Middle-Income Households Haven’t Recovered Since the Great Recession

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

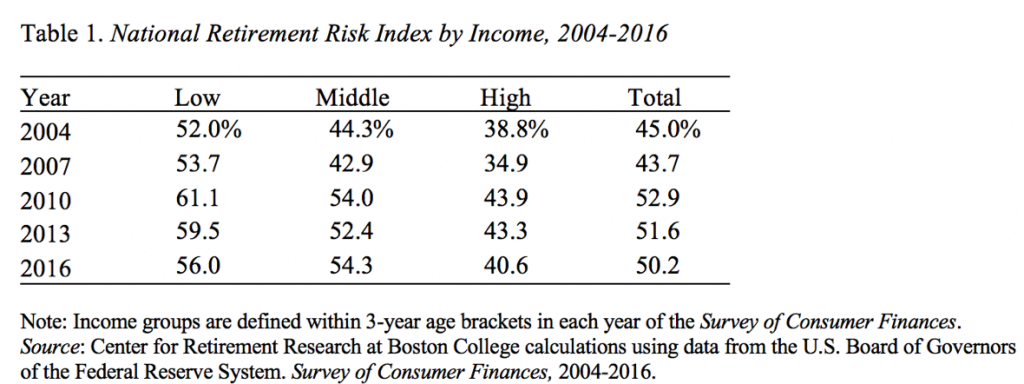

Almost 55% are at risk of not being able to maintain their lifestyle in retirement.

Increasingly, commentary and studies are focusing on the trends in retirement well-being over the last decade. Last week’s blog post showed that the wealth for households in the middle of the wealth distribution actually declined for Late Boomers in their early 50s compared to that for earlier cohorts at a similar age.

I was curious how the middle income households were doing according to the National Retirement Risk Index (NRRI) that the Center for Retirement Research maintains. The NRRI is based on data from the Federal Reserve’s Survey of Consumer Finances and is constructed in three steps: 1) projecting a replacement rate – retirement income as a share of pre-retirement income – for each household; 2) constructing a target replacement rate that would allow each household to maintain its pre-retirement standard of living in retirement; and 3) comparing the projected and target replacement rates to find the percentage of households at risk.

Overall, the NRRI shows that half of today’s working-age households are at risk of not being able to maintain their standard of living in retirement. This percentage is much higher than before the Great Recession, but improved from the peak in 2010.

What’s the story if we look at the results by income level? Table 1 shows that households in the middle-income group have suffered the greatest deterioration in their circumstances. The percentage at risk for this group increased 10 percentage points (44.3% to 54.3%) between 2004 and 2016. That increase compares to 4 percentage points for low-income households and less than 2 percentage points for households in the top third of the income distribution. In 2004 and 2007, the percentage at risk for middle-income households was below average; after 2007, the percentage at risk exceeded the average.

Why are the middle-income households doing so poorly? The story hinges on homes and equities. In the NRRI, home ownership and home prices have a significant impact because households are assumed to access their home equity at retirement by taking out a reverse mortgage. The house is the major asset for middle-income families, and this asset took a beating when the housing bubble burst. And, while house prices have rebounded, they have not returned to their previous levels in many parts of the country.

In contrast, equity prices have increased dramatically. The stock market has more than quadrupled since it bottomed out in March 2009. However, these gains have been concentrated in the top third of the income distribution, which holds about 87 percent of all equities.

It’s easy to tell a good story about retirement security if the focus is on the top half of the income distribution. It’s much harder if looking at the population as a whole!