Filter

Millennial Couple Squares Away Finances

The Knapkes hiking last May in the Rocky Mountains. Heather and Tyson Knapke were like a lot of young couples starting out: they were in debt. One household expense on their credit cards loomed larger than all the others: at least $1,000 every month for groceries and dining out. Some weeks, the Denver-area couple could be found at their various favorite restaurants Thursday night straight through Sunday night. The food budget “was astronomical, and I had no idea,” Heather said. Their lives changed dramatically after realizing about 2 1/2 years ago that their finances were spinning out of control. How this couple transformed their debt-laden household into one that is free of credit card and college debts and has a…

January 5, 2017

Our Readers’ Favorite Blogs in 2016

The 10 articles that received the most attention from our readers last year are ranked below in the order of their total page views. Retiree taxes and Medicare made up the top three: Why Most Elderly Pay No Federal Tax Medicare Advantage: Know the Pitfalls Federal Taxation Drops for Retirees Financial Fallout from Gray Divorce Stress is One Reason People Retire How Many Years Can You Do Your Job? ……

January 3, 2017

Enjoy!

Squared Away writer Kim Blanton invites you to follow us on Twitter @SquaredAwayBC. To stay current on our Squared Away blog in 2017, we also invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. …

December 22, 2016

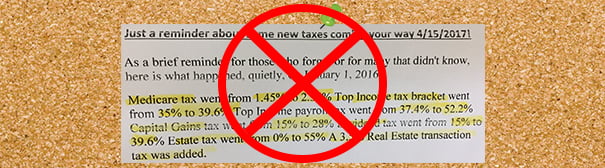

Financial Misinformation Shared Online

My mother sent an anxious email that included the above picture, which one of her elderly friends had emailed to her as a warning about coming tax increases. “Have you seen this?” my mother asked in her email. I’m glad she inquired, because it took 15 seconds to learn on factcheck.org that this misleading information has made the rounds on the Internet for three years in a row, updated to the new year – 2017 this time. There are nuggets of truth in the misinformation above. The Medicare tax already increased as part of the Affordable Care Act. However, it applies only to employed couples earning more than $250,000 and employed individuals earning more than $200,000. The retirees living in my mother’s…

December 20, 2016

Bypassing College for a Professional Job

Apprenticeship programs in the United States are largely found in just a few unionized skilled trades: construction worker, plumber, electrician. But a recent panel made up of British and American employers and other experts made the case that U.S. employers in myriad professional fields – health care, social care, information technology, law, medical exercise therapy, lab technician, teaching assistantship, nursing, and finance – would benefit from thinking more creatively about providing apprenticeship training. Apprenticeship programs are much more common among U.K. and other European employers. Microsoft Corp. is a big exception here: its U.S. program, modeled on what the company does in Europe, will graduate 1,000 apprentices next year, said Bill Kamela, Microsoft’s policy counsel for U.S. government affairs. Apprentices “have incredib…

December 15, 2016

Retirement Isn’t Always Fair

More than half of older Americans with the lowest socioeconomic status can expect to face an income gap if they retire when they’re planning to. That finding is from a study by the Center for Retirement Research, which supports this blog. The researchers quantified and compared the gaps in the retirement preparedness of more than 3,000 older U.S. households, grouped by four levels of educational attainment. First, the researchers estimated the target income that each working household will need in retirement to maintain its current standard of living. That target income will be less than its current income from working, because retirees no longer need to save money, and they pay less in taxes. Then, the researchers projected the incom…

December 13, 2016

Inside the Minds of Older Workers

A decade of research into the impact of cognitive aging shows that workers throughout their 50s and 60s are generally just as productive as the younger people working alongside them. A new summary of this research, by the Center for Retirement Research at Boston College, explains how older people are able to adapt to the gradual loss of brain mass in the parts of the brain associated with memory and an ability to think on one’s feet – their “fluid intelligence.” The highly skilled pharmacy profession is a good example of how workers in their 50s or 60s adjust to this changing dynamic. These pharmacists have an advantage over their younger coworkers in what psychologists call “crystallized intelligence,” which is…

December 8, 2016

Student Loan Repayment: 12 Rules

It’s easy to drown in the financial details of student loan repayment. Here’s a life preserver. The rules of thumb listed below were culled from interviews with two experts on student loans. Betsy Mayotte is director of consumer outreach for American Student Assistance, a non-profit that educates people about their loans. Craig Lemoine is program director for the American College of Financial Services, which trains financial planners. 1. If you earn enough to make your payments, start paying. The reason: Student loans in most cases must be repaid in full. The sooner you start making your full monthly payments, the sooner your loans will be paid off and the less in total you will have to shell out. A decision…

December 6, 2016

Retirees’ Tax Puzzle: Pay Now or Later?

The majority of retirees pay no federal taxes. But taxes should be a concern for retirees who have retirement savings. That’s because the money they take out of their retirement accounts for living expenses will be treated as federal taxable income. It’s difficult enough to figure out how much money to withdraw – and when. Taxes are a separate but related issue. In this blog, we interviewed Michael Kitces, a well-known financial adviser and partner with a Maryland financial firm, who writes the “Nerd’s Eye View” blog. He discusses the basics of navigating the tax code. The challenge facing retirees is to make tax decisions today that will minimize taxes now and in the future. Question: Do you find…

December 1, 2016

Caring for Her Elderly Parents 24/7

Vivian Gibson Taking care of her elderly parents is Vivian Gibson’s full-time job. The last two weeks in October weren’t so unusual. She tended to her 86-year-old father for several days in the hospital – another episode in his unending battle with ankle sores stemming from service in the Korean War. Gibson also helped her mother, age 81, get through a medical procedure and chauffeured both parents to more than a dozen doctor’s appointments and to their dentist. Her mother has been dealing with a pulled tooth, along with abnormal cells in her bladder and an abnormal EKG. In addition to their medical needs, Gibson helps them with everything else, from cleaning and dressing her father’s wound daily to buying…

November 29, 2016

Happy Thanksgiving!

The staff at Squared Away hope our readers enjoy their time with family and friends during the holiday weekend…

November 23, 2016

Video: Overtime Rule to Benefit 4 Million

Just hours after the following blog went live on Tuesday, major media reported that a Texas judge blocked implementation of the new overtime regulation in response to challenges by a group that included 21 states and businesses. The future of this regulation is now in question. On Dec. 1, an additional 4.2 million U.S. workers will potentially be eligible for overtime pay when the annual earnings cap doubles to $47,476 under the new federal overtime rule. Retail workers bracing for the holiday onslaught will be among those receiving overtime if they work more than 40 hours per week but earn less than $47,476. The previous cap, $23,660, was set in 2004. Under the new rule, employers must pay overtime to any eligible full-tim…