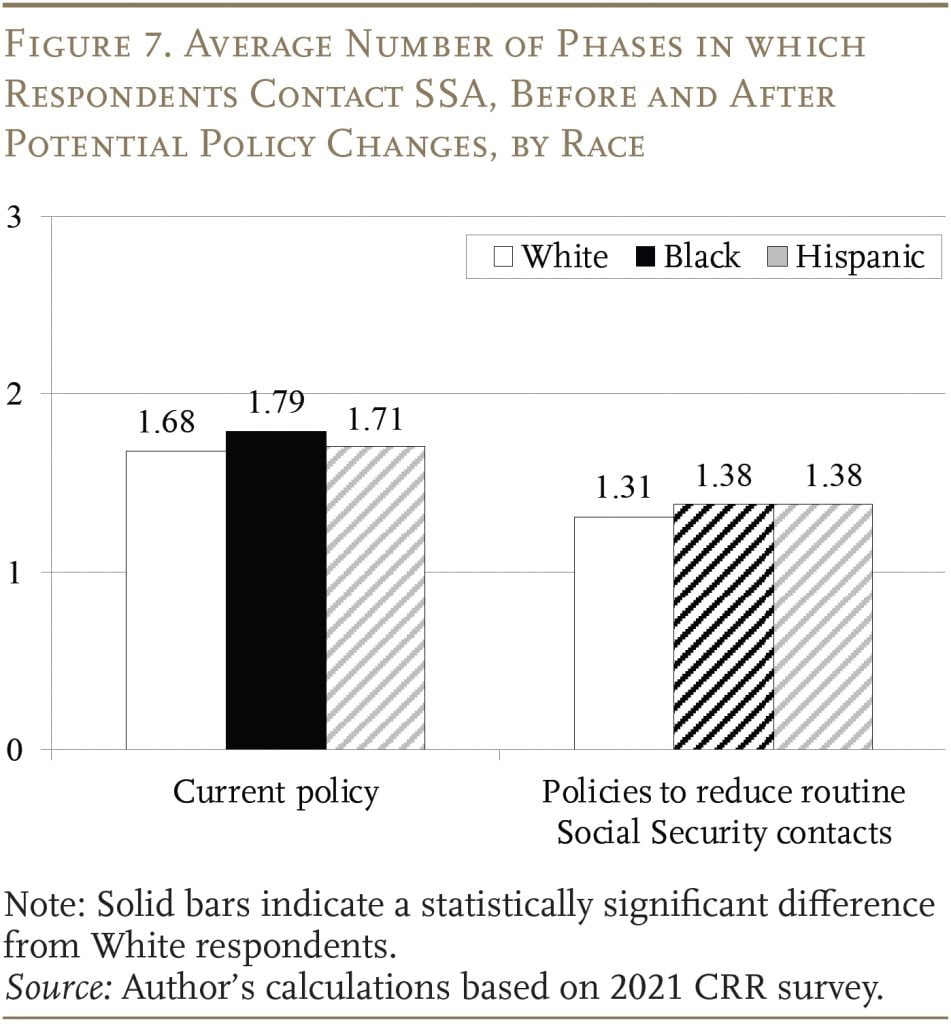

Similarly, if individuals no longer needed to contact SSA for basic inquiries or to resolve obstacles to using online services, the number of phases in which individuals contact SSA would decrease for all racial categories (see Figure 7). Importantly, the differences across the three racial groups remain small in this scenario, and neither Blacks nor Hispanics are statistically different from that of Whites.

In short, if individuals no longer needed to contact SSA to get basic information about retirement benefits or correct data errors, existing racial differences in SSA contact would shrink because Black and Hispanic individuals are more likely than Whites to contact SSA for these reasons.

Conclusion

A 2021 CRR survey suggests that almost two-thirds of retirees contact SSA in person or by phone at some point in their claiming process; and non-White individuals are more likely to do so. Using the same survey data, this brief examined potential racial differences in when and why individuals contact SSA during their claiming process. Ultimately, the data show that racial differences in the timing and reasons for contacting SSA are minor compared to the differences in whether individuals choose to contact SSA at all. That said, policies that reduce the need for individuals to contact SSA to obtain basic information or correct data errors could help equalize racial differences, since a large share of Hispanics contact SSA for these reasons.

References

Aubry, Jean-Pierre and Kevin Wandrei. 2021. “How to Increase Usage of SSA’s Online Tools.” Working Paper 2021-15. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Carman, Katherine, Samer Atshan, and Jhacova Williams. 2023. “Disparities in Social Security Knowledge and the Role of Social Capital.” Working Paper 2023-458. Ann Arbor, MI: University of Michigan Retirement and Disability Research Center.

Knapp, David and Francisco Perez-Arce. 2022. “Racial and Ethnic Disparities in Knowledge about Social Security Programs.” Working Paper 2022-449. Ann Arbor, MI: University of Michigan Retirement and Disability Research Center.

Peterson, Janice, Barbara A. Smith, and Qi Guan. 2019. “Hispanics’ Knowledge of Social Security: New Evidence.” Social Security Bulletin 79(4): 11-23.

Rabinovich, Lila, Janice Peterson, and Barbara A. Smith. 2017. “Hispanics’ Understanding of Social Security and the Implications for Retirement Security: A Qualitative Study.” Social Security Bulletin 77(3): 1-14.

Yoong, Joanne, Lila Rabinovich, and Saw Htay Wah. 2015. “What Do People Know About Social Security?” Working Paper 2015-022. Los Angeles, CA: University of Southern California, Center for Economic and Social Research and Schaeffer Center.

Appendix

Endnotes

- 1Specifically, the CRR survey was administered to older individuals in NORC’s AmeriSpeaks Survey Panel from May to June of 2021. The survey targeted individuals ages 62-70 who claimed retirement benefits in the last five years and those ages 57-70 who intended to apply within the next five years. In total, the survey contained about 1,600 recent retirees and 1,000 near retirees. Importantly, the survey sample adequately reflects the national demographics for older individuals (based on a comparison to the 2020 Current Population Survey). For more details, see Aubry and Wandrei (2021).

- 2For example, the survey captures whether a respondent communicated with SSA online, on the phone, or in-person before, during, and/or after claiming their benefit, and the specific reasons why. Also, if a respondent claimed online, the survey asks whether they did so at home, at a field office using an SSA desktop or kiosk, or at a public location (e.g., a library). And, for those who did not claim online, the survey prompts respondents for specific reasons – such as an error involving their name, age, and/or work history in the SSA system or simply a lack of awareness of the online option – as well as allowing for open-ended responses.

- 3Multiple studies in the last 10 years have highlighted racial differences in sources of information about Social Security and knowledge of Social Security rules that would contribute to differences in when and why individuals contact SSA during their claiming process. See Carman, Atshan, and Williams (2023); Knapp and Perez-Arce (2022); Peterson, Smith, and Guan (2019); Rabinovich, Peterson, and Smith (2017); and Yoong, Rabinovich, and Wah (2015).

- 4For the survey results covering the full list of reasons why individuals contact SSA before the application process, see Appendix Figure A1.

- 5For the survey results covering the full list of reasons why individuals contact SSA during the application process, see Appendix Figure A2.

- 6For a full list of the specific reasons included under each of the four broad categories, see Appendix Table A1.