New Proposal Would Improve Social Security’s Finances and Modestly Enhance Benefits

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

It also avoids the potential pitfalls of making benefit improvements temporary.

Representative Al Lawson (D-FL) recently proposed a piece of Social Security legislation, which has been scored by SSA’s Office of the Chief Actuary. The Lawson proposal is the second major Social Security bill in a month, following Representative John Larson’s (D-CT) Social Security 2100: A Sacred Trust.

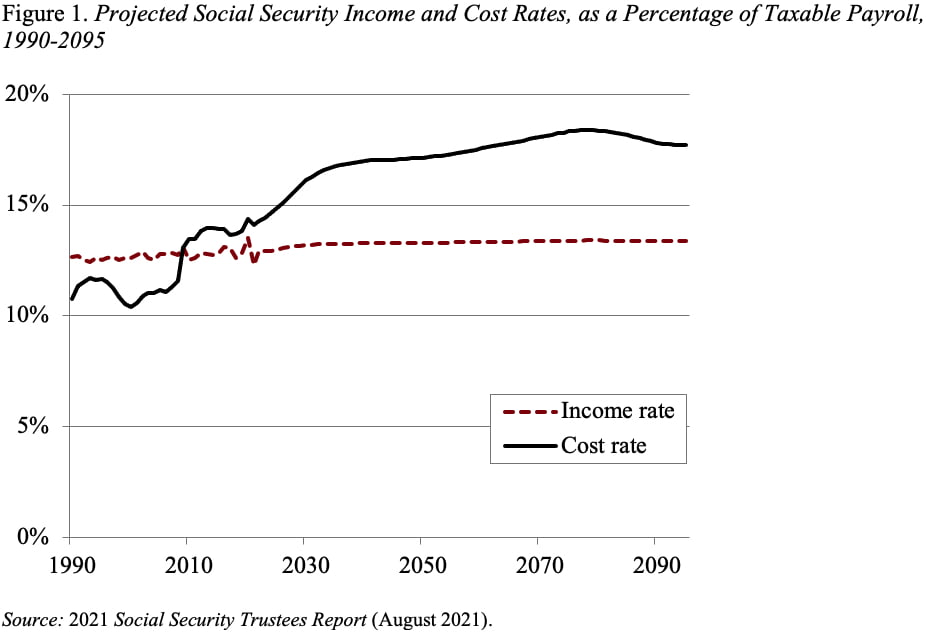

As a reminder, the Social Security actuaries project a program deficit over the next 75 years of 3.54 percent of taxable payrolls. This deficit reflects the combination of rising costs and constant levels of income (see Figure 1). The increasing costs are the result of a slow-growing labor force and the retirement of baby boomers, which raises the ratio of retirees to workers. Social Security’s deficit can be eliminated either by bringing up the income rate and/or lowering the cost rate.

Both the Lawson and Larson bills maintain current benefits – that is, they do not reduce the cost rate. Instead, they raise the income rate by lifting the cap on maximum taxable earnings. The area where the two bills differ the most is benefit enhancements. Whereas the Larson bill proposes a dozen enhancements for a five-year period, the Lawson bill offers four enhancements on a permanent basis.

Specifically, the Lawson legislation proposes to:

- Use the Consumer Price Index for the Elderly (CPI-E), which historically has risen faster than the CPI-W price index currently used for Social Security, to adjust benefits for inflation.

- Extend student benefits up to age 23 if full-time students.

- Increase the special minimum benefit for workers with very low earnings and index it by the growth in average wages.

- Establish an alternative benefit for surviving spouses equal to 75 percent of the couple’s benefit (subject to an upper limit).

To pay for these benefit enhancements and, more importantly, to reduce the 75-year deficit, the Lawson legislation would apply the payroll tax on earnings above $250,000 and on all earnings once the taxable maximum reaches $250,000. The legislation would apply a 2-percent benefit factor on average earnings above the current law maximum.

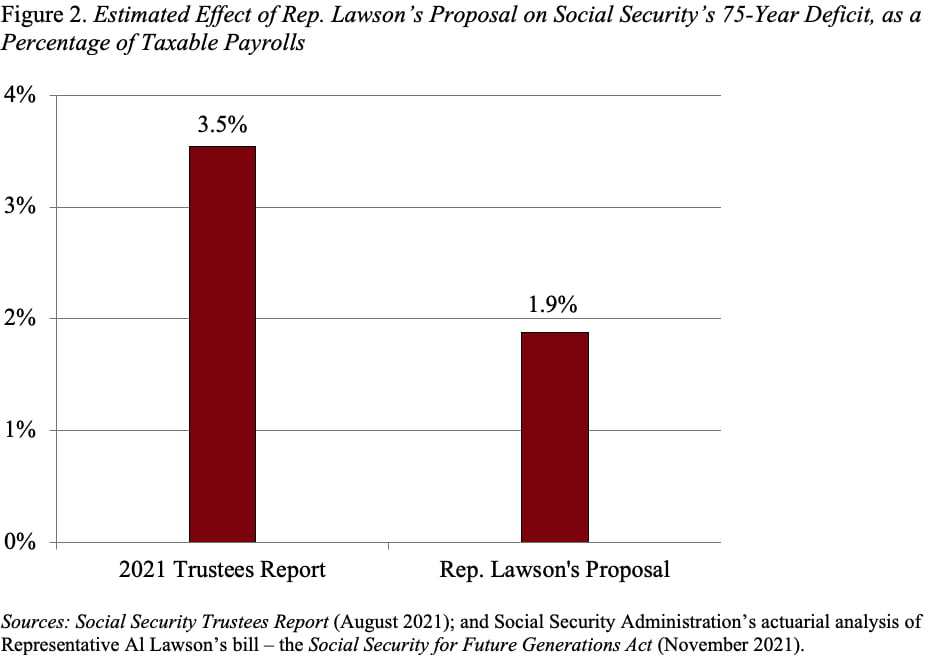

Enactment of these benefit and revenue provisions would cut Social Security’s long-range deficit roughly in half – from 3.54 percent of taxable payroll to 1.88 percent (see Figure 2).

Both bills have some favorable aspects: they maintain current benefits and they raise additional revenues – although at least the Larson bill appears limited in the revenue-raising efforts by the President’s pledge not to raise taxes on households earning less than $400,000.

In terms of benefit enhancements, both “spend” a lot of future revenue switching from the CPI-W to the CPI-E for indexing benefits. Personally, I wouldn’t bother. The other benefit changes in the Lawson bill are relatively small and positive. Most importantly, they are permanent, avoiding the chaos likely to be created by the temporary enhancements in the Larson bill.

In the end, however, any solution is likely to involve a modest increase in the payroll tax rate – a change that would raise taxes on those with less than $400,000.