Is 70 the “Right” Retirement Age?

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Many can work until 70, but the system also needs to accommodate those who can’t.

I keep thinking about this notion that 70 is the real Social Security retirement age. It is the age at which people get maximum monthly benefits, and if they work beyond this age they see their lifetime benefits decline. But is 70 the right age? “Right” can mean a number of things. One is how 70 in 2013 compares with 65 in 1940 in view of the increase in life expectancy. Another is how to rationalize it given the large dispersion in life expectancy gains between high- and low- income groups.

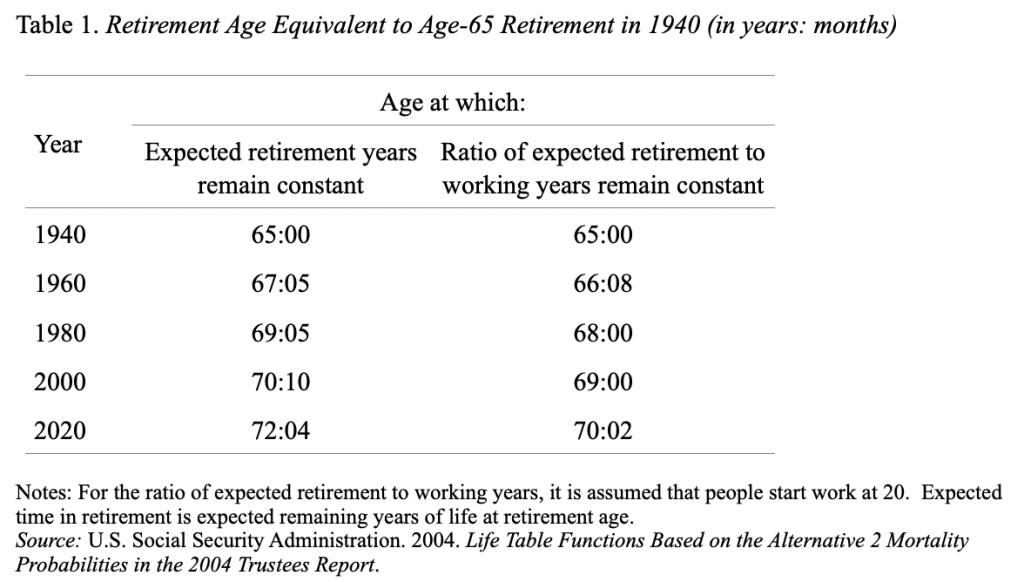

People are certainly living longer in 2013 than they did in 1940; the increase has been about seven years for both men and women. How should these additional years of life expectancy be spent? One alternative is that the retirement age should be set so that the expected number of years in retirement remains unchanged. This must certainly be viewed as the limiting case because it assumes that all adult years added by improved mortality should be spent in the labor force. Another possibility is that the retirement age should be set so that the ratio of the expected number of years spent in retirement to the expected number of years working remains constant. This seems like a better measure because it distributes gains in life expectancy into both working years and retirement years. Table 1 shows that the limiting case suggests a retirement age of 72 in 2020, while the one that distributes gains between work and leisure suggests age 70.

So, for the average person, age 70 seems like a perfectly reasonable retirement age given the improvements in life expectancy since 1940. The problem is that not all groups of workers face average mortality risk. Evidence, both for the United States and other developed countries, shows that richer, better-educated people live longer than poorer, less-educated people. According to calculations from the National Longitudinal Mortality Survey, which tracks the mortality of people originally interviewed in government surveys, men whose 1980 family income fell in the top 5 percent had a life expectancy at all ages that was about 25 percent longer than those in the bottom 5 percent (Deaton 2002).

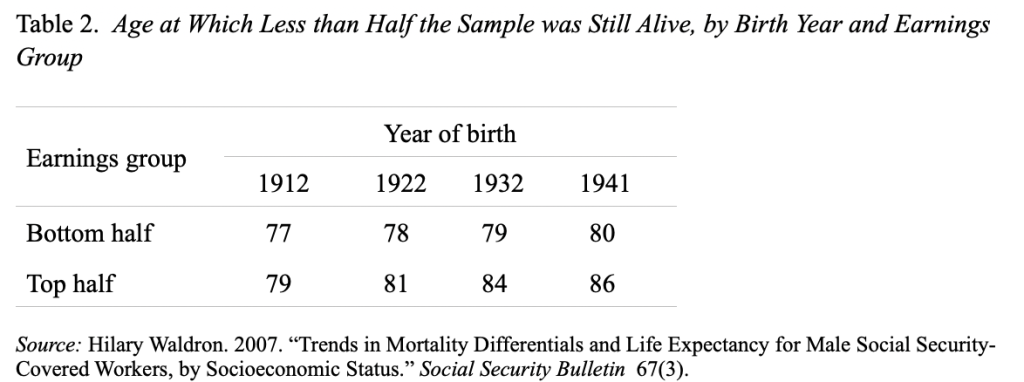

Moreover, the discrepancy in life expectancy between high- and low-earners is getting larger with each cohort. Table 2 shows – for those in the top half of the earnings distribution and for those in the bottom half – the first age at which less than half the sample of workers age 60 and over was still alive. For male workers who were born in 1912 and lived to age 60, the difference between the benchmark age for high- and low-earners was only two years. For those born in 1941, the difference between the ages for high- and low-earners had increased to six years. Thus, an increase in the retirement age to 70 could involve a significant additional burden for many.

The answer seems to be twofold. For many people, 70 is a perfectly appropriate age for retirement. Their Social Security benefit will be 76 percent higher than if they retired at 62 – one of the best kept secrets in America!! And retiring at 70 provides time for 401(k) balances to grow and dramatically reduces the number of years requiring support. At the same time, the strong and increasing relationship between earnings and life expectancy means that any system must be flexible enough to accommodate those for whom 70 is an impossible age.