Retirement Savers Should Be Protected Against Costly Financial Advice – Especially for Rollover IRAs

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

But courts block effort to curtail conflicts of interest.

In October 2023, President Biden announced that the Department of Labor (DOL) would propose a new rule to protect people saving for retirement against conflicted advice.

Under the current state of play, DOL regulations regarding advice to employer-sponsored plans are governed by ERISA’s fiduciary rule, which requires recommendations to be in the best interest of the client. With the shift from defined benefit plans to 401(k)s, the client has become the individual. In the case of IRA rollovers, IRS regulations simply require that fiduciaries not “self deal.” In terms of the Securities and Exchange Commission (SEC), which regulates broker-dealers, in 2019 the agency imposed a new standard of conduct that went beyond the “suitability” standard to require that broker-dealers act in the “best interest” of their customers.

Despite the progress, important loopholes remain. The proposed rule would do three things:

- Broaden the range of products subject to the “best interest” requirement to include commodities and insurance products such as annuities, which are not currently covered by the SEC’s best-interest regulation.

- Cover all advice to roll over assets from employer-sponsored plans to IRAs. Under ERISA, advice provided on a one-time basis, such as that pertaining to a rollover, is not currently required to be in the saver’s best interest.

- Cover advice to plan sponsors regarding investment options. Currently, such recommendations to plan sponsors, including small employers, are not covered by the SEC’s best-interest regulation.

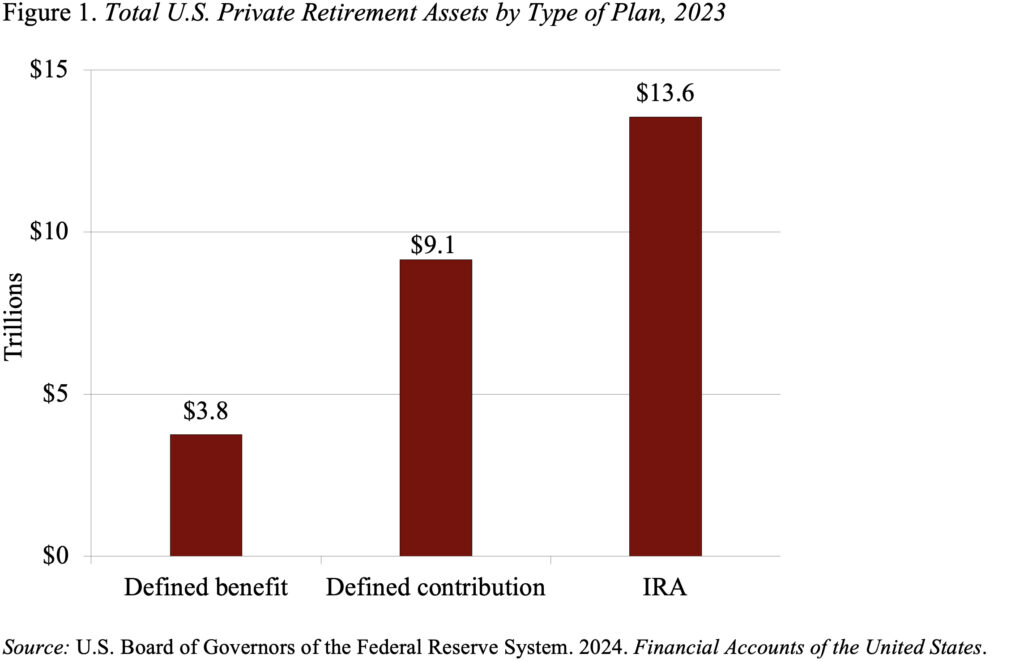

In April 2024, the DOL finalized the rule and scheduled implementation for September. From the beginning, however, financial service firms and insurance companies pushed back in Congress and the courts. They have been quite successful. Congress is moving towards invalidating the rule, and two courts in Texas’ 5th circuit have blocked the proposed implementation. While insurance companies led the opposition, the most important protection in my view is the one governing rollovers from 401(k) plans to IRAs. The rollover business is huge. 401(k)s have essentially turned into a collection mechanism for retirement savings, and the bulk of the money is rolled over into IRAs. At the end of 2023, IRA assets exceeded those in 401(k)s by 50 percent – $13.6 trillion compared to $9.1 trillion (see Figure 1).

The rollover of balances from 401(k)s to IRAs is extraordinary given that participants are typically passive in their interactions with their 401(k) plans. They rarely change their contribution rate or rebalance their portfolios in response to market fluctuations. Thus, one would think that the force of inertia would lead participants to leave their balances in their 401(k)s. The fact that they actually take the trouble to move their funds suggests a strong motivating force. Some households may be attracted by the opportunity to obtain a wider menu of investment options or to consolidate their account holdings. But others may be seduced by advertisements from financial service firms urging participants to move their funds out of their “old,” “tired” 401(k) plan into a new IRA.

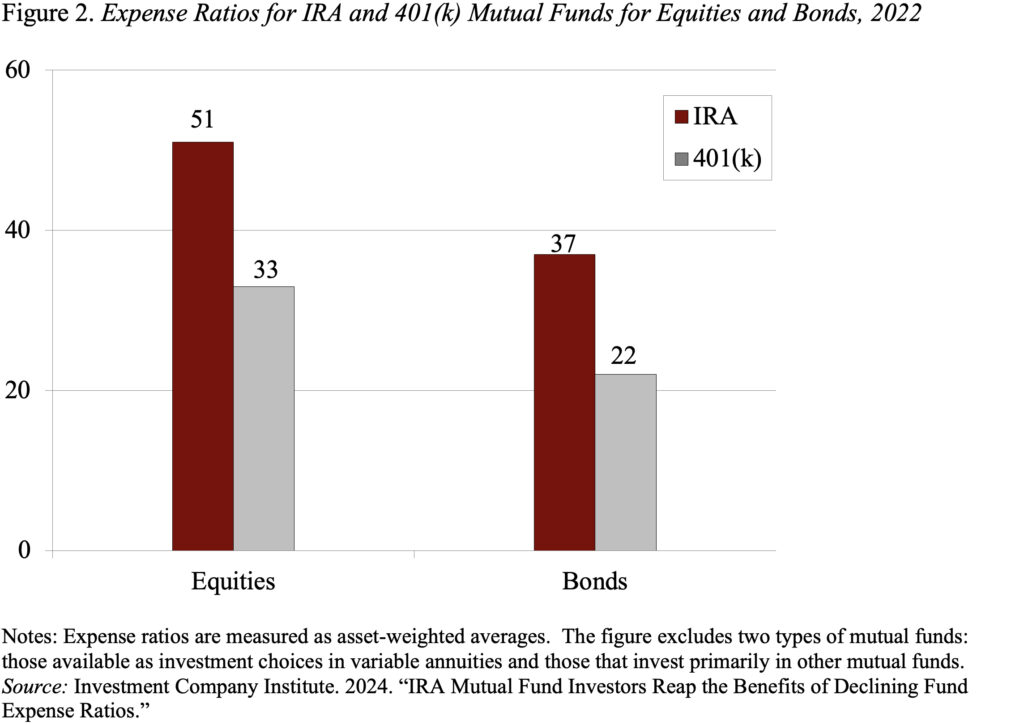

The assumption by participants must be that the firms advertising rollovers are operating in the participants’ interest, but, in fact, participants very often are moving from fiduciary protection and low-fees into an unprotected arena where their assets will be invested in high-fee mutual funds. Sponsors of IRAs are not required to report the assets in these plans nor the fees charged, but data from the Investment Company Institute show that the asset-weighted fees for equity and bond mutual funds are substantially higher for IRAs than for 401(k)s (see Figure 2).

The bottom line is that protections clearly are required for rollovers. If a fiduciary standard is appropriate when funds are in 401(k) plans, then such a safeguard is still appropriate when participants are contemplating moving those funds to an IRA.