How Much in Those 401(k)s?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Most people approaching retirement who are lucky enough to have an employer-sponsored retirement plan will have a 401(k). This pattern is particularly true in the private sector where defined contribution plans dominate; most public sector workers continue to be covered by traditional defined benefit plans, which pay benefits for life based on years of service and final salary.

An important question is how much have people accumulated in their 401(k)s. The best source of nationally representative data is the Federal Reserve’s Survey of Consumer Finances (SCF). Although the most recent SCF information is from 2007, the data probably give a pretty good indication of today’s balances. The reason is that the impact of the 50-percent decline in equities between October 2007 and March 2009 has probably been roughly offset by the bounce back in the stock market plus three years of new 401(k) contributions.

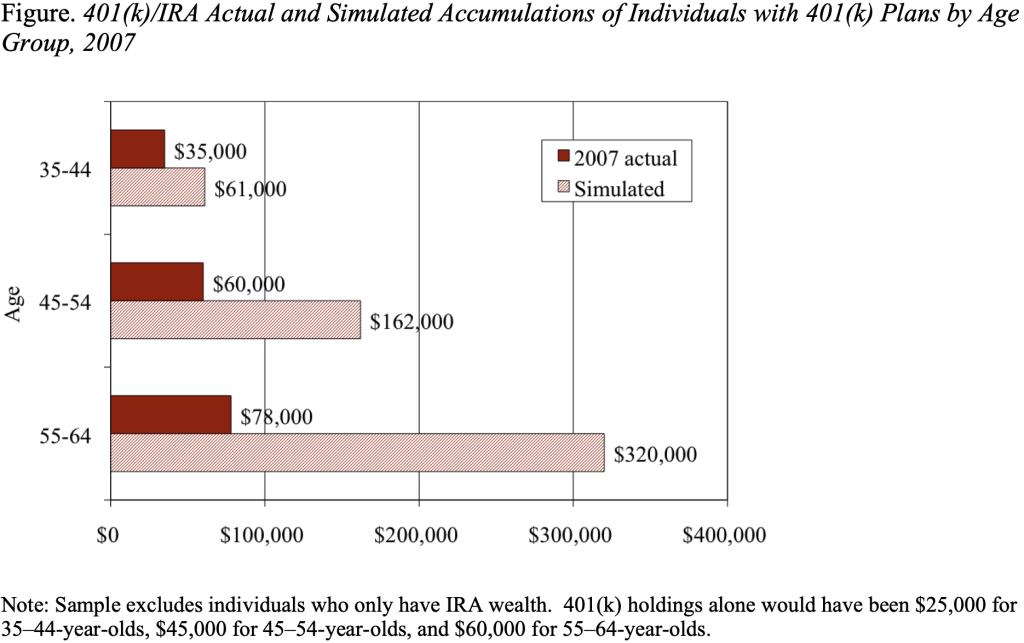

In theory, a typical worker who ends up at retirement with earnings of slightly more than $50,000 and who contributed 6 percent steadily with an employer match of 3 percent should have about $320,000. The bottom bar in the Figure shows the amounts that the typical worker would have at each age along this path of accumulation.

In fact, the typical individual approaching retirement had only $78,000, far short of the simulated amount. (Note that the reported amounts include holdings in Individual Retirement Accounts (IRAs) because these balances consist mostly of rollovers from 401(k) plans.) Moreover, those at younger ages do not appear to be on track in their accumulations either.

How do these numbers compare to others floating about? Vanguard’s median balance for 2009 for participants age 55-64 was $53,586. These balances are somewhat lower than the SCF data reported in the figure because the companies have data only for assets in the 401(k) plans under their management and therefore cannot include IRA balances. The Employee Benefit Research Institute, which has a sample of 20 million participants, only reports means by age, and the 2009 figure for participants in their 50s was $139,932. Means tend to be higher than medians because the distribution of balances is skewed towards those with higher incomes. Applying Vanguard’s ratio of mean to median for those 55-65, suggests an EBRI median of about $60,000 for those in their 50s. The point here is not to reconcile balances to the dollar, but to establish that those approaching retirement have relatively modest amounts in their 401(k) plans.

Using the SCF figure of $78,000, 401(k) balances will produce about $400 per month of income in retirement if the participant buys a joint-and-survivor annuity; $260 per month if the participant applies the “4-percent” rule.

The hope for the future is that workers in younger age groups will have spent more years covered by 401(k) plans and have been exposed to more automatic provisions, such as auto enrollment and auto escalation in the default contribution rate, than the early boomers. But it’s clear we have a long way to go before 401(k)s will provide meaningful retirement income.