Senator Warren Calls for a Dramatic Expansion of Social Security Benefits

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The presidential hopeful’s plan makes protecting current benefit levels seem like a modest goal.

I love any proposal that puts my preferences clearly in the center. And Senator Warren did just that with her plans for Social Security.

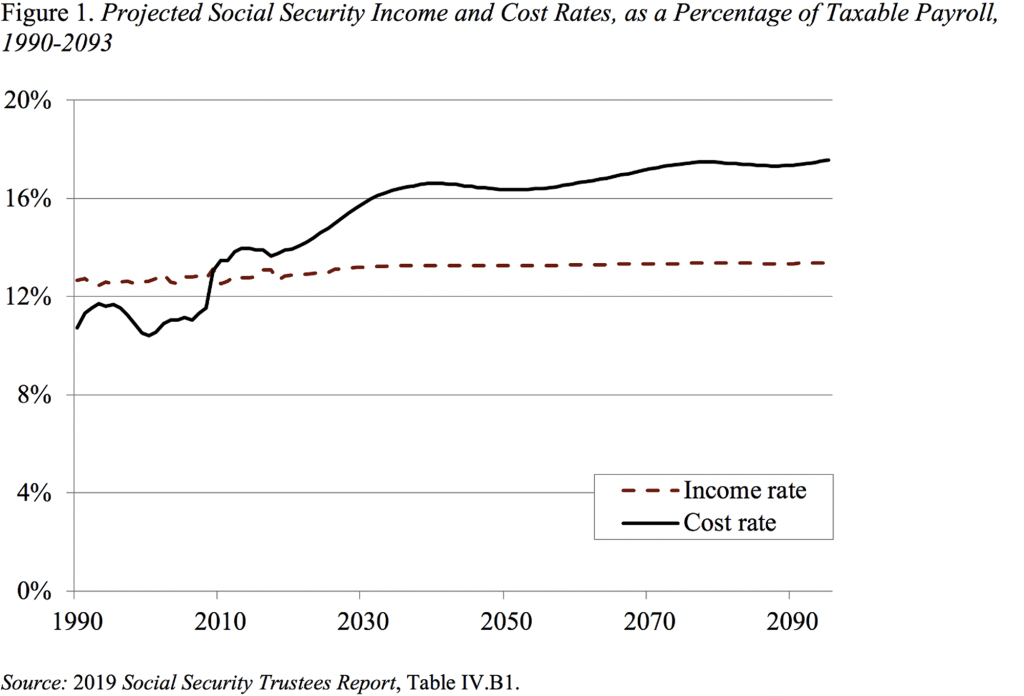

Just to remind you about Social Security’s finances, the program’s actuaries project a deficit over the next 75 years of 2.78 percent of taxable payrolls. As shown in Figure 1, this deficit reflects the combination of rising costs and constant levels of income. The increasing costs are the result of a slow-growing labor force and the retirement of baby boomers, which raises the ratio of retirees to workers. Social Security’s deficit can be eliminated either by bringing up the income rate or lowering the cost rate in Figure 1.

Until now, the debate appeared to have been bookended by competing visions of the former and current Chairmen of the House Ways and Means Social Security Subcommittee – Sam Johnson (R-TX) and John Larson (D-CT). The Social Security 2100 Act, proposed in 2019 by Representative John Larson (D-CT) and others retains benefits and substantially increases the income rate. That is, it brings the income rate to the cost rate. The other vision espoused by Representative Johnson in 2016 would sharply cut benefits and thereby lower the cost rate to match the income rate. Both proposals have been evaluated by the Social Security actuaries and would restore balance over the next 75 years.

Senator Warren places most of her emphasis on expanding benefits, including a $200-per-month increase for all recipients, a more generous index for cost-of-living adjustments, and a new caregiver credit. Her plan also includes several other benefit-enhancing provisions. In addition, the proposal provides more administrative funding to hire staff, keep offices open etc. These costs are more than offset with new revenue from a 14.8-percentage-point payroll tax on earnings above $250,000 and a 14.8-percent tax on investment income on the top 2 percent of earners – the latter change is accompanied by a broadening of the investment tax base.

Senator Warren’s plan has not been “scored” by the Social Security actuaries, but one estimate is that it would extend the life of the Social Security trust fund by about 20 years – far short of restoring 75-year solvency.

With the Warren proposal on the table, the goal of restoring solvency while maintaining current benefits seems very modest indeed!