Roth IRAs Holdings Have Shot Up among Young Households

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Looks like fintech is working its magic.

Based on an inquiry from a reporter, my colleagues JP Aubry, Yimeng Yin, and Angie Chen have been fooling around with data on holdings of Roth IRAs from the Federal Reserve’s 2022 Survey of Consumer Finances.

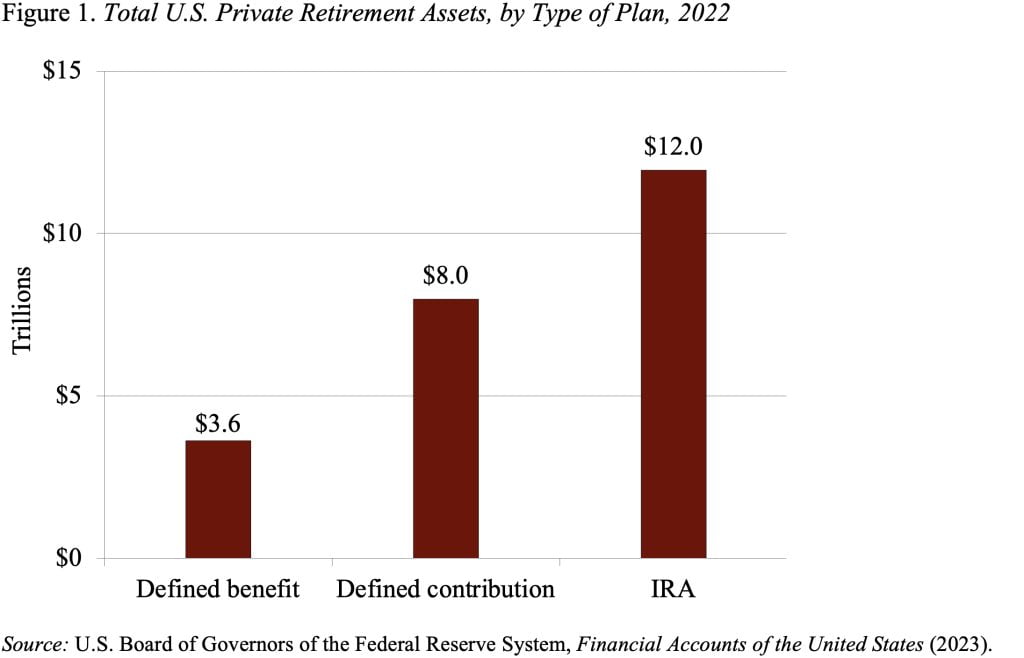

Since assets in IRAs account for more than half of all assets in private sector retirement plans – far exceeding those in either defined benefit or defined contribution (DC) plans – anything happening in this space is important (see Figure 1).

Moreover, Roth IRAs are the vehicle used in the Auto-IRA programs, which have now spread to 14 states. These programs require employers without a plan to automatically enroll their workers in a Roth IRA – the worker can opt out. So, are these state initiatives the source of the growth or does it come from fintech firms such as Robinhood, which have made it very easy to buy and sell financial assets and to contribute to retirement accounts?

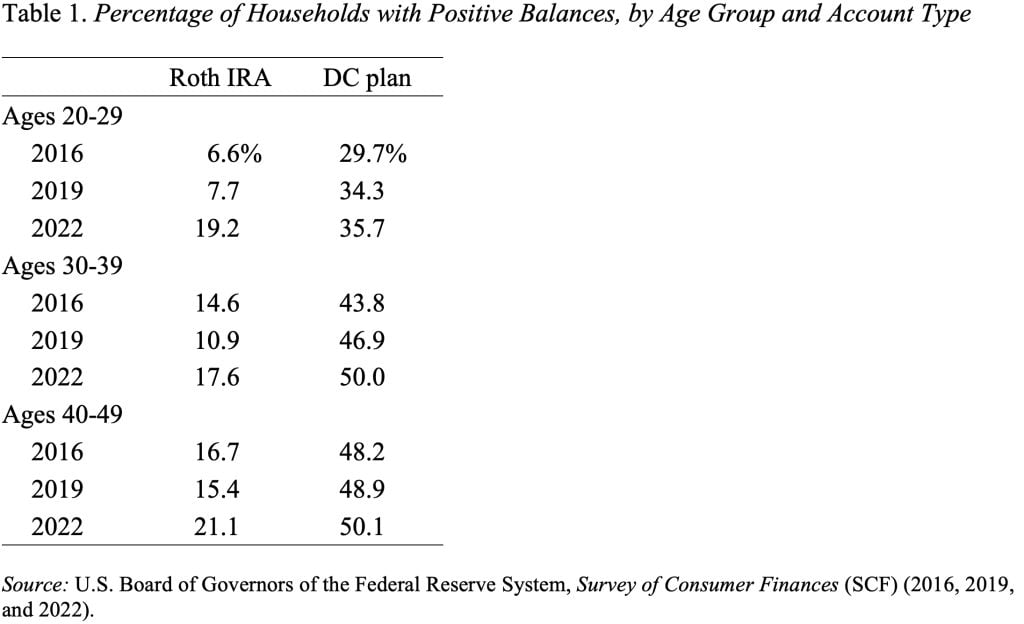

The adventure started with JP and Yimeng determining that the percentage of young households with a Roth IRA has increased a lot since 2016 (see Table 1). Among households with the head ages 20-29, the percentage has tripled from 6.6 percent in 2016 to 19.2 percent in 2022. Nothing similar seems to be happening for older age groups or in terms of DC plan participation.

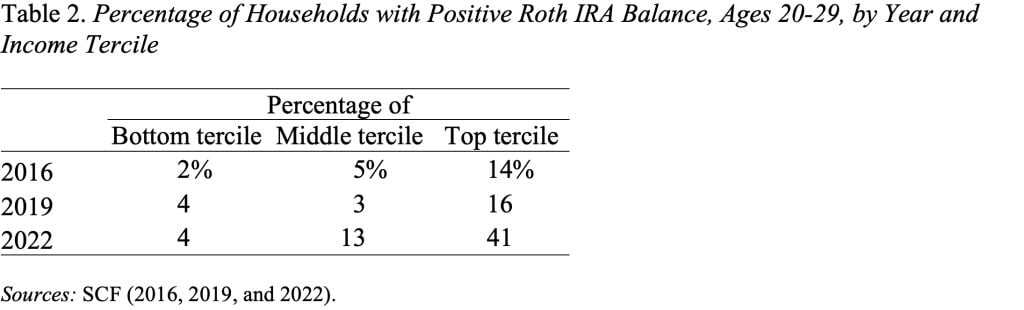

Who are these people opening Roth IRAs? Angie did some cross tabs by income tercile, which you can see in Table 2. The increase in Roths is concentrated among the top tercile – the third of households with the highest incomes. The middle tercile also shows an increase – albeit from really low levels. It’s looking a lot more like a fintech phenomenon than the impact of the state Auto-IRA initiatives, which are generally focused on lower-paid workers.

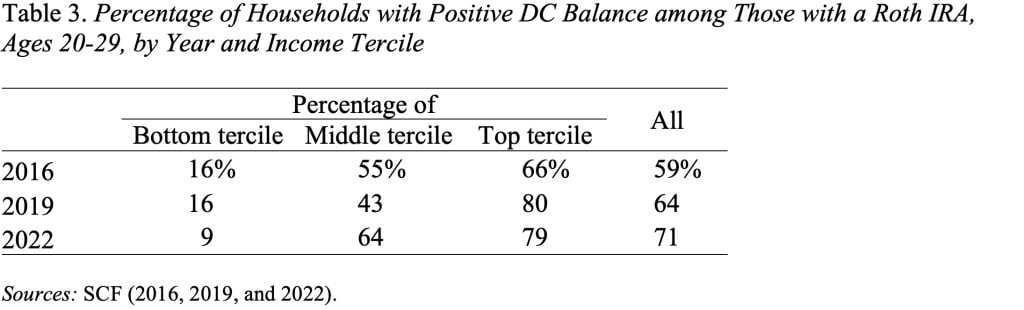

The question still remains whether the growth in Roths reflects an increase in coverage or just households already covered adding another account. Table 3 shows that for the top tercile – the place with all the action – 80 percent of the households with a Roth IRA already had positive balances in a DC plan.

The bottom line seems to be that if technology makes it really easy to save in tax-advantaged accounts, the tech-savvy with money will take advantage of the opportunity.