Filter

Financial Fallout from ‘Gray Divorce’

In the 1960s and 1970s, the baby boom generation had a reputation for breaking down societal norms for behavior – and they’re at it again. Between 1990 and 2010, the rate of individuals over age 50 who become newly divorced in a year doubled to more than 10 people affected per 1,000 married people, according to Susan Brown, a sociologist at Bowling Green State University. Studies by Brown and others are emerging that show this important trend of “gray divorce” is having negative consequences for baby boomers’ financial security in old age. “Individuals who go through gray divorce are considerably economically disadvantaged, and they are a growing demographic group,” Brown said. She estimates nearly 650,000 people over 50 were involved…

January 7, 2016

Few Put Finances First When Retiring

Will you retire when you want to, when you have to, or when you can afford it? This is crucial, because when Americans retire is more important than it’s ever been to our financial well-being in old age. Yet the research indicates this doesn’t carry enough weight in people’s decisions. This doesn’t make any sense. The typical combined 401(k)/IRA balance is a slim $111,000 for working households between 55 and 64 years old that have a 401(k). And fewer and fewer retirees have defined benefit pensions, which provide reliable income. More than half of us are at risk of experiencing a decline in our standard of living after we retire, estimate economists at the Center for Retirement Research, which supports…

January 5, 2016

Year-end Thank You to Our Readers

To stay current on Squared Away blog posts in 2016, we invite you to join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. Readers can also follow the blog on Twitter @SquaredAwayBC or on Facebook…

December 23, 2015

Readers’ Picks in 2015

Squared Away readers should know this ritual by now. We consult Google Analytics to determine the articles with the most reader traffic over the past year. This blog covers everything from student loans to helping low-income people improve their lot. But this year’s Top 10 was dominated by one topic: retirement. Readers’ favorites are listed in order of their popularity, with links to each individual blog: Navigating Retirement Taxes Medicare Primer: Advantage or Medigap? Why I Dropped My Financial Adviser The Future of Retirement is Now Annuities: Useful but Little Understood Winging it in Retirement? Fewer Need Long-Term Care Misconceptions about Social Security Late Career Job Changes Reduce Stress Mortgage Payoff: Freedom versus the Math To stay current on our…

December 22, 2015

Social Status in the Age of Vermeer

A Lady Writing By the 17th century, the Netherlands had developed a major financial industry and thriving maritime commerce in goods produced by the country’s textile mills, dairy farms, herring fisheries, and sugar refineries. The resulting large and diverse middle class supplies the rich subject matter for a portrait exhibit at Boston’s Museum of Fine Arts. The paintings in “Class Distinctions: Dutch Painting in the Age of Rembrandt and Vermeer” are grouped into one of the three classes: the upper crust, the middle classes, and the laborers and indigent. The Dutch elite – nobility, textile merchants, and wealthy landowners – commissioned portraits “to express and affirm their status,” according to exhibit materials. These paintings are replete with class symbols, such as…

December 17, 2015

401(k)s Tapped for Holiday Gifts

Many Americans have poor habits around saving for retirement, but tapping a 401(k) to buy holiday gifts seems beyond the pale. Yet that’s precisely what some people do. In a new T. Rowe Price survey of 1,000 adults, 7 percent said they have spent some retirement savings on “holiday spending.” Surprisingly, men are more likely to do so than women, who, the survey indicates, are better at planning ahead for the holiday shopping season. The survey doesn’t specify whether this spending is on gifts or a sleigh ride to grandma’s house, but it doesn’t really matter. When the commercial pressures of Christmas start eating into long-term saving for retirement, it seems to confirm that it’s too easy to withdraw money…

December 15, 2015

How Couples Deplete Retirement Savings

Americans who save for retirement throughout their working lives often hold tight to that savings after they retire. A new study shows they eventually do spend much of this money and sheds light on where it goes. The study focuses on the retirement spending patterns of couples, adding to similar past studies on single retirees. While both spouses are alive, the researchers found that a couple’s wealth remains relatively stable over time – until they start paying for medical care, nursing homes, and other major end-of-life expenses. The researchers examined spending patterns for more than 4,600 households over a 15-year period using a subset of the Health and Retirement Study that collects data on the health and wealth of peo…

December 10, 2015

Age Discrimination Affects Women More

Some people might plan to work well into their 60s if they can’t afford to retire, or if they just think they’ll be around a long time. But this strategy is more difficult for women to execute than for men. A study of employer discrimination in hiring found “strong and robust” evidence that female job applicants in their mid-60s were much less likely to be called in for interviews for low-skill jobs than were younger women. Evidence of age discrimination among older men was more mixed, or even non-existent in one occupation. “It seems there was age discrimination for women – no matter what,” said Patrick Button, an economist at Tulane University. To conduct their meticulously designed study, the researchers…

December 8, 2015

Is Betting on Fantasy Sports Addicting?

“The best adrenaline rush ever,” says one of the barrage of fantasy sports commercials broadcast into living rooms this football season. An adrenaline rush is known to be a hallmark of addiction to other types of gambling, which can trigger the brain’s pleasure center much like the triggers in a drug addict’s brain, according to University of Cambridge psychologists. Hundreds of thousands, perhaps millions, of Americans are playing fantasy football and other sports online for money. The Internet has made this so accessible that it could facilitate the rapid-fire betting associated with problematic gambling. Playing fantasy sports is “as easy as ordering a pizza online … [or] texting your friends,” a relapsed gambler told the New York Times. He said…

December 3, 2015

What Derails a Planned Retirement Date

Workers are feeling very ambitious these days: one in three plans to retire after age 65. In the 1990s, just one in 10 did. In reality, though, many older Americans today are retiring before they’d planned, resulting in lower monthly Social Security checks, slimmer 401(k) accounts, and more golden years to pay for. There’s no shortage of research looking into what derails these plans. But, for the first time, a new study ran a statistical horse race among the various reasons known to impact older workers’ decisions. Health issues finished first in the race, followed by layoffs, and a spouse’s early retirement. In an ideal world, eliminating these major shocks, along with a few less prevalent shocks that were also analyzed,…

December 1, 2015

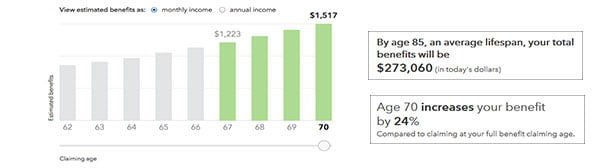

Social Security Delay: the Value to You

What matters most in retirement is how much money comes in the door every single month. That’s why this blog – and its sponsor, the Center for Retirement Research – hammers away at the wisdom of delaying when you sign up for Social Security in order to increase the size of your monthly checks. So here’s a very quick project for the long Thanksgiving weekend: insert your birthday and earnings into this new online tool to get an anonymous, back-of-the-envelope estimate of how much a delay is worth to you. The age you claim your benefits is crucial, because two out of three households rely on Social Security benefits for more than half of their retirement income. Yet the majority…

November 24, 2015

Listen to Your Elders Please

People do not like to hear advice from their “elders.” But shouldn’t retirement be an obvious exception? The options for what most workers can do to salvage their retirement finances rapidly narrow as they get closer to retiring. After 50 or so, it’s also tough to find a better job, and only so much can be saved in short bursts – retirement saving requires years of diligence. If you’re still listening, the following is sage advice drawn from two recent New York Life surveys of older workers on the cusp of retirement and octogenarians. Workers in their 50s and early 60s said they started saving too late for retirement. They put the “magic age” at around 26. Automatic savings vehicles…