Filter

ACA Proves Itself but Race Disparity Persists

The U.S. Supreme Court’s decision in June to reject another challenge to the Affordable Care Act was widely seen as the final word: the law is here to stay. But it was COVID-19 that underscored how important it is. The federal government said nearly 10 million people signed up for Medicaid health coverage during the pandemic year that ended in January 2021. A decade after passage of the Affordable Care Act (ACA), which expanded Medicaid to include more low-income Americans by increasing the income limit for eligibility, the new sign-ups pushed total Medicaid enrollment to a record high of 80 million. The recent increase was largely due to the spike in sign-ups among the unemployed or workers who saw their…

July 8, 2021

Hard for People on SSDI to Resume Work

The federal government runs numerous small-scale experiments across the country to explore ways to help people on Social Security disability ease back into work to reduce the benefits being paid. In a recent webinar, researchers discussed the extreme challenges of designing programs that are effective, given the inherent disadvantages – from the disabling condition itself and discrimination to having less education – that people with disabilities face in the job market. After close examination of several programs, the researchers found that the primary goals of most demonstration programs are very difficult to achieve: reducing disability benefits or increasing the earnings of people on disability who have sporadic or part-time work. But they also suggested that the programs would be deemed…

July 6, 2021

An Appreciation of Professional Caregivers

My 85-year-old mother had been up a few times during a night in early June and still wasn’t feeling well in the morning. I called her doctor, who sent a prescription to her pharmacy, and went about my day’s work. But when I checked in that afternoon, mom was in a full-blown medical crisis that she and her 92-year-old male companion did not think was bad enough to tell me about. I asked her companion to call the EMTs, who immediately dispatched mom to an emergency room a few miles from her Orlando retirement community. These events marked the start of my maiden voyage as my mother’s caregiver from 1,300 miles away in Boston. It was a high-stress affair that…

July 1, 2021

Enrollment Trends in Medicare Options

Most retirees manage to get by on less than they earned as workers. Yet they devote a much larger percentage of their income to medical care than working people. To limit their annual spending on care, retirees usually buy some type of insurance policy to help pay the bills Medicare does not cover. But a big shift is under way: the Medigap and employer plans that once dominated are now in decline. Only about a third of retirees have one of these two supplementary arrangements, down from two-thirds in 2002. Retirees are instead swarming into Medicare Advantage plans – HMOs run by insurance companies – which doubled enrollment in the past decade to become the most popular form of coverag…

June 29, 2021

Women Faster to Accept Jobs. Pay Suffers

Women attend college at higher rates than men. Women’s labor force participation was also fairly steady prior to COVID, while men’s declined, and women continue to move into fields traditionally held by men. Despite all this progress, women still earn much less than men. Discrimination partly explains the pay gap, as does motherhood, which can interrupt the smooth progression in women’s careers at a critical time. But another explanation doesn’t get as much attention: women earn less because they’re not as confident as men about how much they can get and are more afraid of taking some risks in negotiations with employers. In the 2018 and 2019 graduating classes at Boston University’s Questrom School of Business, women started their job…

June 24, 2021

Immigrants’ Wealth Tied to Residency Status

We celebrate the stories of hard-working immigrants who achieve the American Dream. But their success in the real world largely depends on their residency status. Undocumented farm workers are the most precarious. Living in the shadows makes it difficult to break out of low-wage jobs and move into more lucrative work. The Dreamers who came here as children are also undocumented. Some have been granted temporary protected status by the federal government, but they’re not eligible for federal student aid, and companies are often reluctant to hire them, even though the law permits it. UCLA researcher Josefina Flores Morales uses U.S. Census data to investigate the connection between immigration status and socioeconomic status. She confirms what most people would expect…

June 22, 2021

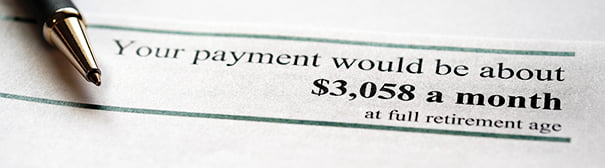

Workers Overestimate their Social Security

The U.S. Social Security Administration reported a few years ago that half of retirees get at least half of their income from their monthly checks. For lower-income retirees, the benefits constitute almost all of their income. Yet Americans have only a vague understanding of how this crucial program works – one of many obstacles on the road to retirement. A new study by the University of Southern California’s Center for Economic and Social Research finds that workers are overly optimistic about their future benefits, which is one reason so many people don’t save enough for retirement. Workers “would probably have fewer regrets after retirement” if they were better informed, the study concluded. And many retirees in the study have regrets…

June 17, 2021

Employers Want Help with Health Costs

The cost of employer health insurance has skyrocketed, and workers are picking up some of that growing tab. Amid employees’ grumbling, employers are loath to push more of the cost onto their workers. That’s why the consensus view among major employers, expressed in a recent survey, sounded like a cry for help. Calling rising insurance costs “unsustainable,” the vast majority said they need help from the government either to provide alternative forms of coverage or control health care and prescription costs. Employers “have reached their limit,” said Elizabeth Mitchell, chief executive of the Purchaser Business Group on Health, an employer advocacy organization that collaborated with the Kaiser Family Foundation on the survey. Employers, she said, “are tired of pouring tons…

June 15, 2021

Here’s Why People Don’t Save Enough

In the United States and Singapore – places that emphasize self-reliance – many older workers and retirees admit that, if given a do-over, they would have saved more money over the past 20 or 30 years. Regret was more common in the United States – 54 percent of older Americans had it versus 46 percent in Singapore, according to comparable surveys in each place. Perhaps the reason Singapore has less is because the government requires that employees set aside more than a third of their income in three government-run savings accounts for retirement, healthcare, and home purchases and other investments. On the other hand, Singapore doesn’t have Social Security or unemployment insurance, and private pensions are rare. Whatever the differences,…

June 10, 2021

$4 Billion in Pension Payments Returned

It’s the employer’s responsibility to find former employees and keep them apprised of any retirement benefits they left behind. But that hasn’t always worked out. Some employers don’t have former workers’ current contact information, and others don’t bother to track them down. Worst-case scenarios are often fallout from a merger: the company being acquired has kept shoddy pension plan records and the acquirer doesn’t update them. Some companies have even deleted a participant’s name from the records. Tyler Compton, an attorney with the Pension Action Center, which connects workers with lost pensions and 401(k) savings plans, said people frequently contact a former employer because they think they might have a plan. But if the worker is told he’s not in…

June 8, 2021

Automation of Jobs Fuels Overdose Deaths

The rise in opioid addiction has created an epidemic of drug overdose deaths in the United States. But what increases the risk that people develop the disorder in the first place? Automation of the U.S. economy turns out to be a contributing factor, as workers lose good jobs to industrial robots and despair about being disengaged from the labor force, conclude researchers at the University of Pennsylvania and Yale in a study funded by the U.S. Social Security Administration. Manufacturing jobs, often in unionized industries, used to be a major route to the middle class. But millions of factory jobs disappeared as U.S. companies moved operations overseas. Compounding the job losses, corporate employers began installing robots in their remaining domestic…

June 3, 2021

No-Benefit Jobs Better than Retiring Early

Many workers in their 60s lose some of their stamina. Either their bodies start showing signs of wear, or they don’t tolerate on-the-job stress like they used to. People who find themselves in this situation but can’t afford to retire will appreciate the findings in a recent study: older workers who transition to a new job – and perhaps a less demanding one – have greatly improved their retirement finances, even if the new job lacks health and retirement benefits. The starting point for the analysis was to identify 61- and 62-year-olds employed in career jobs and follow the changes in their retirement finances over time, as they break into three groups. Some retired, some remained in longstanding jobs wit…