No Need to Talk about the Saver’s Credit in a Presidential Campaign

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

But it is too valuable – especially if it were refundable – to slip off the agenda.

The Saver’s Credit gives a special tax break to low- and moderate-income taxpayers who are saving for retirement. It was introduced in 2001 and scheduled to expire in 2006. The Pension Protection Act of 2006, however, made the credit permanent and indexed the income thresholds. The Saver’s Credit is in addition to other tax benefits for saving in a retirement account.

Two things have made me think about the Saver’s Credit recently. The first is press inquiries about retirement issues that the presidential candidates should address. My usual response is that candidates should be asked what they would do about Social Security and what steps they would take to close the coverage gap – the fact that only half of private sector workers are covered by an employer plan at any given time. The Saver’s Credit is just too small to make the presidential-debate cut.

The second thing is work we have been doing on the Auto-IRA program in Oregon, where employers without a retirement plan are required to automatically enroll their employees in an IRA. The Saver’s Credit could enrich the Oregon program and those underway in California, Illinois and other states. But this isn’t the right time to push the Saver’s Credit, because everyone is focused on just getting the programs up and running.

However, the Saver’s Credit is too valuable to slip off the agenda, and it could be even more valuable with some measured changes.

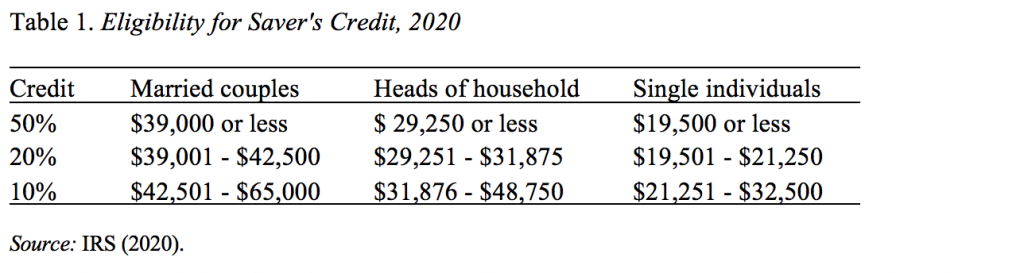

Depending on adjusted gross income (AGI), the household can claim a credit for 50 percent, 20 percent, or 10 percent of the first $2,000 contributed during the year to a retirement account. Thus, the maximum credit for an individual is $1,000, $2,000 for a married couple when each is contributing to a plan. Table 1 shows the 2020 income limits for married couples, heads of households, and single individuals.

In theory, low- and middle-earners could gain a lot from the Saver’s Credit. A married couple with combined income of $39,000 who contributes $2,000 to their IRAs under the new Oregon program are eligible for a $1,000 credit. That is, they pay $1,000 less in federal income taxes than they would have otherwise. The net result is a $2,000 account balance that cost the couple only $1,000 after taxes (the $2,000 contribution minus the $1,000 credit), which is equivalent to a 100-percent match on the contribution.

In practice, the Saver’s Credit does not work as smoothly as suggested above. The first issue is that the credit is nonrefundable, which means that the credit can reduce the required tax repayment to zero but not below. So if the couple only had a tax liability of $750, their credit would be limited to that amount. Second, because of interaction with the Child Care Credit, the Saver’s Credit is often not usable for taxpayers with children. Finally, many people do not know about the Saver’s Credit.

Just as an aside, the design looks a little crazy. As couples move from an AGI of $39,000 to $39,001, their credit rate drops from 50 percent to 20 percent. This drop means that the maximum credit for a $2,000 contribution drops from $1,000 to $400. While it makes sense for the credit rate to decline as income rises, the phase-out could be structured more gradually.

So, my hope is that, even if it is not discussed during the campaign, the next president recognizes the promise of the Saver’s Credit and encourages Congress to make it refundable, create a more gradual phase-out, and perhaps raise the income limits for eligibility (the median salary of a full-time uncovered worker in Oregon in 2017 was $40,000). Since the point of the Saver’s Credit is to encourage retirement saving, it might make sense to have the refundable payment automatically deposited into the saver’s IRA.

So we don’t have to talk about the Saver’s Credit right now, but it could be a really important tool for enhancing retirement security.