President Trump Should Combine Extending Tax Cuts with Fixing Social Security

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

It would be good fiscal policy and, I bet, good politics.

Here’s the plan. The President has linked two budget items, and that may be a good idea. He wants to extend his 2017 Tax Cuts and Jobs Act and provide some other tax breaks, and we need to fix Social Security. The link between tax cuts and Social Security exists because one of President Trump’s new tax-cutting proposals would exempt Social Security benefits from taxation under the federal income tax. Since benefit taxation now accounts for 4 percent of Social Security revenues, exempting benefits from taxation worsens the program’s finances and increases pressure for solving the problem quickly.

My plan is to combine the President’s tax reduction proposals with a package to eliminate Social Security’s 75-year deficit. This plan would not solve all the world’s problems, but it would avoid making our fiscal situation more dire than it is already.

According to the Congressional Budget Office, the government is currently slated to run a deficit equal to 6.2 percent of GDP in 2025. Without corrective action, deficits of roughly that size are projected to continue throughout CBO’s projection period (see Figure 1).

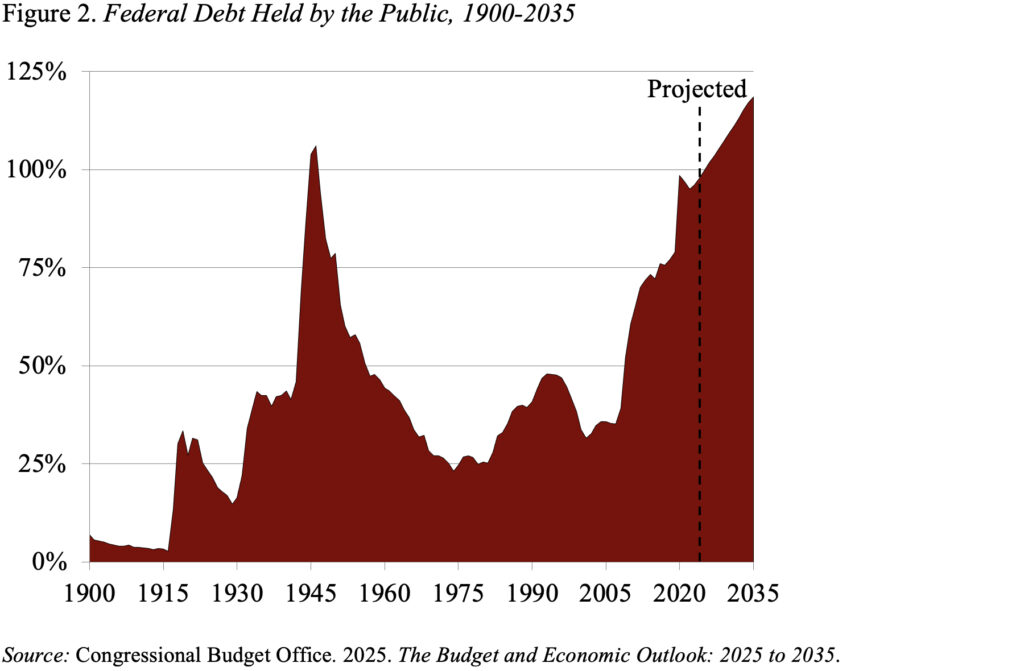

As a result of these persistent deficits, debt swells. Federal debt in the hands of the public rises from 100 percent of GDP this year to 118 percent of GDP in 2035, greater than at any point in our nation’s history (see Figure 2).

Now here’s the important point. These CBO projections assume that the laws “governing taxes and spending generally remain unchanged.” That assumption means that most of the tax cuts in the Tax Cuts and Jobs Act of 2017 expire as planned at the end of 2025. If they do not, the deficits as a percentage of GDP would be about 1.2 percent higher and the debt would balloon even more. The CBO projections also assume that nothing is done to fix Social Security. If Congress did enact a package to eliminate Social Security’s 75-year deficit, the budget deficit would be 1.2 percent of GDP lower.

Just to be clear – extending the 2017 tax cuts alone would make the fiscal situation much worse than current projections; extending these tax cuts and fixing Social Security would do no harm. In other words, a package to fix Social Security could be viewed as a “pay for” for extending the tax cuts – yielding no increase in the projected deficits.

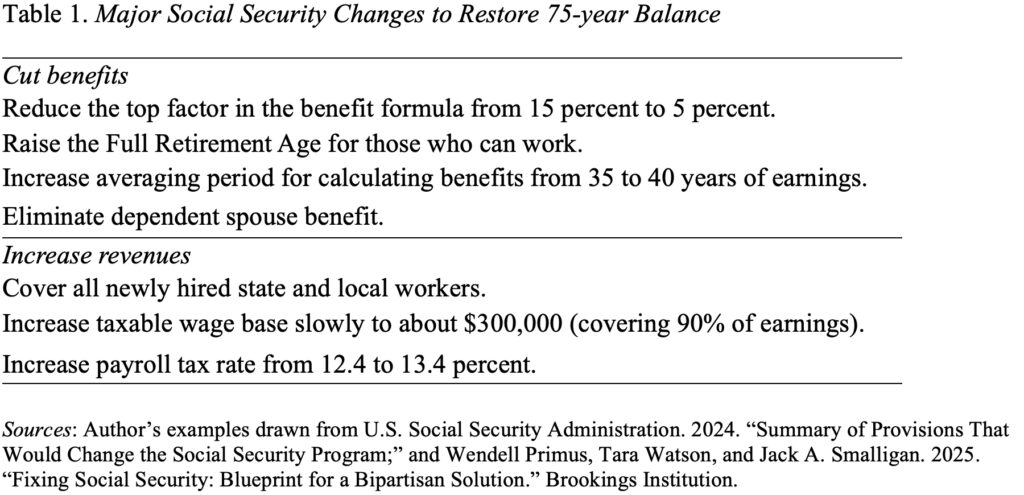

Since the President seems in a hurry to get his tax changes through Congress, here are a few fairly simple, and well-vetted, changes that could restore balance to Social Security – split roughly equally between benefit cuts and revenue increases (see Table 1). The only new item on the list is reducing the top factor in the benefit formula, which would lower benefits slightly for higher earners, now that they would no longer have to pay income taxes on their benefits. Otherwise, this list is pretty standard fare.

When it comes to the federal budget, I’m really old school. I actually think we should pay for any proposal with an offsetting change in revenues or expenditures, and keep deficits at a minimum. Clearly both parties have moved away from that simple framework. The proposal offered here does not address that fundamental failing. All it does is avoid making the situation much worse. It also has a nice ring to it – while the tax cuts primarily benefit the wealthy, fixing Social Security helps everyone.