IBM Reopened Their Defined Benefit Plan. Will Other Companies Follow?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Only a handful seem like logical candidates, with big banks topping the list.

IBM announced last November that it would no longer contribute a traditional company match and instead reopen the cash balance component of its previously frozen defined benefit plan. The question is, what other companies might follow suit? The answer is mainly big banks, but let me provide a little background.

Starting in January 2024, IBM ended its 5-percent matching contribution and 1-percent automatic contribution to employees’ 401(k) accounts in favor of an automatic 5-percent contribution to a “Retirement Benefit Account” for each employee. The Retirement Benefit Account is the employee’s “notional” account in the cash balance component of the company’s defined benefit plan. IBM had closed its defined benefit plan to new participants in 2005 and “frozen” benefits – that is, ended new accruals – for existing participants in 2008. This shift allows IBM to fund its annual retirement contributions of $530 million with the $5 billion surplus in its overfunded defined benefit plan, rather than with corporate cash contributed to its 401(k) plan – improving its cash flow statement.

My colleagues and I did a little work to figure out who might follow IBM’s lead.

Logically, a potential follower should have: 1) a large defined-benefit surplus that can be put to use; and 2) large 401(k) contributions that, once saved or reduced, can significantly improve the company’s cash flow. We started by focusing on companies with defined-benefit obligations of more than $10 billion and then narrowed the focus to those with closed/frozen plans that have a funded ratio of over 100%.

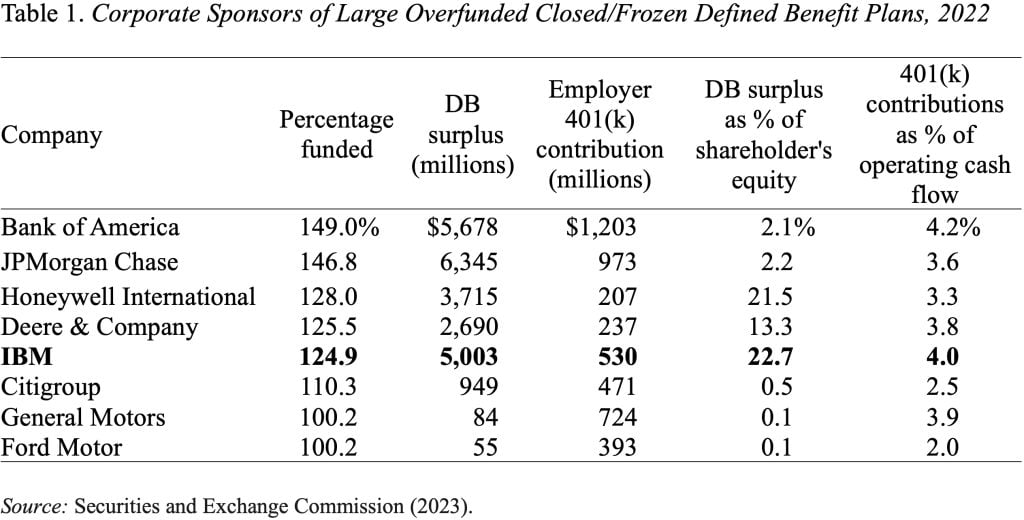

This exercise resulted in the eight companies shown in Table 1. In addition to the funded ratio, the table includes the surplus in the company’s defined-benefit plan, contributions to the company’s 401(k) plan, and two measures that might provide an incentive to consider IBM’s approach. Not surprisingly, IBM ranks high on both incentive measures.

On the top of the list are the nation’s two largest banks – Bank of America and JPMorgan Chase. The sheer dollar amount of their pension surpluses may trigger serious consideration of potential alternative uses. Also, these companies made large 401(k) contributions both in dollar amount and as a share of their annual cash flow. Citigroup, the fourth largest U.S. bank, is also on the list with a funded ratio of 110 percent, although its defined benefit surplus and 401(k) contributions are much lower than the top two.

Honeywell International and Deere & Co., which are third and fourth on the list, face a situation similar to IBM’s in terms of the relative sizes of their surpluses and 401(k) costs. Deere & Co. may not take further actions anytime soon as it just closed its defined benefit plan for salaried employees to new hires in January 2023 and greatly enhanced its 401(k) match. However, down the road, a rapid increase in 401(k) costs could trigger a reconsideration of the defined benefit option.

General Motors and Ford seem unlikely to follow IBM in reopening their barely fully funded defined benefit plans. In recent labor negotiations, the companies rejected the union’s demand to reopen their defined benefit plans and instead agreed to increase their 401(k) contributions substantially.

That’s all we know. It will be interesting to see what happens next.