Large Social Security COLA May Spark Debate about Appropriate Index

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Shifting to CPI-E for retirees would involve a lot of pain for not much gain.

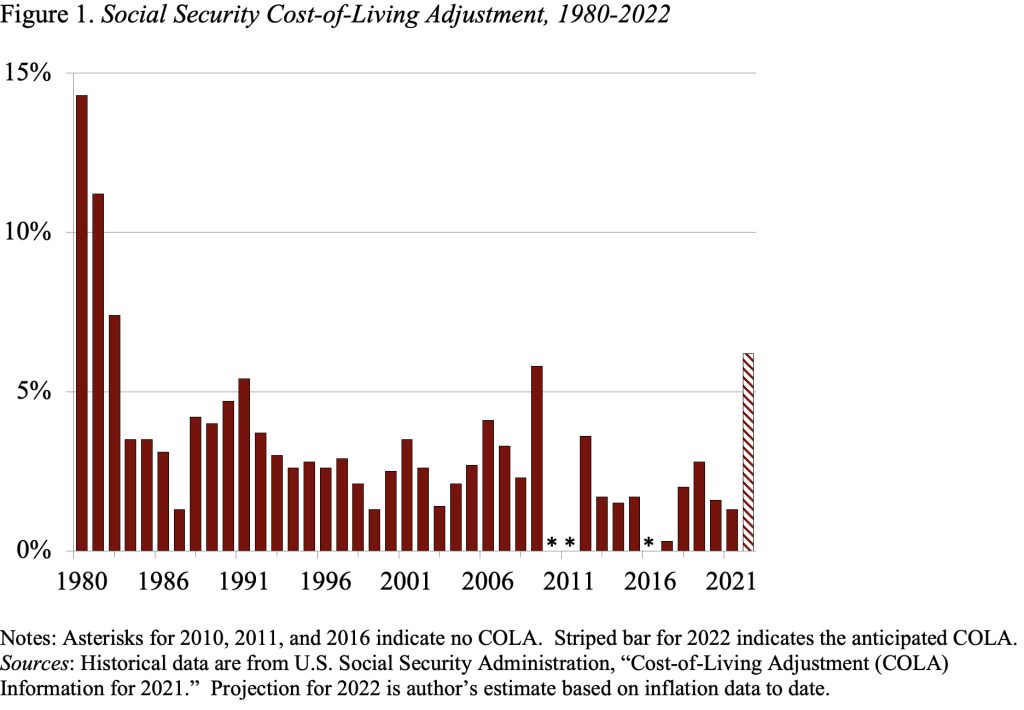

This fall, Social Security is likely to announce a 6-percent cost-of-living adjustment (COLA) for 2022. Such a large COLA – the biggest in 40 years (see Figure 1) – is likely to reignite the debate over whether the government is using the most appropriate index to adjust Social Security benefits.

Critics contend that the CPI-W – the price index for urban wage earners and clerical workers, which is currently used to determine the COLA – understates inflation for retirees because the elderly spend more of their money on medical care and the cost of medical care has been rising rapidly. Indeed, in 2007 – the earliest year for which comparable data are available – the elderly spent more than twice as much on medical care – relative to their total expenditures – than the population as a whole.

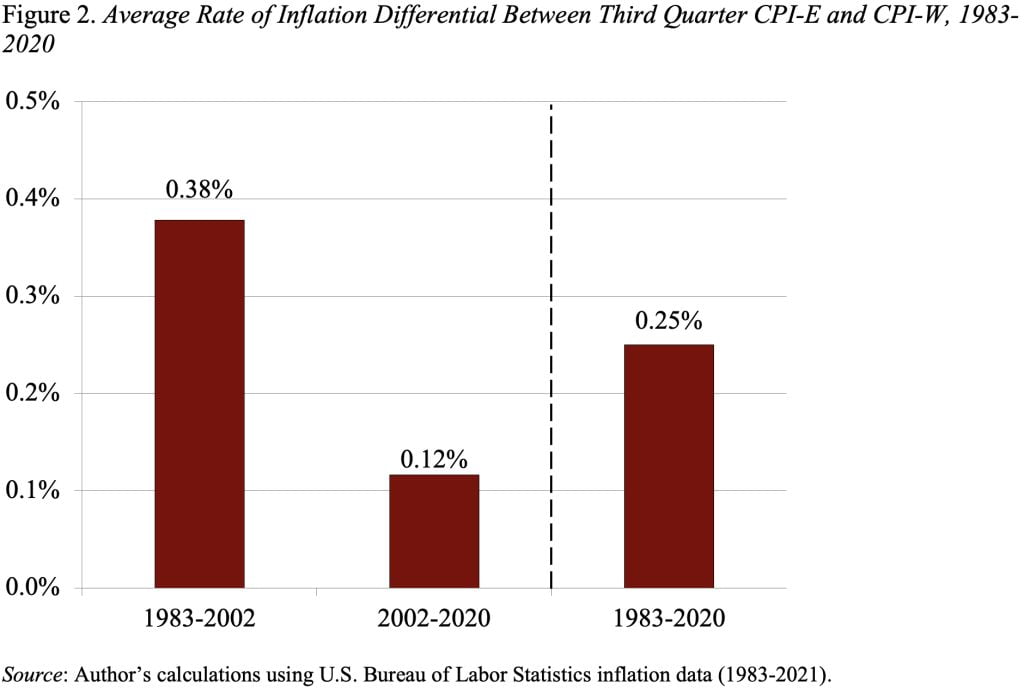

In 1987, Congress directed the U.S. Bureau of Labor Statistics to calculate a separate price index for persons 62 and older. This index, called the CPI-E, has been extended back to December 1982. From the third quarter of 1983 to the third quarter of 2020, the average annual increase for the CPI-E was 2.8 percent, compared to 2.5 percent for the CPI-W.

Interestingly, though, in the last two decades the difference between the rate of increase in the CPI-E and CPI-W has nearly disappeared (see Figure 2). While the CPI-E rose almost 0.38 percent per year faster than the CPI-W over the entire 1983-2002 period, the two indexes showed virtually identical average annual increases during 2002-2020. An earlier study concluded that the main reasons for this shift were a slowing in the rate of increase in the price of medical care and the changing pattern of transportation costs. (Prices for transportation moved from rising slower than average to rising at the average rate, which hurt younger people more than older people.)

Not only has the differential virtually disappeared, but the CPI-E is not ready for prime time. It is not constructed from scratch, but simply involves a reweighting of the data from the CPI for all age groups. As a result, it suffers from several flaws. First, the results are based on a small number of households, which increases the sampling error. Second, prices are based on the same geographic areas and retail outlets used by younger people and may not be representative of the location and types of stores frequented by the older population. Third, the items sampled may not be the same as those bought by the elderly. Finally, the prices are the same as those reported for younger people and do not reflect any senior discounts.

Thus, if the decision were made to employ an index for the elderly, a new index would be needed that used a larger sample of older households and gathered prices for the products that older people buy at the places they shop.

My view – a lot of pain for not much gain!