Inflation Hurts Both Near Retirees and Retirees – Here’s How

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Impact depends on sources of income, asset holdings, and the amount of fixed-rate debt.

In June 2022, U.S. inflation peaked at 8.9 percent – a dramatically high level after nearly three decades of relatively stable prices. A shock of this magnitude must surely have affected the retirement security of near retirees and retirees. The question is which groups and by how much.

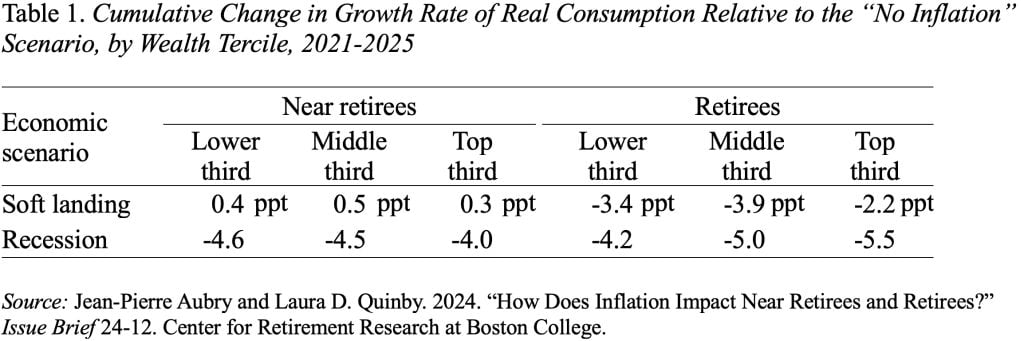

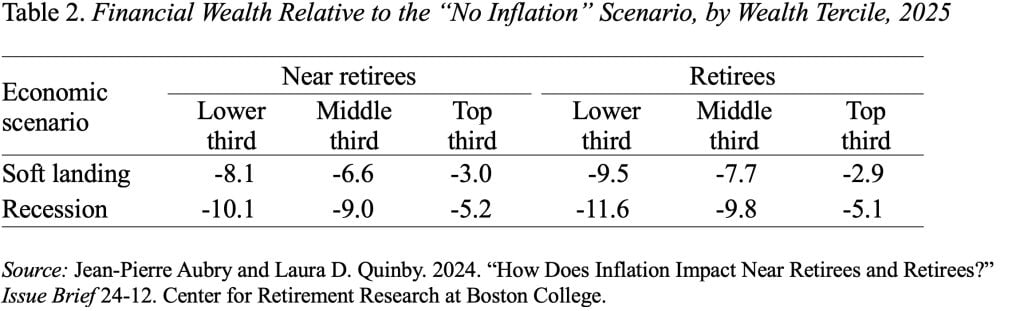

Because it is hard to assess the impact of today’s inflation shock from past experience, my colleagues Laura Quinby and JP Aubry project the finances of six hypothetical households – of different ages and wealth levels – under different possible economic scenarios. They were interested in two outcomes (compared to a no-inflation scenario) – the cumulative change in real consumption from 2021 to 2025 and wealth in 2025.

Research to date shows that inflation impacts households differently based on the specific sources of their income, the allocation of their assets, and their exposure to fixed-rate mortgage debt.

- On the income side, since wages and salaries are often negotiated yearly, earnings tend to lag inflation. And unemployment poses a significant risk if the Federal Reserve’s response to inflation triggers a recession. Similarly, many retirees still rely on defined benefit pensions, which often do not keep pace with inflation. On a more positive note, most retirees also receive fully inflation-indexed income from Social Security.

- On the wealth side, financial models predict that bonds and other fixed-income holdings suffer from sudden price increases, while equities fare better, so long as the Federal Reserve avoids a recession. And while house prices rise with inflation, this growth may be offset by shrinking demand if mortgage rates rise. On the other hand, households that already hold fixed-rate mortgage debt benefit from inflation because the monthly mortgage payment stays constant even as household income rises with prices.

The scenario analysis involves applying the effects described above to the income and assets of a sample of near-retiree and retiree households from the Survey of Consumer Finances. In both cases, the scenarios mimic the actual economy from 2021 to 2023 and then diverge as follows:

- Soft landing: After 2023, the economy is on a smooth path to 2-percent inflation, the output gap closes, and the Federal Funds Rate drops to 4 percent by December 2025.

- Recession: After 2023, inflation begins to rise again, and the Fed responds aggressively – triggering a recession and a decline in inflation. In response, the Fed quickly brings rates back down; however, the economy does not fully recover by 2025 – the end of the analysis period.

The results – compared to a no-inflation scenario – are quite interesting. In terms of the change in real consumption, two points stand out (see Table 1). First, near retirees experience a smaller decline in consumption than retirees because they hold a lot of fixed-rate mortgage debt.

Retirees have less erosion of real debt, and often also lose real income because pension benefits are only partially indexed to inflation. Second, the impact of inflation varies across the wealth distribution.

In terms of financial wealth in 2025, inflation has an unambiguous negative impact (see Table 2). Top-wealth households, however, always lose less than their lower-wealth counterparts, because they invest more in equities, businesses, and other assets that grow with inflation. (As expected, inflation does not have much impact on housing wealth.)

In short, experiencing a bout of high inflation later in life is generally harmful to retirement security, but the impact varies depending on the extent to which income and assets grow with (or lag) inflation, and the amount of debt outstanding.