Limiting Medical Debt: a 50-State Ranking

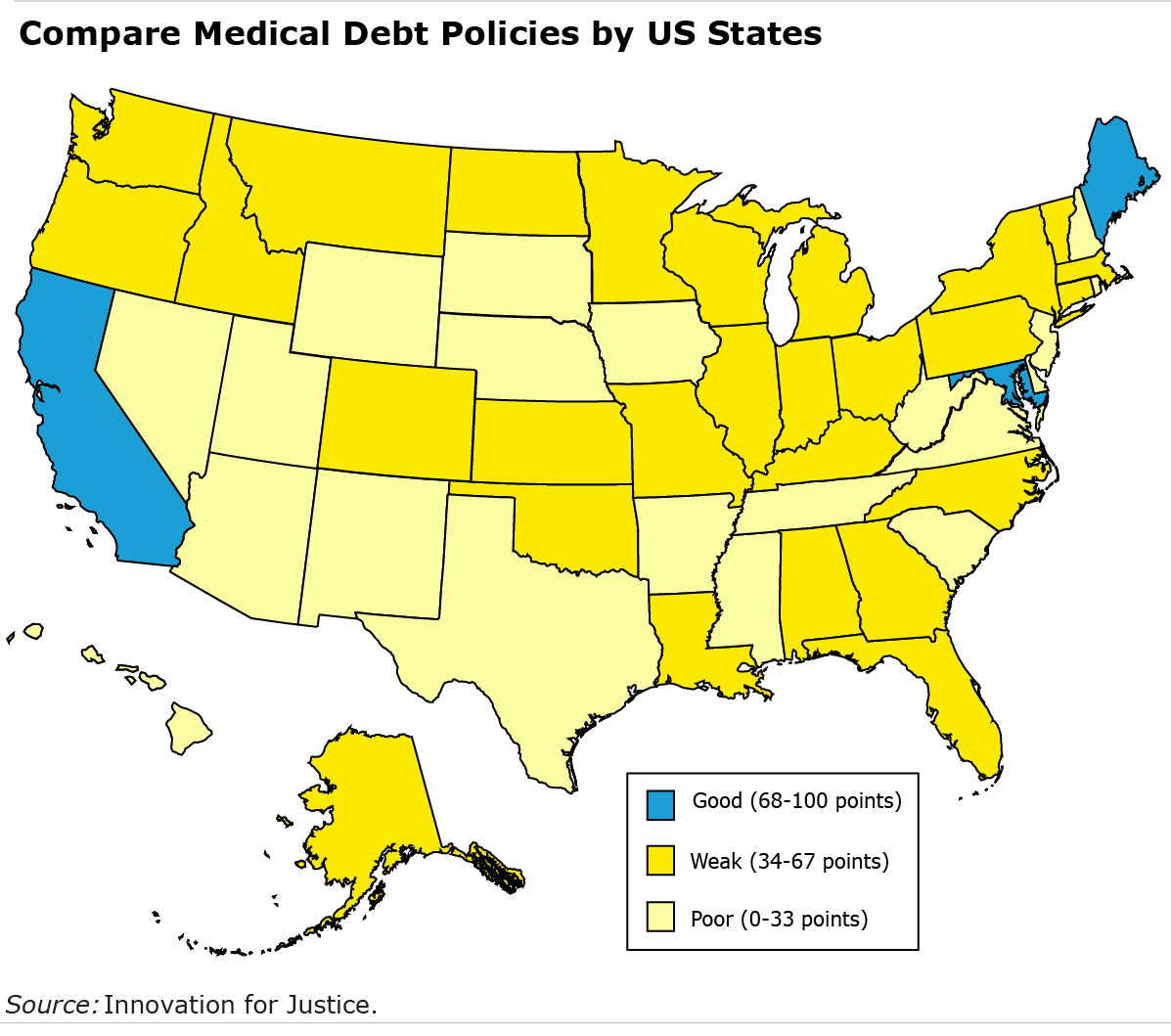

Lawmakers in Maryland, California and Maine have made the most effort to prevent residents from drowning in medical debt. Texas, South Carolina and Tennessee do the least.

This is the assessment of an organization known as Innovation for Justice, a team of researchers at the University of Arizona and the University of Utah. They ranked the 50 states on whether they have taken myriad steps to minimize medical debt. These legislative measures range from restrictions on the healthcare industry’s billing and collection practices to how debt claims are handled in the courts.

Medical debt is the single largest category of consumer debt, and the Kaiser Family Foundation estimates that 100 million Americans are behind on paying their medical or dental expenses – and a quarter of them owe more then $5,000.

This project would be important at any time and is even more so during a pandemic when many people have incurred medical debt for COVID. Some of that debt is even for bills the federal government would’ve paid on behalf of the uninsured cashiers, drivers, retail workers, restaurant servers and cooks who were on the front lines in the worst days of the pandemic.

Putting the state rankings into a national perspective, the consumer protections to prevent the accumulation of debt are not exactly impressive. Only three of the 50 states qualify as having good protections. The researchers ranked another 27 states as weak and 20 as poor.

Maryland, which sits at the top of the medical debt scorecard, satisfies most of the researchers’ criteria for debt reduction. State lawmakers have limited residents’ debt by mandating that patients be screened for health insurance or government health benefits. The state also regulates hospital billing practices, instructing them to offer a payment plan before sending a patient’s bill to collections and requiring that bills itemize every charge, every payment, and whether charity care has been provided to the patient.

Maryland, which sits at the top of the medical debt scorecard, satisfies most of the researchers’ criteria for debt reduction. State lawmakers have limited residents’ debt by mandating that patients be screened for health insurance or government health benefits. The state also regulates hospital billing practices, instructing them to offer a payment plan before sending a patient’s bill to collections and requiring that bills itemize every charge, every payment, and whether charity care has been provided to the patient.

Last but not least, Maryland expanded its Medicaid program, as encouraged by the Affordable Care Act, to extend subsidized or free health insurance to more of its low-income workers. Medical debt has been reduced in the states that expanded their coverage. The lowest-ranked states – Texas, South Carolina and Tennessee – are among the states that have not expanded Medicaid.

Visit the medical debt scorecard to see what your state is – or isn’t – doing.

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

As an illustration of how time-sensitive these rankings might be, consider this. Vermont’s 2022 legislative session enacted 2 or 3 laws that directly address topics on which the rankings give the State a score of 0. For example, one of the laws requires large healthcare facilities to develop a written financial assistance policy that must be submitted to the regulating board as part of its budget review. The law also prohibits the sale of medical debt. The law took effect on July 1, 2022.

Thanks for the update on what Vermont is doing John! Good to hear another state is addressing this problem.