Index Fund Rise Coincides with 401k Suits

Employee lawsuits against their 401(k) retirement plans are grinding through the legal system, with mixed success. Many employers are beating them back, but there have also been some big-money settlements.

This year, health insurer Anthem settled a complaint filed by its employees for $24 million, Franklin Templeton Investments settled for $14 million, and Brown University for $3.5 million.

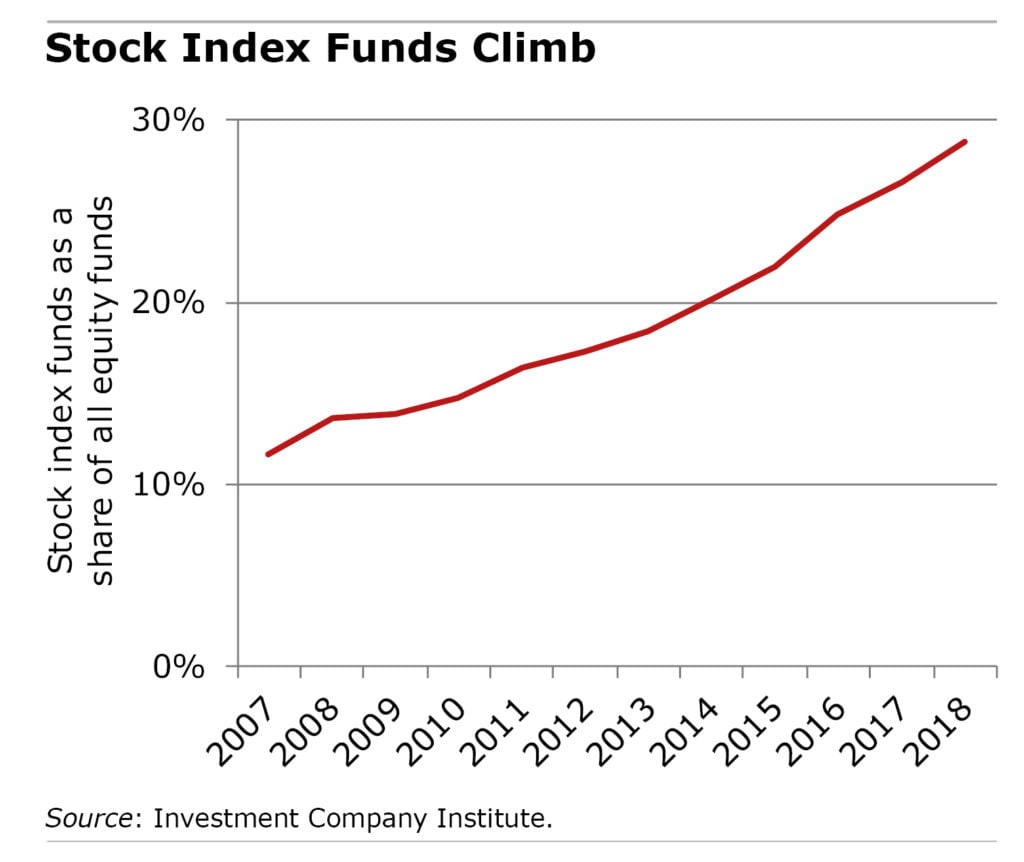

More 401(k) lawsuits were filed in 2016 and 2017 than during the 2008 financial crisis, and the steady drumbeat of litigation could be affecting how workers save and invest. For one thing, the suits have coincided with a dramatic increase in equity index funds, according to a report by the Center for Retirement Research. Last year, nearly one out of three U.S. stock funds were index funds, double the share 10 years ago.

Some see this change as positive. Many retirement experts believe that the best investment option for an inexperienced 401(k) investor is an index fund, which automatically tracks a specific stock market index, such as the S&P500. Federal law requires employers to invest 401(k)s for the “sole benefit” of their workers, and index funds usually charge lower fees and carry less risk of underperforming the market than actively managed funds – two issues at the heart of the lawsuits.

Some see this change as positive. Many retirement experts believe that the best investment option for an inexperienced 401(k) investor is an index fund, which automatically tracks a specific stock market index, such as the S&P500. Federal law requires employers to invest 401(k)s for the “sole benefit” of their workers, and index funds usually charge lower fees and carry less risk of underperforming the market than actively managed funds – two issues at the heart of the lawsuits.

To avoid litigation – and to comply with recent regulatory changes – employers are also becoming more transparent about the fees their workers pay to the 401(k) plan record keeper and to the investment manager. This transparency may have had a beneficial effect: lower mutual fund fees, which translate to more money in workers’ accounts when they retire. The average fund fee is about one-half of 1 percent, down from three-fourths of 1 percent in 2009, according to Morningstar.

In short, these lawsuits appear to be changing how people invest and how much they pay in fees for their 401(k)s.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

HI Kim. A great way for an employer to reduce risk is to write their Investment Policy Statement for their plan so that it states that their goal is to provide investments that try to mimic market based returns less plan fees. This sends a clear message on the goal of the investment offering. This also enables them to offer a lineup of index funds which will simplify their ongoing management of the plan.

Why, when I was your age, everything was actively managed with 100 point expenses. No, seriously…

According to a recent Berkshire Hathaway report, Buffet made a bet with any investment firm that over a 9 year period the Vanguard Index 500 could beat any investment fund net of fees and bet $2 MILLION payable to a charity; only one firm showed up and after 8 years, the index fund was ahead by $700k. The win was easy but most people spend more time on their IPHONES than learn to invest properly by simply reading. I bought Apple stock 10 years ago.

I’m a believer!

It’s frustrating how expensive and awful the investment options in a 401K can be. If that’s the case for you, you might consider investing the minimum in your company 401K to get your match, then open a self-directed Roth IRA (or traditional IRA if you’d rather defer taxes). You’re limited to $5500/year in contributions for the Roth, but unless you’re normally saving more than that, it should be much of a limitation.

For those interested in ERISA, 404(c), fiduciary duty, prudence, and lawsuits, I suggest “The Prudent Investment Fiduciary Rules.” Here is the most recent post.

Even with ERISA, plenty of 401(k) plans provide an inappropriate number of expensive investment options. It’s the opposite of the old restaurant review, “The food was awful and the portions were small.” With far too many 401(k) plans, the review is, “The investment options are super expensive and there are far too many of them.”

That said, the 403(b) market place is not subject to ERISA and it shows. Certified Financial Planner Tony Isola’s “A Teachable Moment” website is informative. Here is a link to his “The Retirement Land That Time Forgot – The Video.”

In terms of fees, the 401(k) market, even with “ERISA protections,” remains a mess. And a significant segment of the 403(b) market is an unmitigated disaster.

For those interested in ERISA, 404(c), fiduciary duty, prudence, and lawsuits, I suggest “The Prudent Investment Fiduciary Rules.” Here is the most recent post.

Even with ERISA, plenty of 401(k) plans provide an inappropriate number of expensive investment options. It’s the opposite of the old restaurant review, “The food was awful and the portions were small.” With far too many 401(k) plans, the review is, “The investment options are super expensive and there are far too many of them.”

That said, the 403(b) market place is not subject to ERISA and it shows. Certified Financial Planner Tony Isola’s “A Teachable Moment” website is informative. Here is a link to his “The Retirement Land That Time Forgot – The Video.”

In terms of fees, the 401(k) market, even with “ERISA protections,” remains a mess. And a significant segment of the 403(b) market is an unmitigated disaster.

In addition to not having qualified plans, I’d gotten the impression somewhere that people with K-12 403(b)s would not have been protected under Labor’s late fiduciary rule proposal. Do you know if that’s true?

That wasn’t Buffett’s bet. He referred to hedge funds, and being the smart guy he is, he made the bet essentially at the bottom of the 2008/2009 market crash. It was a sound bet. I propose he wouldn’t make the same bet today; that in 10 years, no hedge fund will be ahead of the S&P 500.

Too many advisors and pundits talk about 401k lawsuits without having proven defensible strategies. There are legitimate reasons for some suits, for sure. But when suits are filed because someone pays 4 basis points for an index fund that someone else offers for 2 basis points, it causes needless disruption to participant accounts. Plan sponsors chasing fund expense ratios (which change) so they can try and avoid a lawsuit wastes time and money. Next year, an index may reduce their expense ratio from 4 to 1.5. Now the sponsor is at jeopardy again? Thanks lawyers! Saving 2 basis points on my half million dollar account in 20 years, will do what exactly? Prevent me from buying a gallon of ice cream or two? Enough already.