IRAs by Far the Largest Component of Retirement System

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

401(k)s may be the gathering mechanism, but IRAs are where people put their money.

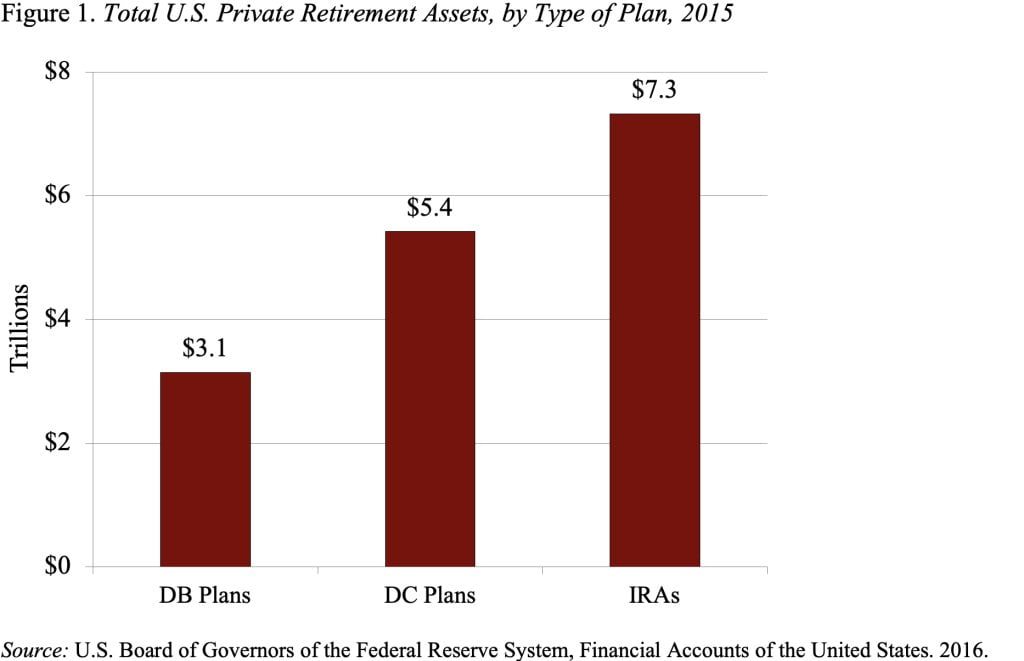

Given that private sector households now hold more money in individual retirement accounts (IRAs) than in defined contribution plans (see Figure 1), I am always looking for more info about IRAs.

The Investment Company Institute (ICI), an organization dedicated to promoting public understanding of mutual funds, puts out information on IRAs based on its Annual Mutual Fund Shareholder Tracking Survey. Three things seemed particularly interesting in the most recent publication.

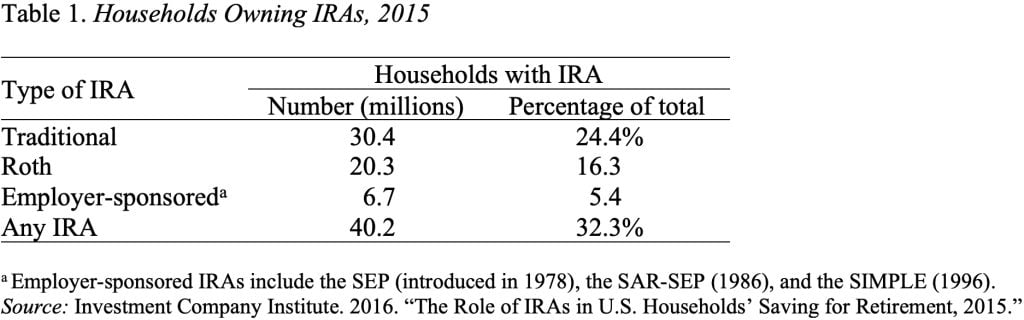

First, 32 percent of all U.S. households own IRAs (see Table 1). Most hold traditional IRAs, but Roth IRAs are catching up fast.

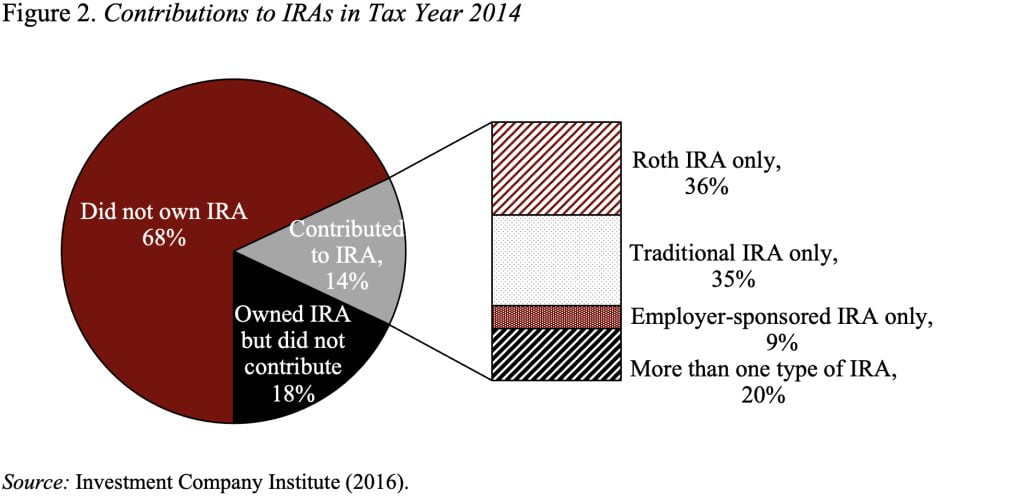

Second, only 14 percent of all households made a contribution in 2014 (see Figure 2). Among those making contributions, the percentages contributing to a Roth IRA and a traditional IRA were about the same. ICI reports that rollovers from employer-sponsored plans have fueled the growth in IRAs.

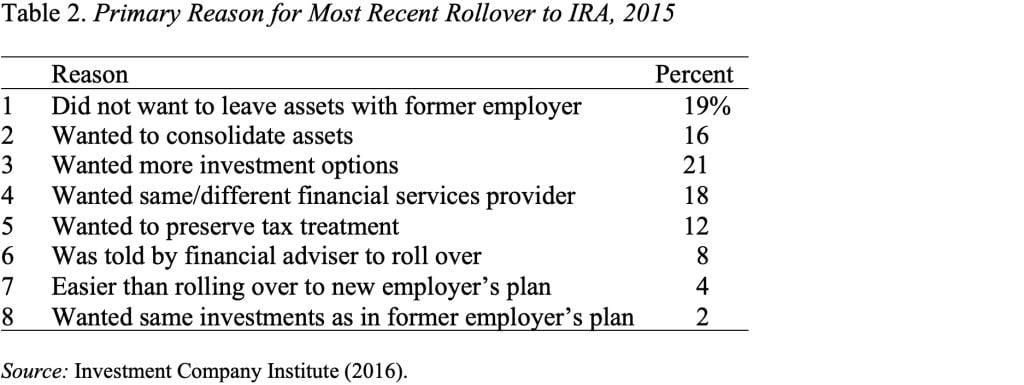

Finally, the lack of portability in the current system is a major reason for rollovers (see Table 2). Reasons # 1, 2, 5, 6, and 7 would all be eliminated if people could have ‘one account’ that followed them from job to job.

IRAs must be more profitable than 401(k)s to financial services providers, or else they would not engage in such extensive advertising urging people to roll over their balances. What’s good for the financial services industry, however, is not likely to be good for the participant. We’ve got to make portability easier.