Marriage Can Be Great for Your Finances – but Avoid These Three Mistakes

Geoffrey T. Sanzenbacher is a columnist for MarketWatch and a professor of the practice of economics at Boston College. He is also a research fellow at the Center for Retirement Research at Boston College.

What can go wrong? Being in a couple complicates your decision-making.

From an economist’s perspective, one advantage of marriage is the financial benefits. Marriage allows risk sharing between partners (e.g., one partner can work more if the other loses their job) and allows couples to take advantage of returns to scale (i.e., it’s cheaper to maintain one household than two separate ones). These benefits are why I find the roughly 30-percent drop in marriage rates over the last 40 years troubling.

But marriage also complicates financial decision-making. People who aren’t yet married may delay big decisions like saving for retirement. Once married, couples need to recognize that their retirement savings must eventually be enough for two people, not one. And, decisions around these savings must reflect two sets of personalities and preferences.

The truth is that couples – and this might include you – often make mistakes. A study I did with colleagues Alicia Munnell and Wenliang Hou found that despite the financial gains to marriage, married couples had a higher risk of having insufficient retirement income to maintain their pre-retirement living standard. So, what goes wrong? A few things that people can resolve to fix in the new year, starting before couples even get married.

Mistake 1: Waiting Until Marriage…to Save

Along with declining marriage rates, people are getting married later. Since marriage is a milestone that often delineates youth from adulthood, a logical question is how this delay affects retirement saving. Such a delay could rob people of years of contributions, employer matches, and compound interest.

To examine this issue, a study that I did back in 2019 linked data on marriage to 401(k) savings and followed people right before and after their marriages. The study found that men were 13 percent more likely to participate in a 401(k) following marriage and that, when participating, they contributed 6 percent more. For women, the participation gains from marriage were smaller – 5 percent – but their contribution gains larger, at 17 percent. So, if the trend towards delayed marriage continues, it will likely lead to delayed saving too.

The plan: Start saving now…whatever your relationship status.

Mistake 2: Forgetting that You May Be Saving for Two

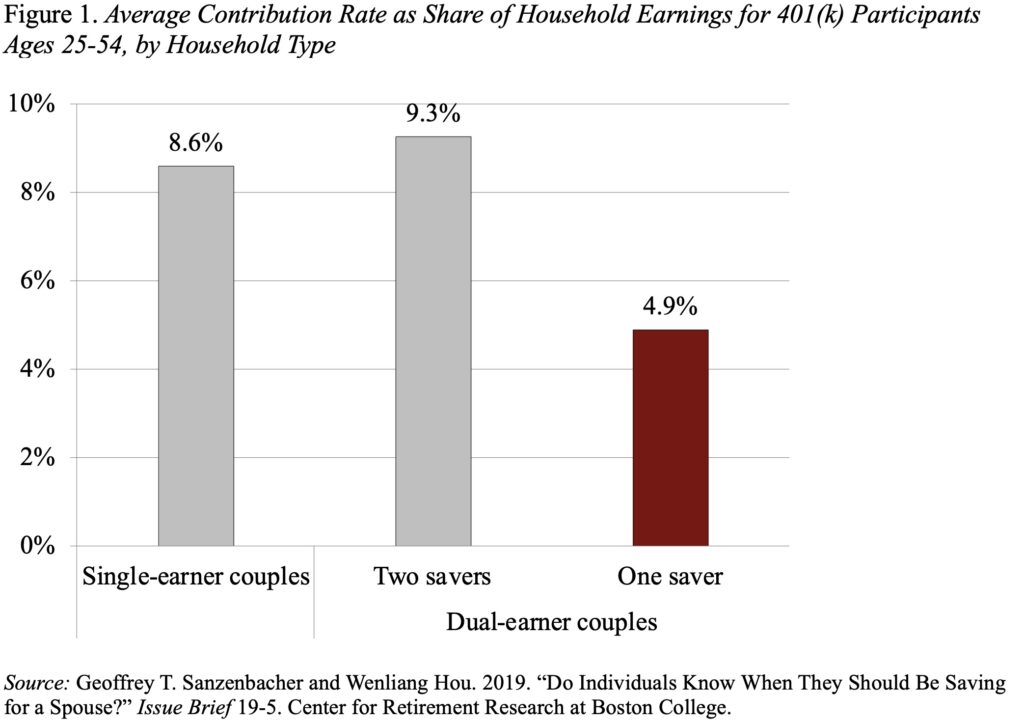

Once married, couples would do well to remember an obvious point: you are now two financially linked people. So, a couple with two earners needs to have more saved for retirement than a couple with one earner, since they need to replace more total income. But here’s the thing: while retirement needs are a household problem, saving for retirement is often an individual one. Most people make saving decisions while at work and without their spouse. Or, they may just follow their plan’s defaults. These decisions may be fine if both earners have retirement plans at work. But, if one member of a couple earns income but doesn’t have a 401(k), their spouse needs to save more to replace that income. Yet, a study I worked on with Wenliang Hou showed that they don’t. Households with two-earners but one 401(k) save about half as much as other couples relative to their income (see Figure 1). In other words, the saver fails to recognize that they are saving for two.

The plan for two-earner couples: Make sure you know if the other member is saving and, if not, save more yourself.

Mistake 3: Taking on the Personality of a Low Self-Control Spouse

Everyone who is currently married knows that the key to remaining married is simple: compromise. But, a study I came upon shows the downside – sometimes individuals who have good financial habits accommodate their less financially capable spouse.

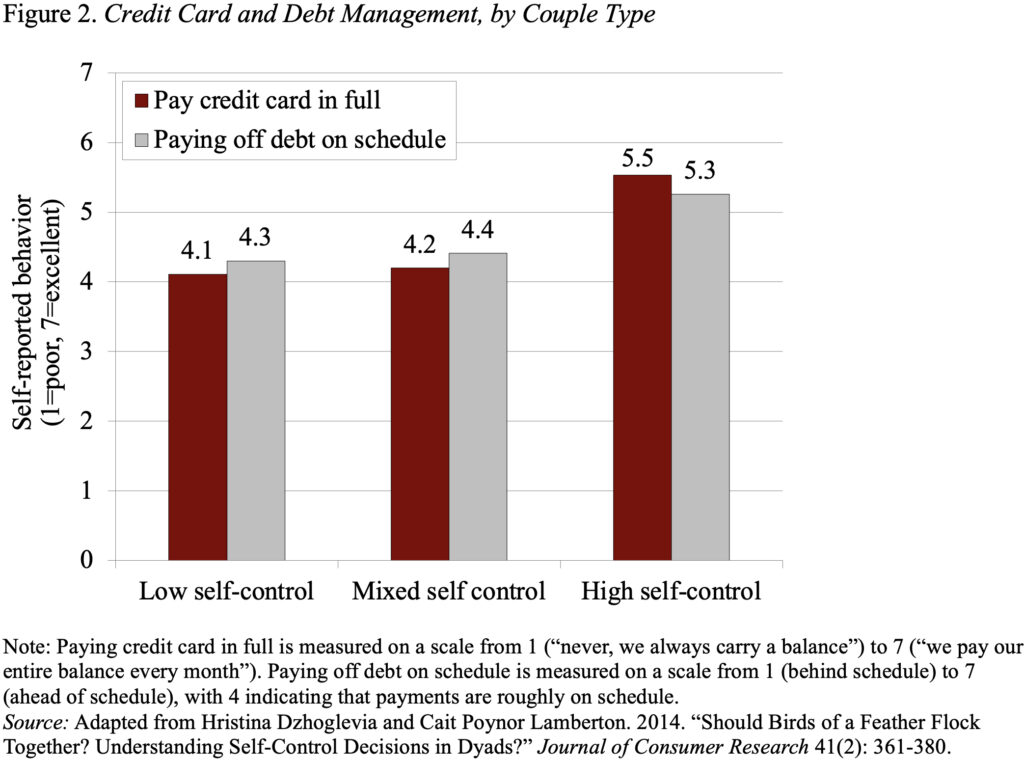

To measure capability, the study assessed couples’ capacity for self-control. After all, research consistently shows that individuals with lower self-control save less, carry more debt, and make poorer financial choices. Couples were then identified as having either two high self-control members, two low self-control members, or being a mixed self-control couple.

Figure 2 shows one of the key results. When individuals were asked to report on a scale from 1 (poor) to 7 (excellent) how often they paid off their credit cards in full or their debt on schedule, high self-control couples looked a lot better than low self-control couples. Not surprising. But, what is surprising is that mixed self-control couples looked just like low self-control couples. It seems that in trying to be a good spouse and accommodate their low-self-control spouse, the high self-control spouse lets their finances suffer.

The plan for high self-control spouses with a low self-control partner: Try to work with your spouse to ensure that some of your good financial habits shine through.

And the lesson for all people: make sure you avoid these three common mistakes.