How Far Off Are the Actuarial Adjustments of Social Security Benefits?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Not that far, but high earners, who live long and claim late, come out ahead.

The option to claim Social Security early was introduced over 60 years ago, when Congress set 62 as the program’s “Earliest Age of Eligibility.” To keep lifetime benefits constant, on average, those claiming at 62 receive 20 percent less in monthly benefits than if they had claimed at 65. The option to claim between 65 and 70 on an actuarially fair basis stems from the 1983 Social Security Amendments, which gradually increased the annual “delayed retirement credit” from 3 percent to 8 percent.

Much has changed since these actuarial adjustments were introduced: interest rates have declined; life expectancy has increased; and longevity improvements have been much greater for high earners than low earners. Are the historical adjustments still actuarially correct?

Longer life expectancy, which reduces the impact of an additional year of early or late claiming, would call for smaller adjustments – less of a reduction for early retirement and a smaller delayed retirement credit in order to keep costs constant across claiming ages. Lower interest rates, which raise the cost of late versus early claiming, would also call for reducing the penalty for early claiming and the reward for later claiming.

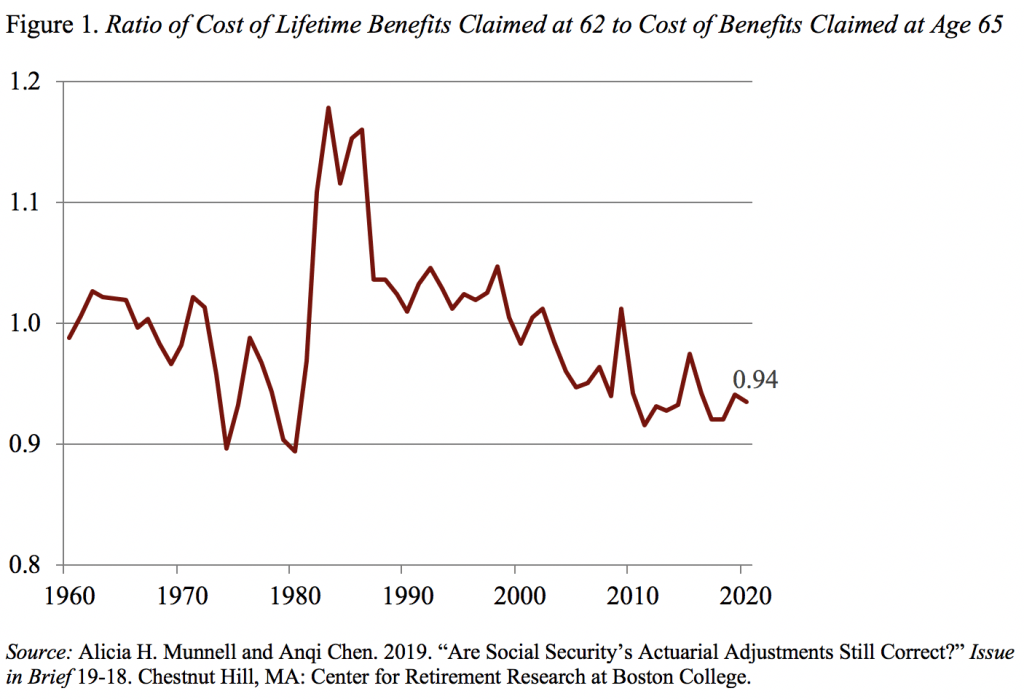

To estimate the magnitude of the required adjustment requires comparing the cost of lifetime benefits for early versus late claiming. If the costs to the government are equal – that is the ratio of the two costs is 1.0 – then the adjustment is actuarially fair. Figure 1 shows that the ratio of age 62 costs to age 65 costs, which was close to 1.0 in 1960, is expected to be 0.94 in 2020. Thus, the reduction for early retirement is too large, and reducing it would bring the costs at 62 and 65 closer together.

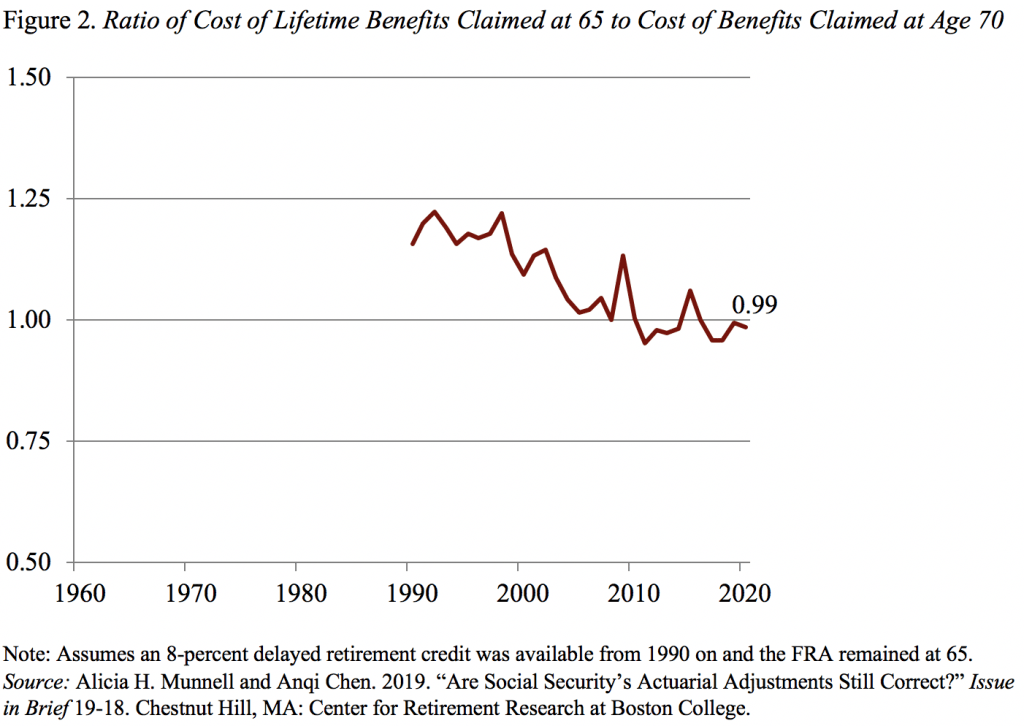

The exercise was repeated for the delayed retirement credit. The calculation is hypothetical because 1) the full 8-percent delayed retirement credit was not available until 2008; and 2) the Full Retirement Age was increasing from 65 to 67. The results in Figure 2 show that initially the cost to the government of an individual claiming at 65 significantly exceeded that of an individual claiming at 70. In other words, the delayed retirement credit of 8 percent was too small. As life expectancy has increased and interest rates have declined, the costs to the government of an individual claiming at 65 and at 70 have narrowed and today the ratio looks about right.

One final note. The stylized fact that high earners live longer and claim later adds a distributional consideration to these findings. At the simplest level – taking the adjustments as given – low earners claim early and are overcharged for that privilege, and high earners claim later and are rewarded roughly correctly. The simple results, however, substantially understate the advantages for high earners. The evaluation of the adjustments presented above was based on the life expectancy of the average worker. If the assessment had been based on the longer and increasing life expectancy of high earners, the delayed retirement credit should be smaller than the current 8 percent to equalize the cost of early versus late claiming.