Retirement: a Priority for Millennials?

Saving for retirement is more crucial for Millennials than for any prior generation. Data are emerging that reveal how they’re doing.

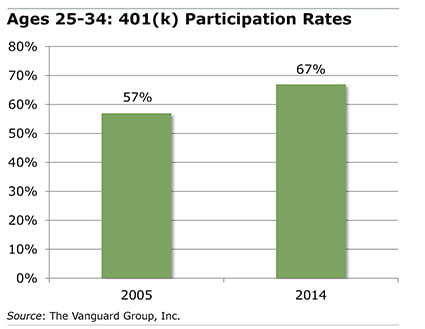

Vanguard’s 2014 data from its large 401(k) client base shows that 67 percent of young adults between 25 and 34 who are covered by an employer plan are saving – this is well above a decade ago.

Vanguard’s 2014 data from its large 401(k) client base shows that 67 percent of young adults between 25 and 34 who are covered by an employer plan are saving – this is well above a decade ago.

A survey recently by the Transamerica Center for Retirement Studies found evidence that this generation makes retirement a priority: a majority of working adults in their 20s and early 30s – now the largest single demographic group in the U.S. labor force – view retirement benefits as “a major factor in their decision on whether to accept a future job offer.”

This indicates that Millennials are getting the message, said Catherine Collinson, president of the Transamerica Center for Retirement Studies.

The growth of automatic enrollment in 401(k) plans “has helped pull young people and non-participants into the plans,” Collinson said, “but I also believe it’s also due to heightened levels of awareness.”

Her center’s random survey found that 71 percent of Millennials with a 401(k)-style plan at work are saving for retirement – fairly close to the Vanguard figure. Further, the typical Millennial said they started saving at age 22, compared with 27 for Gen-Xers and 35 for baby boomers responding to the same Transamerica survey. Millennials are also two times more likely than older coworkers to report they “frequently” discuss retirement.

The Consumer Federation of America found that just 42 percent of young adults currently save – slightly less than in 2013 – but this survey covered people as young as 18. Many Millennials also have a tenuous relationship with the post-Great Recession job market, and it’s harder to save in a low-paying job. While 69 percent of Millennials working full-time are offered a 401(k) at work, just 42 percent of Millennials with part-time jobs have access to a plan, according to Transamerica.

It will take time to see if Transamerica’s findings of greater retirement awareness produce larger 401(k) balances. One thing is crystal clear: it’s critical that Millennials start saving, and the earlier the better.

Comments are closed.

With pensions being a thing of the past, employers really need to emphasize the importance of starting early. As parents, I convinced my kids (age 18 and 17) to start IRAs when I told them them tale of Ben and Arthur: https://www.daveramsey.com/media/pdf/forms/ben_and_arthur_military.pdf

I think that we saw the impact of not having a retirement saved up during the 2008 recession with our parents. Also, I think that we have been taught and understand the importance of compounding interest and want to make that work in our advantage.