Many Americans Feel Financial Distress

The unemployment rate is an incredibly low 4.4 percent, and a Federal Reserve survey released last week shows that American households’ net worth is increasing.

Yet all is not well.

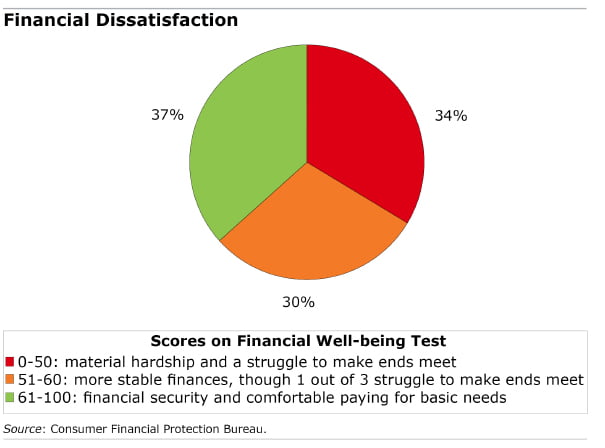

One in three Americans say they are suffering financial hardships, and another third report they are making it but aren’t exactly thriving. One in five struggles to cover what is most basic: food, housing and medical care. These new findings, which came out of a report by the federal Consumer Financial Protection Bureau (CFPB), aren’t about economists’ traditional, objective measures of security, income and wealth levels. This is about how people are feeling about their financial state of affairs.

The common, everyday financial distress expressed in the report is one marker of the familiar socioeconomic chasm that persists in this country. The CFPB highlights the most significant – and unsurprising – differences separating the secure from the struggling: education and income levels, the presence of health insurance, and how much of one’s budget is consumed by housing costs. “Access to jobs, benefits, sufficient income, and family resources likely play a major role in a person’s financial well-being,” the CFPB said.

But it’s also more complicated than that. For example, some lower-income people might, despite their challenges, be able to find their comfort level, CFPB said, while not all higher-income people do. One thing the survey can’t get at is the extent to which feelings of financial security or insecurity are being influenced by how Americans are doing relative to co-workers or people in their communities.

The agency used answers to its 2016 survey to assign financial well-being scores, ranging from 0 to 100, to nearly 6,400 participants. The findings are summarized in a new report.

Myriad factors influence how individuals feel, sometimes leading to surprising results in the CFPB report:

- In contrast to income levels, which economists find are correlated with race, subjective feelings of financial well-being don’t vary as much: whites’ average score in the CFPB survey was 56; blacks 52; and Hispanics 51.

- Two older age groups – all Americans over 65 and a separate category described as officially “retired” – have higher financial well-being scores than younger and working people. One possible explanation is that retirees today still enjoy the benefits from an earlier, golden age for retirement, when defined benefit pensions were more common and Social Security benefits were more generous. Indeed, the CFPB finding also showed that receipt of Social Security benefits is central to older Americans’ sense of well-being.

- Single people scored lower than married people, who tend to have more financial resources and often two incomes. That’s not surprising. But a new American Enterprise Institute (AEI) report underscores the importance of marriage status in undergirding the “class divide in American family life.” Less than 40 percent of working-class and poor Americans are married, compared with well over half of high-income people. The poor and working-class “have more fragile families and fewer socioeconomic resources,” AEI said.

- The greatest disparity between high and low well-being scores is tied to the amount people hold in bank and retirement savings accounts, CFPB said. The average well-being score is 41 for people who’ve saved less than $250 in these accounts, compared with 68 for people with more than $75,000. The ability to absorb unexpected expenses is fundamental to relieving financial anxiety.

The CFPB said there is one way some people can escape financial distress: greater well-being is more common among people with “higher levels of financial know-how, confidence, and certain day-to-day money management.”

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our blog, please join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here.

Comments are closed.

A national team of academic scholars and other experts (Garman et al. 2005) recently concluded that 30 million workers in America — one in four — are seriously financially distressed. Not only does this have negative consequences for individual workers, their families, and employers, but it also constitutes a serious social problem.

The estimate of financial distress is based on findings from over 2 dozen research studies, national opinion polling data, and newly conducted research. Although most working adults are satisfied with their personal finances and are not financially distressed, a substantial minority is having considerable trouble. They worry about money, debt, bills, and having enough money to live on once they retire and have given up hope of catching up financially.

A national team of academic scholars and other experts (Garman et al. 2005) recently concluded that 30 million workers in America — one in four — are seriously financially distressed. Not only does this have negative consequences for individual workers, their families, and employers, but it also constitutes a serious social problem.

The estimate of financial distress is based on findings from over 2 dozen research studies, national opinion polling data, and newly conducted research. Although most working adults are satisfied with their personal finances and are not financially distressed, a substantial minority is having considerable trouble. They worry about money, debt, bills, and having enough money to live on once they retire and have given up hope of catching up financially.