How Much Would People Take Out of Retirement Accounts If Left on Their Own?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

There is a risk that people will spend and consume too little.

For the last few years, my colleagues and I have been focusing on the drawdown aspect of 401(k) plans. The time has come when the first cohort of workers will retire entirely reliant on the accumulations in their 401(k)s and IRAs (mostly rollovers from 401(k)s) to supplement their Social Security benefit. And this shift is happening when Social Security will replace less of pre-retirement earnings than it has in the past because the increase in the full retirement age cuts replacement rates at every age, Medicare premiums will take a bigger chunk, and more households will pay taxes on their benefits. With relatively less from Social Security and total reliance on 401(k)s/IRAs, how people use their balances is crucially important.

Unlike defined benefit pension plans, which provide participants with steady benefits for as long as they live, 401(k) plans and IRAs provide no guidance in terms of decumulation. Retirees have to decide how much to withdraw each year; and they face the risk of either spending too quickly and outliving their resources or spending too conservatively and consuming too little.

Surveys of individuals’ intentions and several recent studies suggest that people will not draw down their accumulations for fear that they will exhaust their money and be unable to cover end-of-life health care costs. (For example, see Poterba, Venti, and Wise (2011), and Society of Actuaries (2017). And a new study provides further evidence on this reluctance to spend by showing that much of the withdrawals occur only because of the IRS required minimum distribution (RMD) rules.

The RMD rules are designed to ensure that the foregone revenues associated with the favorable treatment of retirement saving are used to support consumption in retirement rather than creating tax-advantaged assets for bequests. The RMD rules become effective in the year the taxpayer turns 70½. They are not designed to force full depletion of the account; assuming the retiree earns 4 percent returns, over 70 percent of the original account balance remains at age 90. The rules have remained virtually unchanged since the 1980s with one exception: they were temporarily suspended in 2009 so that people would not be forced to cash in severely depressed assets in the wake of the financial crisis.

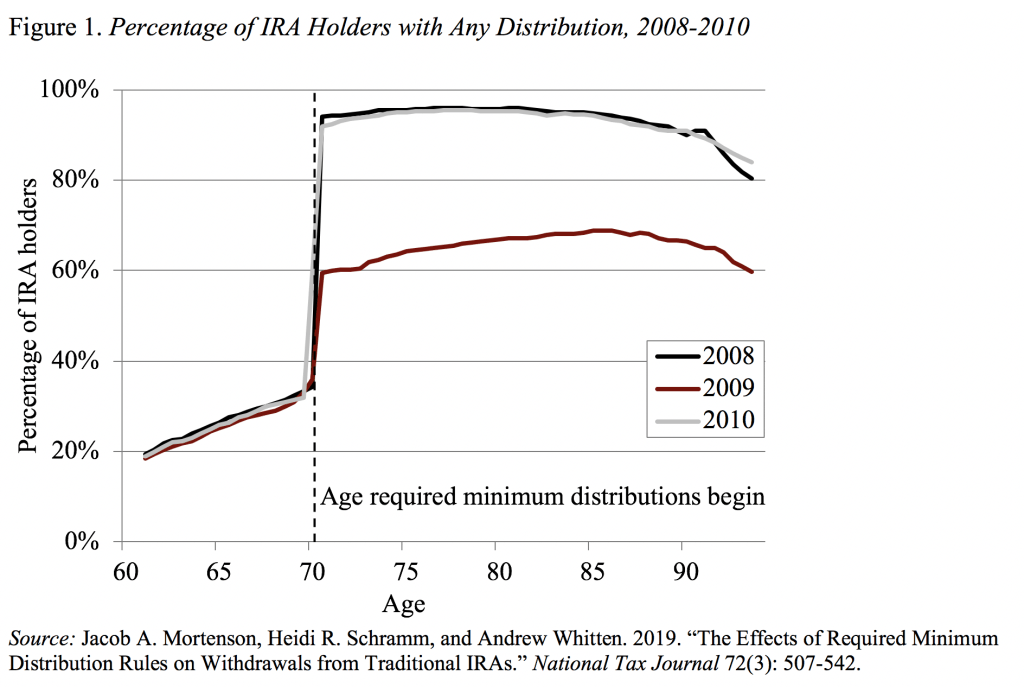

The new paper uses data from the tax returns of 1.8 million IRA holders in 2000-2013 to determine the extent to which the RMD rules are binding – that is, force people to do something they would not do otherwise. In my view, the most interesting part of the paper is the raw data on the percentage of IRA holders with any distribution for the years 2008-10 (see Figure 1). The data show that approximately 25 percent of individuals younger than 70½ take an IRA distribution; that figure jumps to over 90 percent once the RMD kicks in. Second, the percentage taking any distribution dropped from the 90-percent range to 60 percent when the RMD was suspended in 2009.

In short, the RMD appears to increase the number of withdrawers by about 65 percentage points (25 percent to 90 percent) when households reach 70½, and the 2009 suspension of the RMD reduced the number of withdrawers by about 30 percentage points. So, the answer to how many people are taking more out of their IRAs than they would have without the IRS provision is in the 30- to 65-percent range. That is, the RMD rules are strongly binding.

To me, this result means the greater risk in terms of decumulation is that people will spend too conservatively and consume too little rather than spend too quickly and outlive their resources. Retirees need some vehicle for drawing down their balances in an orderly fashion.