Retirees in the U.S. Do Not Live on “Fixed Incomes”

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Social Security’s COLA keeps the bulk of retirement income up to date with inflation.

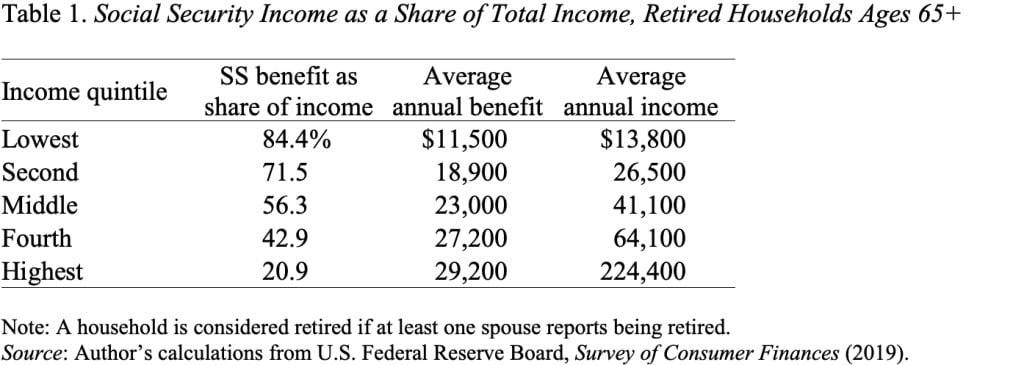

As inflation has gained traction in the last year, commentators constantly remark about how it is particularly hard on retirees who live on a “fixed income.” Please stop! Retirees do not live on fixed incomes. The 60 percent of households in the lower portion of the income distribution receive the bulk of their retirement income from Social Security (see Table 1). Social Security adjusts benefits each year to reflect changes in the Consumer Price Index.

The automatic increase in monthly benefits in response to inflation is a wonderful aspect of the Social Security program. It ensures that retirees do not lose purchasing power as inflation rises. The most recent adjustment increased monthly benefits by 5.9 percent. Since the cost-of-living adjustment (COLA) first affects benefits paid after January 1, Social Security needs to have figures available before the end of the year, and thus uses inflation numbers from the third quarter of the preceding two years to calculate the adjustment. That is, the adjustment for January 1, 2022 is based on the increase in the CPI from the third quarter of 2020 to the third quarter of 2021.

I guess one could complain that the 2022 COLA is only 5.9 percent, when the CPI-W – the index used for adjusting Social Security benefits – increased by 7.8 percent year over year in December. But once inflation stabilizes, the COLA will keep pace with rising prices, and once inflation starts to decline, the lag in the adjustment will keep the COLA higher than the inflation rate. In short, over an entire inflation episode, Social Security COLA increases will fully compensate for inflation.

Ah! Some might say, wouldn’t it be better to use a price index that more accurately measures the spending pattern of retirees? Indeed, older people do spend more on health care than their younger counterparts. But the difference in the inflation rates between the two indexes is small and has declined over time. Indeed, the CPI-E – the index for the “elderly” – is currently rising less rapidly than the CPI-W (see Figure 2).

The bottom line is that retirees in the United States do not live on a “fixed income.” For most households, Social Security benefits are their main source of retirement income, and these benefits are adjusted annually for changes in the cost of living. And the annual adjustments do a really good job of offsetting the effects of inflation.