Filter

Loneliest Seniors Vulnerable to Fraud

“Lost my husband to 9/11 terror attack” – using heartbreaking stories like these, a U.K. scam that became public last month persuaded some lonely older men to turn their money over to widows. This report is a dramatic illustration of a relationship between loneliness and fraud that has been uncovered in recent research. That study found that people over 50 have been vulnerable to being victimized by fraud in recent years – but the prevalence of fraud was three times higher among people who are extremely depressed or lonely. The 2013 study in the journal Clinical Gerontologist might be the first to examine financial exploitation from the point of view of psychological vulnerability. It was based on a general survey…

March 1, 2016

Home Equity: a Retirement Resource

The National Council on Aging (NCOA) has redesigned its website providing information for “house rich but cash poor” older people who want to think about tapping their home equity. Home equity – the house’s market value minus the amount owed on the mortgage – remains a largely unused source of income that many older Americans could be putting toward their medical care or to improve their lives. Home equity held by Americans age 62 and over reached $5.76 trillion last year – an increase of nearly 30 percent since 2013. A marker of how much of this retirement resource remains untapped is the small number of federally insured reverse mortgages – about 50,000 – that seniors take out every year against t…

February 25, 2016

8 College Repay Plans – and Counting

This was going to be a quick blog post about the new student loan repayment program rolled out by the federal government in January. But the differences between it and the seven plans that preceded it were too confusing to figure out on a tight deadline. This isn’t just the view of one cranky blog writer. Craig Lemoine, a financial planning professor and student loan expert at the American College of Financial Services, which trains financial planners, also admits to being confused about the repayment options, which keep increasing in number. If Lemoine were a student, he asked, “How on earth would I know which one to pick?” His confusion pales in comparison with that of a lovely and loved…

February 23, 2016

U.S. Workers Got a Raise Last Year

It probably doesn’t feel like it, but workers got a decent pay raise in 2015. Inflation last year was an improbably low 0.7 percent, and the fairly strong job market helped, too, by pushing up average hourly wages by 2.6 percent. Together, these translate to nearly a 2 percentage point increase in workers’ pay. Wages rose again in January by one-half percent, which was the second-best monthly increase in the current economic expansion. Minimum wages are also going up in many states. It gets even better, based on an analysis by the American Institute of Economic Research (AIER) in western Massachusetts. An inflation measure designed by AIER that it calls the everyday price index, or EPI, actually declined last year…

February 18, 2016

Can You Pass this Retirement Quiz?

Most people in a recent retirement survey fielded by the American College of Financial Services were confident that they had saved enough money to live in comfort in retirement. But how do they know if they’re on-track? Four out of five also flunked the survey’s retirement planning quiz, answering less than 60 percent of its 38 financial questions correctly. What’s striking about the poor results is that the quiz takers were a select and relatively well-off group: 60- to 75-year-olds with at least $100,000 in financial assets, excluding their home equity. A majority of them also have a financial adviser. One would think that people with both investment and retirement experience would do better. This also raises the question of what…

February 16, 2016

More Parents Split Bequests Unequally

As the American family becomes increasingly complex, so do parents’ wills. The result has been a dramatic increase over the past two decades in the share of wills in which parents distribute their estate’s assets unequally among their genetic offspring and stepchildren. New research, based on surveys of older Americans, finds that about one-third of parents today do not distribute their assets equally. The reasons range from the greater incidence of divorce and the inherent disadvantage of being a stepchild to the fact that some children naturally take on the role of caring for their aging parents. With parents now living longer and needing more care, children may receive compensation in the will for providing that care. About 42 percent…

February 11, 2016

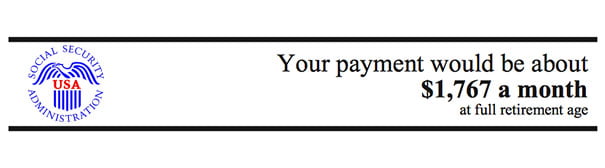

Could Social Security Statement Do More?

Two out of three working Americans grade their retirement readiness at no better than a “C.” So how about using the Social Security Statement that lands in their mailboxes, grabbing their attention, to spur them to action? The statement is already valued by millions of Americans. A survey funded by the U.S. Social Security Administration (SSA) found that people who received statements were “dramatically” more knowledgeable about their basic pension benefits than people who had already retired when SSA started mailing them out in the mid-1990s. Social Security is the nation’s most important source of retirement income, and the information in the statements is essential to most workers’ retirement planning. Mailed out before every fifth birthday – 25, 30, 35,…

February 9, 2016

U.S. Millionaires: a Racial Breakdown

This video examines wealth through the prism of race. It compares the share of the nation’s African-American, Hispanic, Asian-American and white populations who have net worth exceeding $1 million; net worth equals financial and other assets minus mortgages and other debts. If the fact that there is a racial divide isn’t surprising, the magnitude of it might be. Other factors also have an enormous influence over who gets rich, and understanding this becomes increasingly important amid rising inequality. The biggest determinant of wealth is whether our parents are rich, as recent research has shown. Age and education are also crucial. That’s because older people have more time to save and accumulate wealth, and a college education typically leads to jobs…

February 4, 2016

No-Free-Lunch Seminars for Seniors

Economists like to joke about free lunches. The subtext is that there’s a cost to everything. A free lunch is also literally how high-pressure financial companies sometimes lure older Americans into a room to hear their investment pitches. The FINRA Investor Education Foundation says some 6 million older Americans have attended seminars in return for a free lunch. Every year, my mother’s retirement community outside of Orlando hosts a handful of these seminars, which are presented by financial firms, insurance companies, and even funeral homes. FINRA warns that they can pressure seniors into making “unsuitable, even fraudulent investments.” The above FINRA video explains what’s behind the free-lunch presentations and proposes some questions that people can ask to determine the legitimacy…

February 2, 2016

Personal Finance Info – now in Spanish

The wealth of good financial information available from government, university, and non-profit organizations is an antidote to the television and Internet advertisements selling financial products. Squared Away regularly compiles these resources for our readers’ benefit. This newest installment starts with some that are available in Spanish for the nation’s growing Hispanic population: The FINRA Investor Education Foundation translated its short video about why people make bad financial decisions into Spanish. “Pensando Dinero: la psicología detrás de nuestras mejores y peores decisiones financieras” – or “Thinking Money” – explores how emotions get in the way of common sense when making decisions about money. Several other FINRA resources also in Spanish include a glossary of online financial publications and a video about financia…

January 28, 2016

How Melanie Paid Off Her Student Debt

Sitting at her computer in the oversized studio apartment she shares with her boyfriend in Portland, Oregon, Melanie Lockert received confirmation on Dec. 10 that her ordeal was over: $81,000 in college and graduate school loans were finally paid off. She had two reactions. The first was an existential panic. “Who am I without debt?” the 31-year-old asked herself. Then a grin spread across her face. “I started dancing and screaming in my apartment. It was such an amazing moment, and I felt incredibly happy to be done with this,” she said. Recent college graduates might despair that their day of liberation is far away or might never come. But Lockert’s single-minded focus on demolishing her debt, particularly by accelerating her…

January 26, 2016

Seniors Vulnerable to Drug Price Spikes

Total U.S. spending on prescription drugs by individuals, insurers and governments jumped 13 percent last year – the largest increase since 2001. One in four Americans report having difficulty paying for medications. Older Americans are somewhat shielded from the full impact of rising drug prices by Medicare’s Part D program, which greatly expanded their coverage. Since Part D’s implementation in 2006, seniors’ average out-of-pocket spending on medications has actually declined, from $708 to $564 annually in 2012. But a recent trend of price spikes for specialty drugs might be a snake in the grass for seniors on fixed incomes. Since most take multiple prescriptions, they face greater odds of needing at least one of these expensive medicines. Drug cost stability…