Yes, It’s True: Older People Depend on Social Security

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

This dependency needs to be part of any discussion about the program’s future.

For decades, the Social Security Administration has put out reports showing the percentage of household income attributable to Social Security. In recent years, some analysts have criticized the reliance of these estimates on data from the Current Population Survey (CPS). Studies have shown that the CPS was underreporting income from both defined benefit and defined contribution plans. To the extent that the survey underreports pension income, it will overstate the importance of Social Security. Candidly, due to this concern, I have shied away from using these statistics in the last couple of years.

Fortunately, three researchers from the Social Security Administration have produced a comprehensive study that clarifies the role of Social Security by drawing data from three separate household surveys. One survey is the CPS, which was substantially redesigned in 2014-15 so that it now includes separate questions about retirement-income account withdrawals and distributions. Comparing the results of the redesigned CPS to earlier years shows that the prevalence and aggregate value of retirement income other than Social Security were about 50 percent and 22 percent higher, respectively.

The second survey is the Health and Retirement Study (HRS), the most comprehensive longitudinal study for Americans ages 51 and older. The HRS can be linked to verifiable administrative information on Social Security benefits and provides comprehensive information on retirement plan account balances and distributions from defined benefit plans. To adjust for the fact that the HRS income measure does not include withdrawals from 401(k)s or IRAs, the researchers assumed that those over 70½ took the Internal Revenue Service’s required minimum distribution and made comparable estimates for the years 65-70½.

The third survey is the Survey of Income and Program Participation (SIPP). The SIPP participants can also be linked to Social Security administrative records, and this survey includes distributions from both defined benefit and defined contribution plans in its measure of income.

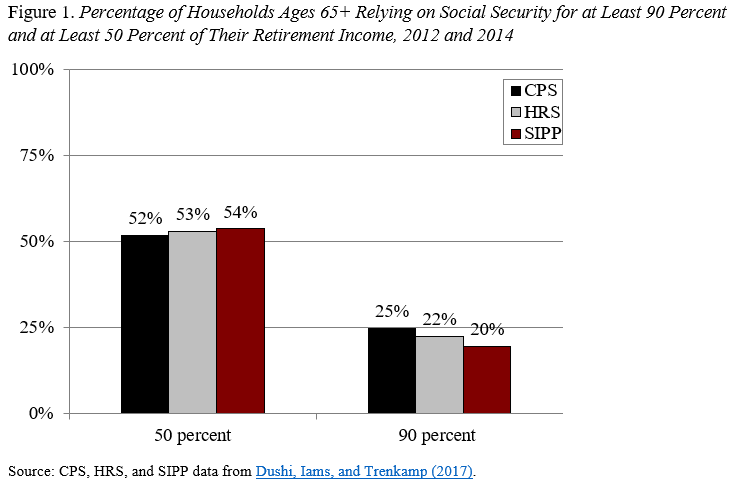

Figure 1 shows the results from all three surveys for the percentage of households relying on Social Security for 90 percent and 50 percent of their retirement income. The results are remarkably similar across surveys.

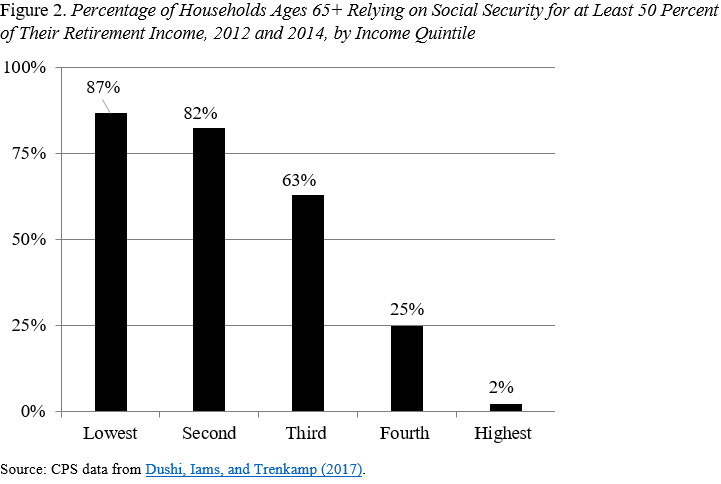

Figure 2 uses the CPS to show how the dependence varies by income. For the first three fifths of the income distribution, the vast majority depend on Social Security for more than half of their retirement income.

Hopefully, this comprehensive analysis will put the statistical debate to rest. Social Security is a very important source of retirement income and that needs to be recognized in any debate about the program’s future.