This New Social Security Bill Could Make the Program Even Better

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

And raises enough new revenue to more than restore long-run balance.

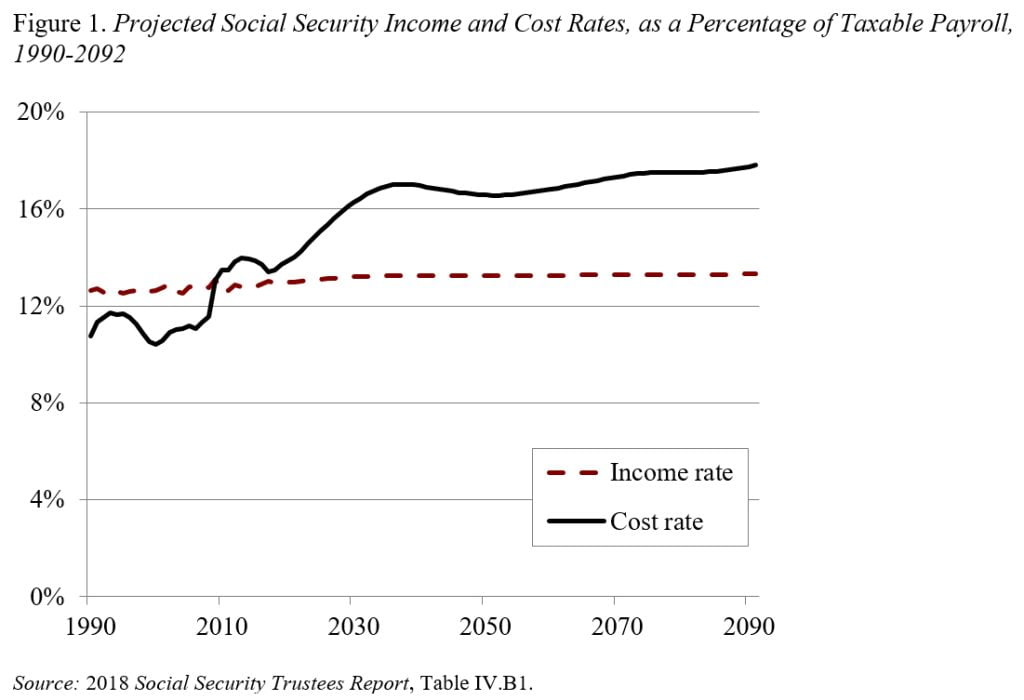

The Social Security actuaries project a program deficit over the next 75 years of 2.84 percent of taxable payrolls. As shown in Figure 1, this deficit reflects the combination of rising costs and constant levels of income. The increasing costs are the result of a slow-growing labor force and the retirement of baby boomers, which raises the ratio of retirees to workers. Social Security’s deficit can be eliminated either by bringing up the income rate or lowering the cost rate in Figure 1.

The Social Security 2100 Act, proposed by Representative John Larson (D-CT), Chairman of the House Ways and Means Subcommittee on Social Security; Senator Richard Blumenthal (D-CT); and Senator Chris van Hollen (D-MD), retains – and even slightly enhances – benefits and substantially increases the income rate. I think this is the right approach.

The legislation, which currently has 202 co-sponsors in the House of Representatives, includes four benefit enhancements:

- Uses the Consumer Price Index for the Elderly (CPI-E) to adjust benefits for inflation. The CPI-E rises faster than the current index (the CPI-W).

- Raises the first factor in the benefit formula from 90 to 93 percent, which would slightly raise replacement rates for all.

- Increases thresholds for taxation of benefits under the personal income tax, which would allow middle-class workers to keep more of their benefits.

- Increases the special minimum benefit for those with very low earnings.

To pay for these benefit enhancements and, more importantly to eliminate the 75-year deficit, the legislation increases income to the program in two significant ways:

- Raises the combined OASDI payroll tax of 12.4 by 0.1 percent per year until it reaches 14.8 percent in 2043.

- Applies the payroll tax on earnings above $400,000 and on all earnings once the taxable maximum reaches $400,000, with a small offsetting benefit for these additional taxes.

Enactment of these benefit and revenue provisions would change Social Security’s long-range deficit from 2.84 percent of taxable payroll under current law to a positive actuarial balance of 0.25 percent. This Larson-Blumenthal-Van Hollen proposal is not only appealing to me but also helpful for the required debate about how to fix Social Security. The American people need to let their representatives in Congress know how they would like the elimination of Social Security’s 75-year shortfall allocated between benefit cuts and tax increases – 100 percent with benefit cuts, 100 percent with tax increases; 50 percent/50 percent; 75 percent/25 percent; or 25 percent/75 percent? My guess is that Americans are willing to pay more taxes to retain current benefits under this crucial program.