Raising Social Security’s Full Retirement Age Is a Bad Idea

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

It puts low-wage workers who retire early at increasing risk .

Proposals are beginning to pop up once again to increase Social Security’s retirement age. The notion is that if people are living longer, they can work longer. But the retirement age has little to do with how long people work, and a lot to do with how much money they get. Increasing the retirement age is a benefit cut.

Social Security’s Full Retirement Age (FRA) under current law is in the process of moving from 65 to 67. To keep lifetime benefits for the average worker roughly constant, benefits claimed earlier than the FRA are actuarially reduced and benefits claimed later are actuarially increased. That is, an FRA of 66 means that people will get 100 percent of their benefits at 66, 75 percent if they retire at 62, and 132 percent if they claim at 70. The comparable numbers for age 67 are 100 percent at 67, 70 percent at 62, and 124 percent at 70.

So as the FRA rises from 66 to 67, the worker retiring at 62 sees his monthly benefit cut from 75 percent to 70 percent of the full benefit. The worker who increases his retirement age from 66 to 67 sees no cut in the monthly benefit but receives benefits for one less year, reducing his lifetime benefit. So raising the FRA is a cut in benefits either way.

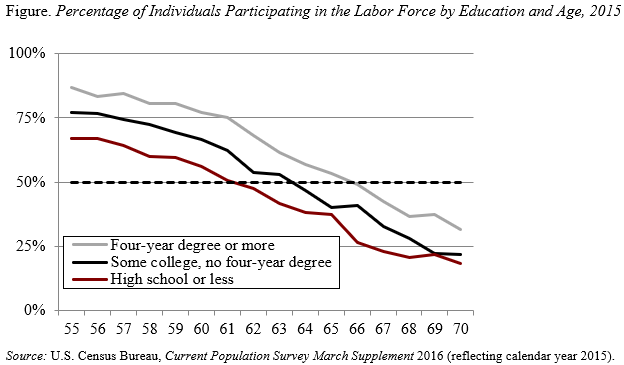

Continuously increasing the FRA is particularly hard on the lower paid, because they tend to retire early. This impact can be seen in the Figure, which shows the average labor force participation rate for those with a high school degree or less (roughly the bottom third of the education distribution), those with some college but no four-year degree (the middle third), and those with a four-year degree (the top third). Although education is not a perfect proxy for lifetime earnings, the two are highly correlated. If the average retirement age is defined as the age at which half the group is still in the labor force, then the average retirement age is about 62 for the low earners, 64 for the middle earners, and 66 for the top third.

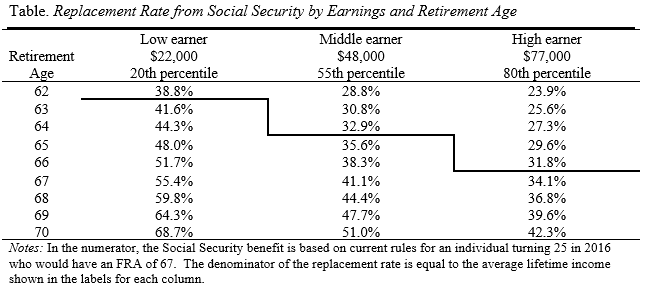

Superimposing these “average retirement ages” on a chart of replacement rates for Social Security’s stylized “low,” “middle,” and “high” earners shows that benefits received are on average much less than those advertised (see Table). And the average low earner – who is unlikely to be covered by any type of employer-provided retirement plan – will receive a benefit of $8,536 (38.8% x $22,000) in today’s dollars once the FRA goes to 67.

Raising the full retirement age may sound innocuous. But it is nothing more than a benefit cut, and one that puts low-paid workers at risk.