Filter

Get Help with Medicare Coverage Denials

The United States has a notoriously complex healthcare system, and Medicare is no different. In the early months of the pandemic, the Medicare Rights Center received a large number of calls to its telephone help line from people over 65 who had suddenly been laid off and lost their employer coverage. Even when there isn’t a crisis, the center’s staff and volunteers answer all manner of questions about Medicare enrollment rules, insurance options, and what to do when an insurance company denies them coverage. Sarah Murdoch is the center’s director of client services and oversees the helpline. She spoke with Squared Away about the common issues retirees face and how they can address them. Question: Your helpline fielded 42,000 questions…

June 9, 2022

Some Public Sector Pensions are Inadequate

About 5 million employees in state and local government are not currently part of the Social Security system. Federal law tries to protect them by requiring that their traditional government pensions provide the same retirement benefits they would receive if they and their employers were instead contributing to Social Security. But the Center for Retirement Research finds that roughly 17 percent of these workers’ pensions fall short of that modest standard. The reasons involve how long they remain in their government jobs and how their pensions are calculated. Let’s start with the workers who usually do not fall short: career public sector employees. They are protected because their pension annuities are based on their average salaries in the final years…

June 7, 2022

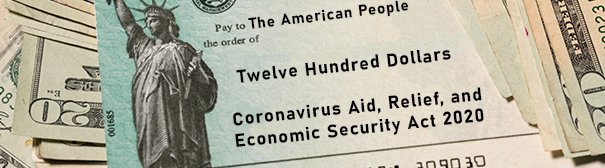

COVID Relief Checks Helped Needy the Most

In the pandemic’s early days, the unraveling of economic life was breathtaking. Some 3.3 million Americans filed for jobless benefits in the second week of March 2020. A record 6.6 million joined them the following week. By April, government checks were starting to land in workers’ bank accounts, bringing the urgent relief Congress intended. The unemployed used the often-substantial assistance – up to $3,400 for a family of four – to cover basic expenses, and the people who were holding on to their jobs saved for possibly difficult days ahead. New research shows that the benefits of this assistance disproportionately went to those who needed it most: low-income workers and people who had financial problems before COVID hit. The relief…

June 2, 2022

Remote Work Has Pushed Up House Prices

Slack, Citizens Bank, Penguin Random House, Verizon, 3M, Twitter – the list is long and growing of companies that have allowed employees to continue working remotely even though the pandemic seems to be easing. The COVID-19 upheaval in lifestyles – the moving around to larger homes, to the countryside or to an affordable city – is pushing up house prices. John Mondragon at the Federal Reserve Bank of San Francisco and Johannes Wieland at the University of California, San Diego, estimate that remote work fueled a 15 percent rise in house prices over the two-year period that ended in November 2021. That’s more than half of the total price increase for that period, which was a record, the researchers said…

May 31, 2022

Parents Work Less After Kids Leave Home

When children grow up and become financially independent, how do parents adjust their finances? Are they finally spending money on themselves? Saving more for retirement? Paying down debt? No one has come up with a convincing answer yet. Especially puzzling is that past research has shown that parents seem to reduce their consumption after the adult children move out. Yet there’s no evidence that much of the extra money is going into 401(k)s. So what’s going on? A new study for the first time finds a missing puzzle piece: parents, freed from the obligation to support their children, are choosing to work less. Parents work one to two hours less per week after their adult children leave home for good,…

May 26, 2022

Americans Say They Need a Finance Class

For all of Americans’ financial shortcomings, at least we recognize there is a problem. More than 80 percent of adults believe states should require a personal finance class in high school and wish they’d taken one themselves, according to a March survey by the National Endowment for Financial Education (NEFE). Rarely do we see that much agreement on anything, and it indicates people don’t always feel confident about the choices they are making. A famous questionnaire takes the measure of their insecurity: less than a third of people surveyed correctly answered three basic questions about interest rates, inflation, and investment risk. Of course, people over 60 have more experience, and 92 percent of them think financial education is important. But…

May 24, 2022

Explaining Social Security’s Earnings Test

The reduction in benefits for some people who collect Social Security while simultaneously working is frequently called a “tax.” It is not a tax. Under a Social Security rule known as the Retirement Earnings Test (RET), some benefits are withheld if the worker earns above a certain level – $19,560 in 2022 – and has not yet reached his full retirement age under the program. At that age, the government starts paying the deferred benefits back incrementally. As older workers plot a path to retirement, they should have a clear understanding of this financial impact. But a new study finds they have a poor grasp of the tradeoff that is the central feature of the RET: a smaller monthly check…

May 19, 2022

Enhancement to Savers Tax Credit is Minor

The Savers Tax Credit sounds great on paper. Low-income people get a federal tax credit for saving money for retirement. But this part of the tax code always seems to disappoint. The House recently overwhelmingly passed a bill, the Secure Act 2.0, that – along with numerous other retirement provisions – makes the savers credit more generous for some low-income workers. Under current law, taxpayers can get one of three credits – 10 percent, 20 percent, or 50 percent of the amount they save in a 401(k). The Secure Act, which is now headed for the Senate, would somewhat increase the top income levels for the 50 percent credit – from $20,500 currently to $24,000 for single taxpayers and from…

May 17, 2022

Got a Retirement Plan? Race Plays a Role

The following statistic will sound familiar since I use it regularly: about half of U.S. workers are not saving enough and may see their standard of living drop when they retire. A major culprit in this poor state of preparedness is that millions of Americans at any given moment don’t have a traditional pension or 401(k) savings plan at work. A new study takes a close look at who these people are and shows stark differences along racial lines. A large majority of Hispanic workers in the private sector – two out of every three – do not have access to a pension or 401(k)-style plan, and more than half of Black workers do not have access. Although the numbers…

May 12, 2022

Too Much Debt Taxes Baby Boomers’ Health

Staying healthy is becoming a preoccupation for baby boomers as each new medical problem arises and the existing ones worsen. The stress of having too much debt isn’t helping. The older workers and retirees who carry debt are less healthy than the people who are debt free, and higher levels of debt have worse health effects, according to Urban Institute research. The type of debt matters too. Unsecured credit cards have more of an impact than secured debt – namely a mortgage backed by property. Debt can erode an individual’s health in various ways. The stress of carrying a lot of debt has been shown to cause hypertension, depression, and overeating. And it can be a challenge for people to…

May 10, 2022

Use of Medicare Subsidy Low in Some States

A major government program helps poor and low-income retirees and adults with disabilities defray what can be substantial healthcare expenses that aren’t covered by Medicare. But enrollment is unusually low in some states because of more stringent eligibility standards. The Medicare Savings Programs, which are administered by the states and funded by the federal government, subsidize Medicare’s Part A and Part B premiums and cost-sharing obligations for more than 10 million Medicare beneficiaries. But participation varies widely from state to state, according to a new report by the Kaiser Family Foundation, due to a combination of differences in need and varying eligibility standards. No more than 10 percent of the retirees in Nebraska, New Hampshire, North Dakota, Utah, and Wyoming…

May 5, 2022

Opioids Make it Harder, Not Easier to Work

The twin goals of prescribing opioids to workers with a bad back or arthritis are to alleviate their pain and keep them employed. But the use and abuse of opioids can cause poor memory, extreme drowsiness, and an inability to engage in normal social interactions – all of which limit workers’ ability to function. Opioids also have serious physical effects outside of the dependence itself. The resulting detachment from the labor market, revealed in a new research study, calls into question any benefits the medications have. Between 2012 and 2018, average employment declined by nearly 2 percent for every 10 additional opioid prescriptions per 100 adults in a county-sized area, the researchers found. Wages also dropped by 6 percent, indicating…