Social Security Claiming: COVID-19 vs. Great Recession

The brief’s key findings are:

- In early 2020, many thought the COVID crisis – like the Great Recession – might force many workers to claim Social Security early.

- But the COVID economy turned out very different, with robust growth in the stock market and substantial unemployment relief.

- The analysis compared the relative impacts of the two recessions on early claiming by earnings group and found that:

- During COVID, the booming stock market induced early claiming among workers with retirement assets;

- while the generous unemployment benefits decreased early claiming for many lower-paid workers.

- Overall, the latter effect more than cancelled out the former, so COVID actually led to a slight decline in early claiming.

Introduction

As COVID-19 shut down the economy in early 2020, the press asked repeatedly how the economic turmoil – combined with a health crisis and a plunge in the stock market – would affect older workers. At that time, the natural inclination was to draw similarities to how older workers responded in the Great Recession. Specifically, despite a desire to work longer to replenish lost savings, the lack of available jobs forced many to claim Social Security benefits as soon as they were eligible – at 62.

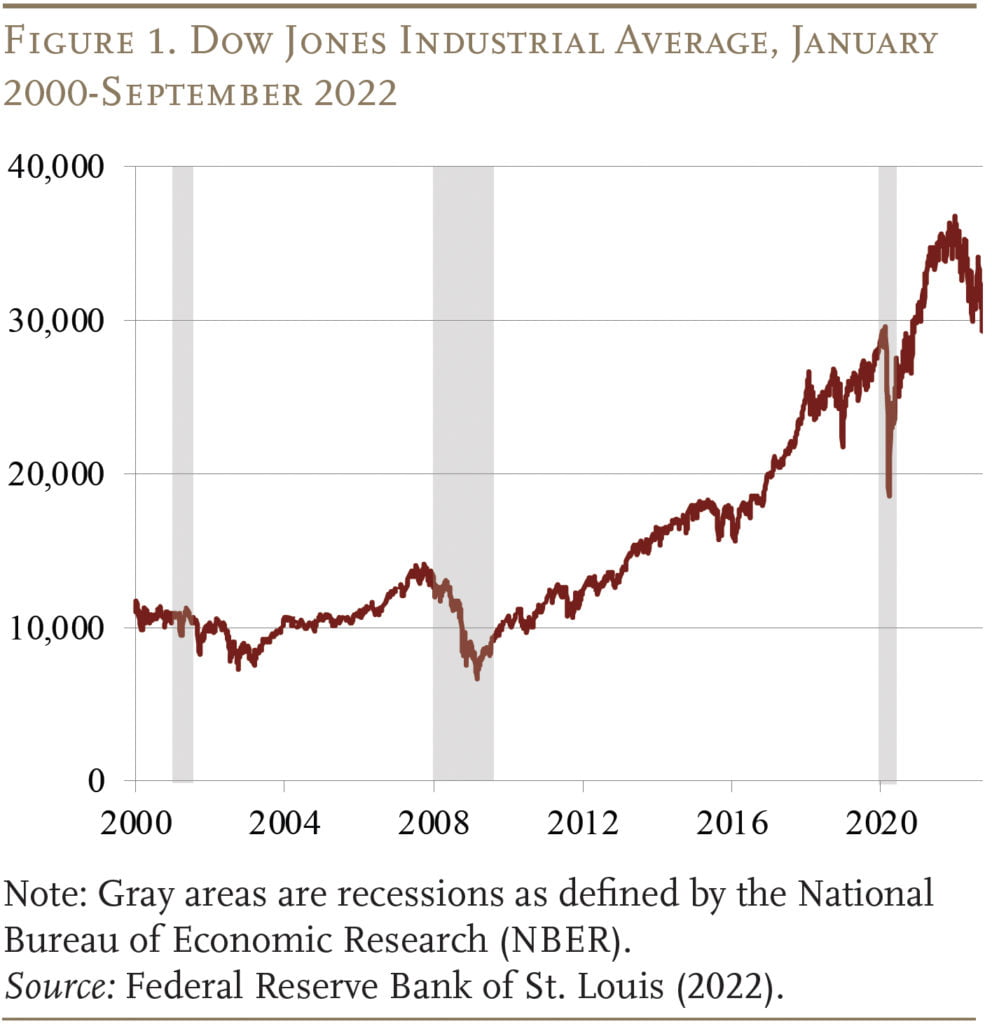

Of course, the COVID experience turned out to be very different than the Great Recession. Although the Dow Jones Industrial Average initially plunged by 34 percent, it soon recovered and continued to increase. The economy also quickly bottomed out, and the National Bureau of Economic Research (NBER) defined it as the shortest recession in history. And unprecedented government support for the unemployed made looking for a job much more attractive than claiming Social Security benefits.

While the contours of the two recessions differ sharply, older workers continued to retire and claim Social Security. The question explored in this brief, which is based on a recent study, is the relative impacts of the COVID Recession and the Great Recession on the claiming behavior of different groups.1Chen, Liu, and Munnell (2022). Specifically, the analysis, using data from the Health and Retirement Study (HRS), compares how the claiming pattern changed in the recession years 2008-2010 from the expansion years 2004-2006 with how the pattern changed in the recession year 2020 from the expansion years 2016-2018.

The discussion proceeds as follows. The first section provides background on the Great Recession and the COVID Recession and summarizes what research to date reveals about the basic contours of the two recessions. The second section describes the data for the current analysis and the methodology. The third section summarizes the results of the two recessions on the claiming behavior of different groups. The final section concludes with three findings. The COVID Recession did not increase the relative likelihoods of early claiming among those in poor health. This result is surprising, but consistent with the findings for the Great Recession. The other two findings were in stark contrast to what happened during the Great Recession. First, during the COVID Recession, the booming stock market increased the relative likelihood of early claiming among those with retirement assets, whereas during the Great Recession workers remained in the labor market to replenish depleted balances. Second, generous unemployment insurance (UI) benefits reduced early claiming among workers in the lowest two earnings terciles, whereas little change was evident during the Great Recession. In terms of the overall impact, the competing effects of the COVID Recession resulted in a slight decline in early claiming as a result of the COVID Recession, whereas the percentage claiming early rose notably during the Great Recession.

COVID Recession vs. Great Recession

The COVID Recession, like the Great Recession, came after several years of a strongly expanding economy. While, initially, many feared that the COVID Recession would result in a spike in early claiming among older workers, research on the pandemic recession has found only very small increases in retirement rates.2Quinby, Rutledge, and Wettstein (2021). This difference in outcomes reflected the many ways in which the COVID Recession differed from the Great Recession.

- Cause: Whereas the Great Recession was sparked by the Global Financial Crisis, the COVID Recession was caused by a health crisis that shut down offices and businesses and increased mortality. The pandemic represented a particular threat for older workers, who were more vulnerable to the virus.

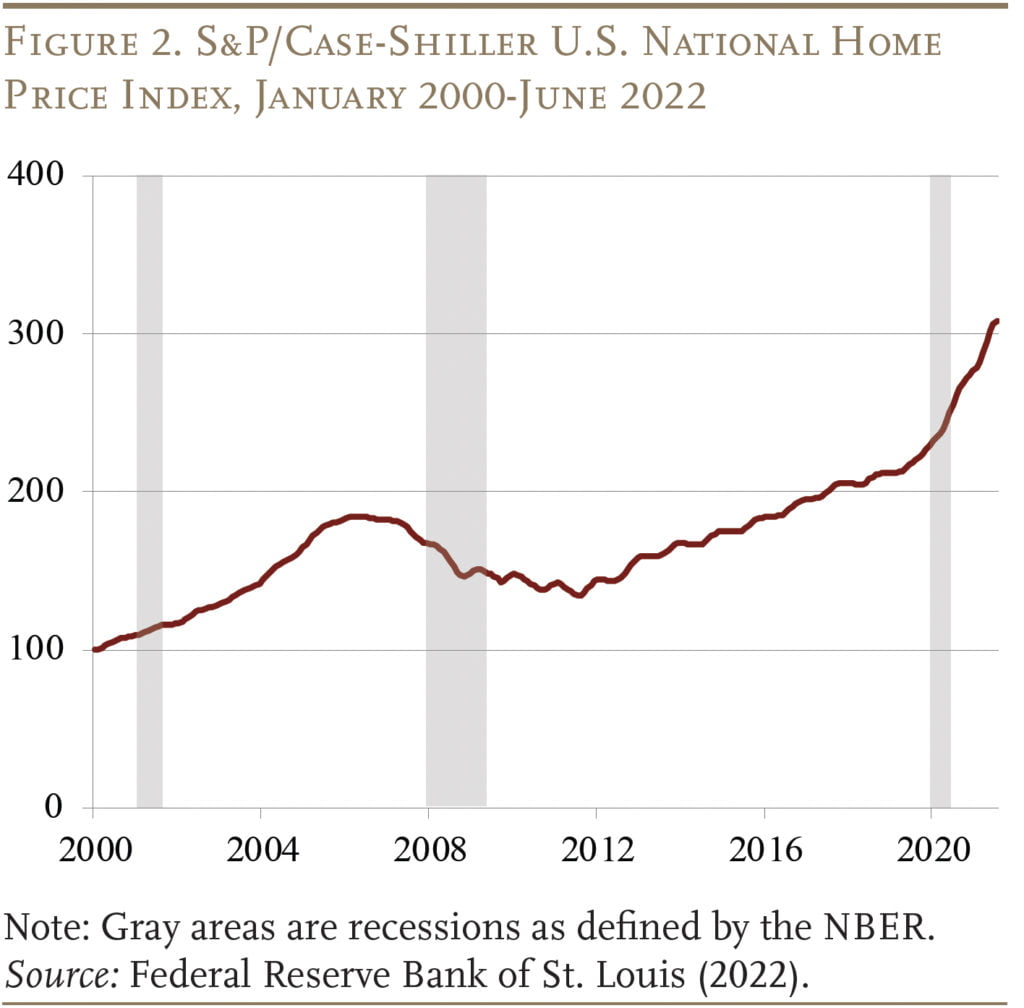

- Asset Prices: Whereas the Great Recession saw the Dow Jones lose half its value, the housing market collapse, and prices remaining depressed for years, the COVID Recession was accompanied by a quick recovery in the equity market followed by rapidly rising prices, and strong growth in the housing market (see Figures 1 and 2).

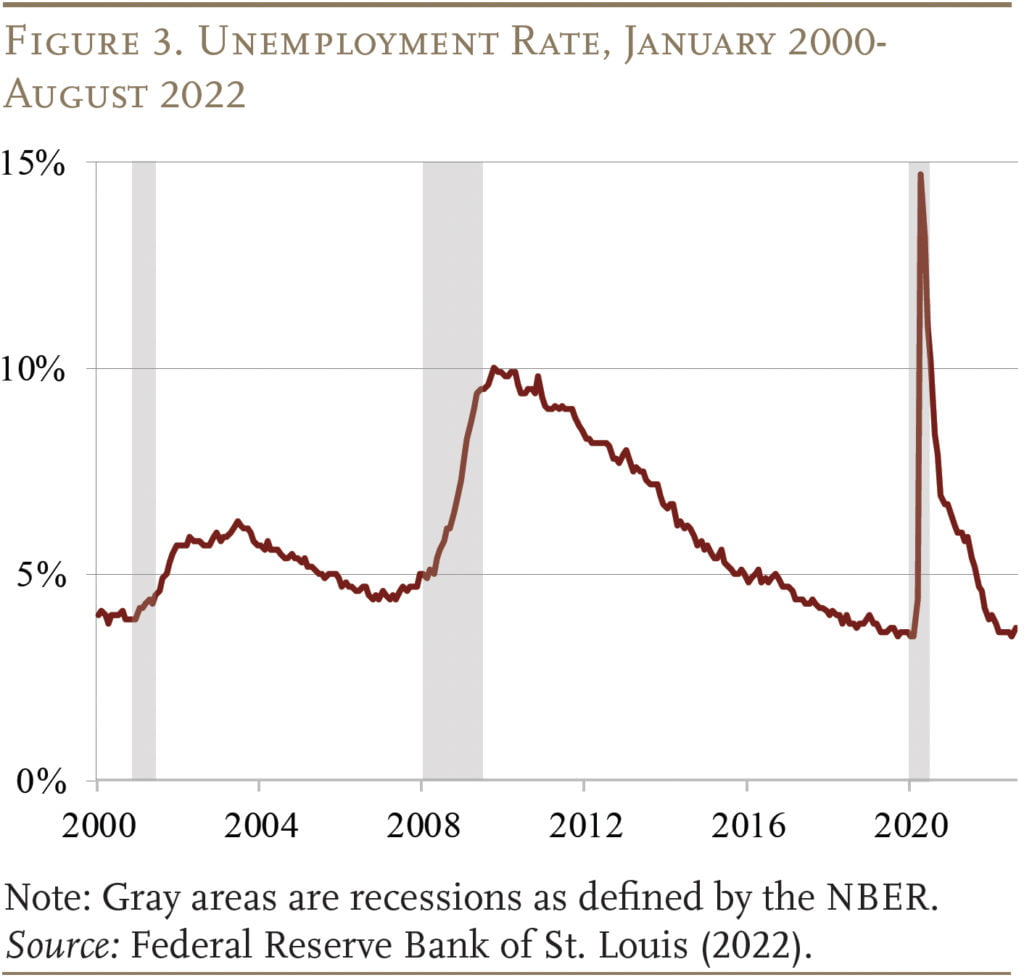

- Duration: While the Great Recession dates from a peak in December 2007 to the trough in June 2009 – 18 months, the COVID Recession began in February 2020 and the trough occurred in April 2020 – two months later. More importantly, the unemployment rate fell back to 6 percent after four months, compared to 64 months after the trough of the Great Recession (see Figure 3).

- Relief Measures: While the government increased unemployment benefits in both recessions, the expansion in the COVID Recession was unprecedented. In March 2020, the Coronavirus Aid, Relief and Economic Security Act (CARES) provided $268 billion in additional UI benefits through $600 weekly supplements, an expansion of the eligible population,3The Pandemic Unemployment Assistance program temporarily provided unemployment benefits to people unable to work for reasons related to COVID who were not usually eligible for unemployment assistance, including the self-employed, independent contractors, and those with limited work. This program paid for up to 39 weeks of unemployment benefits between January 27, 2020 and December 31, 2020. and an additional 13 weeks of benefits for those who exhausted the regular benefits.4The Families First Coronavirus Response Act which was signed into law on March 18, 2020, provided $4.7 billion in additional funding to state governments to administer unemployment programs and to fund benefit payments. In December 2020, the Coronavirus Response and Relief Supplemental Appropriations Act included an 11-week extension of the supplement (at a reduced level of $300) and the other provisions of the CARES Act. Finally, in March 2021, the American Rescue Plan Act further extended unemployment support programs through September 2021.5This legislation increased the total number of weeks available for unemployment benefits from 50 to 79 for self-employed people and other unemployed people deemed ineligible for state UI benefits; increased eligibility for benefits from 24 to 53 weeks for those who exhausted their benefits; and continued the $300 per week supplement. It also exempted the first $10,200 in 2020 unemployment benefits from federal income tax for households with incomes below $150,000 per year. However, 25 states opted to terminate temporary pandemic UI programs by June or July 2021. See Whittaker and Isaacs (2021).

- Demographics: While vulnerable groups are always hurt the most by recessions, COVID raised some unique issues. Black and Hispanic workers were more concentrated in occupations with greater exposure to the virus, which – combined with higher prevalence of comorbidities – meant that they faced higher risk of hospitalization and death.6Clark, Lusardi, and Mitchell (2020); Borjas and Cassidy (2020); Chetty et al. (2020). Women were also adversely affected by the COVID Recession, because school closures and loss of regular caretakers increased their caretaking duties.7Alon et al. (2020).

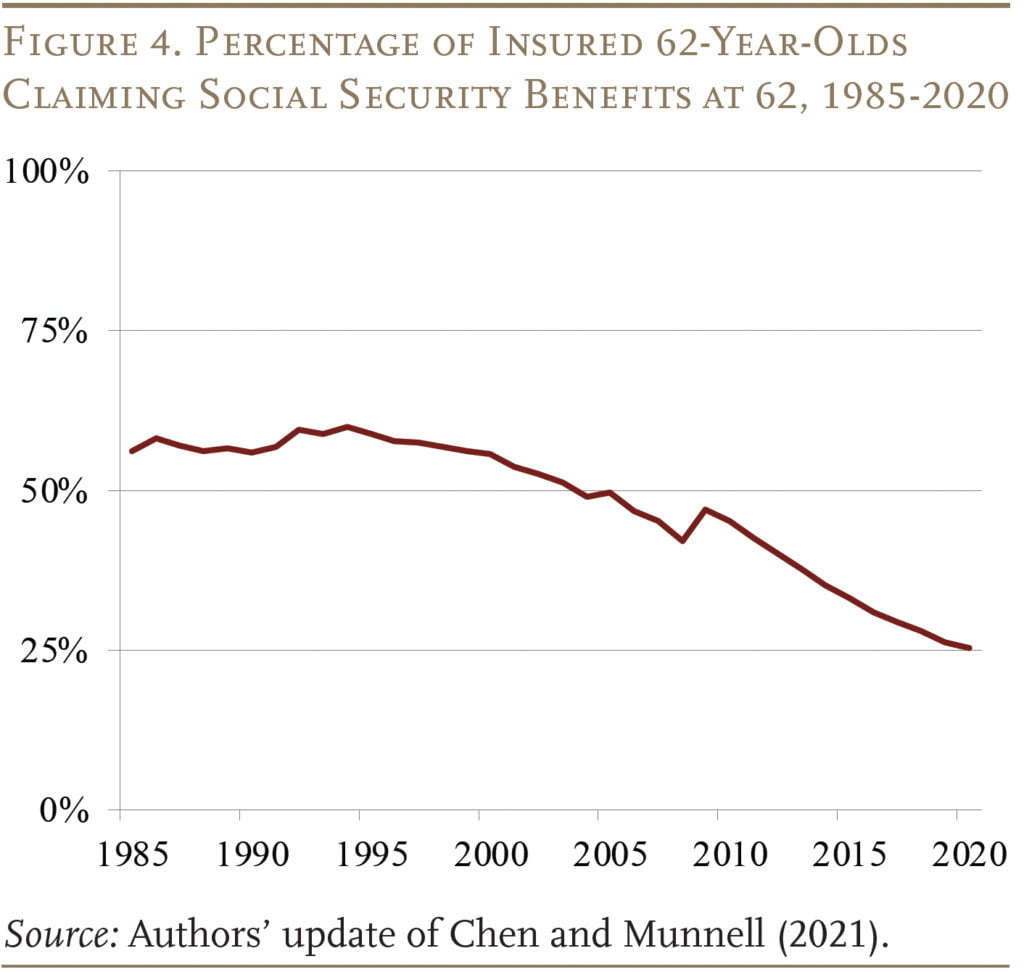

Two recessions with such different profiles would be expected to have very different impacts on older workers. And, indeed, that appears to be the case. While older workers left the labor force in both recessions, self-reported retirement hardly increased at all during the COVID Recession.8The trend was largely flat: the average 12-month retirement rate before the pandemic (through March 2020) was 12 percent, compared to 13 percent post-pandemic. Moreover, the only group that saw a statistically significant increase in retirement was workers ages 70 and over. See Quinby, Rutledge, and Wettstein (2021) and Goda et al. (2021). As a result, the percentage of 62-year-olds claiming early benefits did not tick up as it did in the Great Recession but rather continued its downward trajectory (see Figure 4).

Although the likelihood of early retirement did not increase in the wake of COVID, people continued to withdraw from the labor force and claim their Social Security benefits. The question is whether the mix of early retirees changed as the economy moved from the expansion years 2016-2018 to the 2020 COVID Recession and how profiles of COVID retirees compare to those who retired early when the economy moved from the expansion years 2004-2006 into the Great Recession. The unique nature of the COVID Recession suggests three hypotheses about the changing composition of early claimers:

- Workers facing health risks and unable to work remotely would be more sensitive to high unemployment rates during the COVID Recession and more likely to exit the labor force and claim early, relative to the Great Recession.

- Wealthier workers would likely have benefited from the booming stock and housing markets during the COVID Recession, enabling them to claim early.

- Workers with low earnings, who faced high replacement rates from the unprecedented expansion and increased generosity of UI benefits, would be less likely to claim early in the COVID Recession than in the Great Recession.

Data and Methodology

The analysis of the relative impact of the COVID Recession and the Great Recession on retirement claiming is based on the Health and Retirement Study (HRS), a panel survey of older Americans conducted by the University of Michigan. Comparing the impact of the Great Recession and COVID on early claiming first requires defining “early claiming.” In this analysis, early claiming is defined as claiming before the Full Retirement Age (FRA).9Early claimers can also be defined only as people who claim at the earliest possible age, age 62. We include the group that claims after 62 but before their FRA for two reasons. The first is that the share of older workers who claim at age 62 has been declining for several decades and is only representative of about a third of older workers’ claiming decisions (see Chen and Munnell 2021). In fact, claiming at all ages before the FRA has been declining in recent decades. Second, including those who claim at all ages before the FRA allows for a larger sample size for later empirical analysis. The claiming age for most respondents comes from administrative linked data. For respondents who could not be linked, we use their self-reported claiming age. The sample is comprised of respondents who are between ages 62 and their respective FRA during the 2004-2010 and 2016-2020 waves.10Earlier waves of the HRS are also used for information on pre-62 characteristics of some respondents. After dropping some groups of respondents, the final sample consists of 4,398 individuals who are between age 62 and their FRA and are observed at some time between 2004-2010 or 2016-2020.11The sample excludes individuals who receive Social Security Disability Insurance (SSDI) at any time, since their retirement benefit claiming age is pre-determined (it occurs automatically at their FRA) and is not going to respond to macroeconomic conditions; individuals not linked to administrative claiming data who self-report claiming before age 62, as this is due to survivor benefits or reporting error; and individuals with no claiming information at all.

To understand whether specific groups of older workers were more likely to claim Social Security benefits early due to pandemic-related unemployment and how that compared to the Great Recession, the analysis estimates two hazard models – one for each recession period. We define recession period as when the unemployment rate is greater than 6 percent; this definition differs from the NBER’s peak-to-trough period. The models estimate the probability of claiming early – between ages 62 and the FRA – conditional on not having claimed in prior months.

Probability of claiming early = ƒ( U% + X + U%*X + EARN + EARN*UIRR + FE + T)

Specifically, the probability of claiming early is related to the unemployment rate (U%) and a vector of individual characteristics (X), which encompasses demographics, retirement assets and pensions, work history, earnings tercile, and information on spousal work history and age. The demographic characteristics are interacted with the unemployment rate to determine whether certain groups may have responded differently to unfavorable economic conditions.

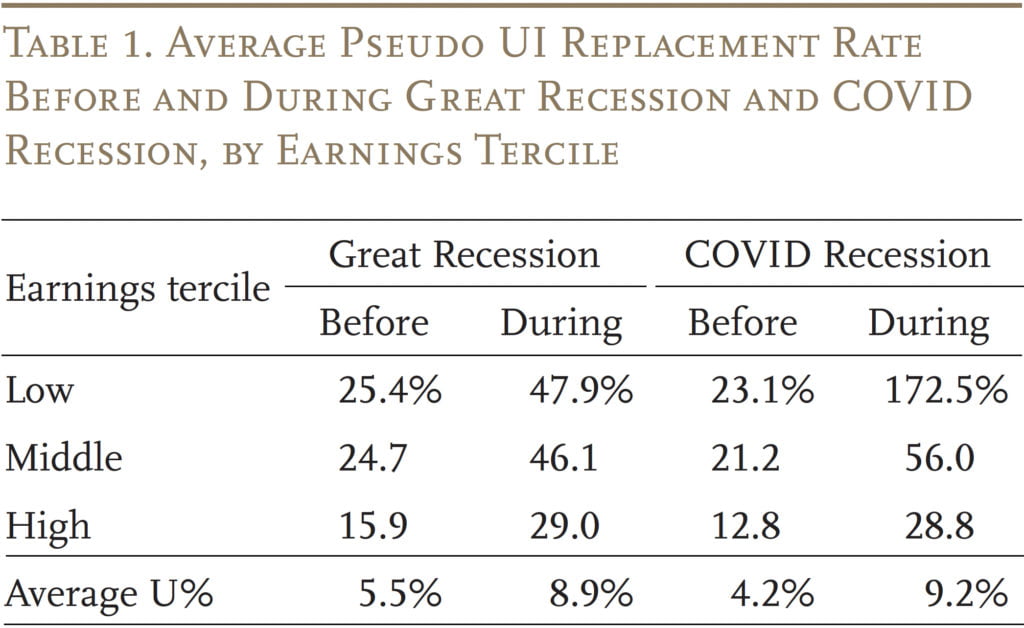

As noted, a unique aspect of COVID is the enormous expansion in UI benefits, especially among low-wage workers. To measure how UI generosity changed during the COVID Recession and how that compares with the Great Recession involved constructing pseudo UI replacement rates (UIRR) for workers in each tercile of the earnings distribution (see Table 1). These rates reflect the increase in benefit amounts, the extended duration of benefits, and the expansion of workers eligible for benefits. For low earners, UI replacement rates increased more than sevenfold during the COVID Recession.

To capture the potential effect of increased generosity for different earnings groups, the equation includes an interaction of the UIRR and a dummy variable for being in the lowest or middle earnings tercile (EARN) (with high earners as the omitted group). Finally, the equation includes age-month fixed effects (FE) and a linear time trend (T) to reflect the downward trend in early claiming rates over time.12For both hazard models, the marginal effects, rather than the coefficients, are reported because of the nonlinearity of the probit mode. The marginal effect is the derivative of the claiming probability with respect to a variable evaluated at each variable’s mean. The Delta Method is used to calculate the standard errors. We also report interaction effects and standard errors that account for the nonlinearity.

Results

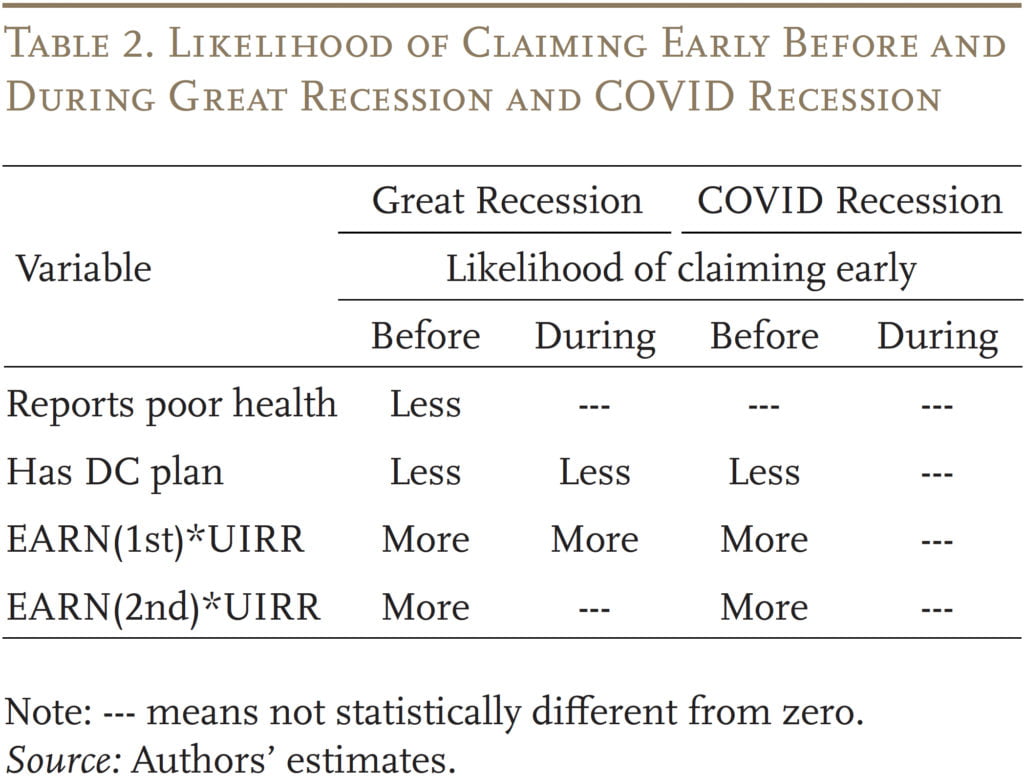

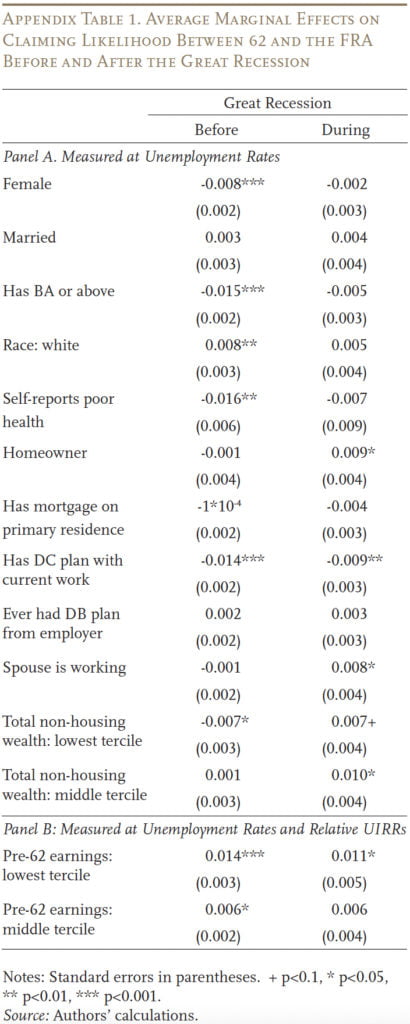

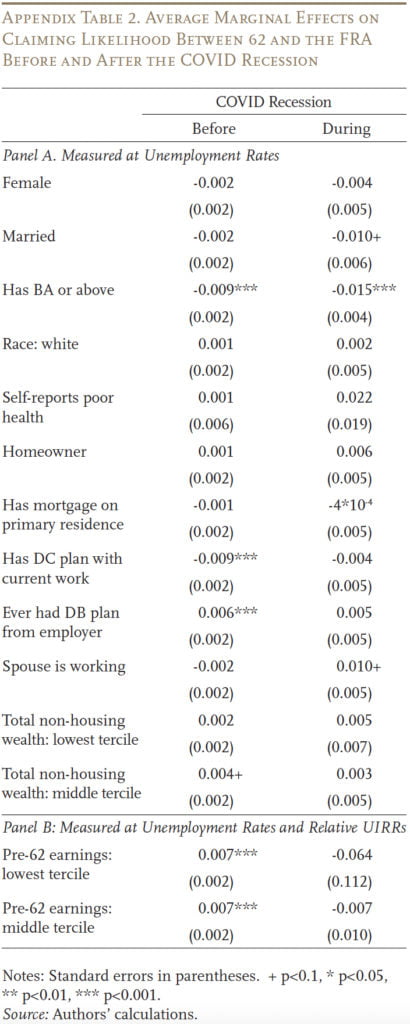

The direct results of estimating the two hazard models are almost impossible to interpret, so the focus here is the relative likelihood of early claiming for different groups, calculated using the average unemployment rate and UI replacement rate “Before” and “During” the Great Recession and COVID Recession (see Table 2). The full results for these relative marginal effects are presented in the Appendix. The following highlights the results for the three key issues identified above: health, wealth, and UI.

Health

Let us start with the disappointing and puzzling result for health. The hypothesis was that, with a pandemic-induced recession, workers in poor health would be more likely to exit the labor force and claim early, relative to the Great Recession. The results do not provide any evidence to support this assumption.13The variable used in the analysis is whether the individual reports being in poor health, although the equations were also estimated for being in poor or fair health and the results were the same. During the boom before the Great Recession, it appears that – holding everything else constant – those reporting poor health were less likely to claim early than those reporting better health. As the economy moved into the Great Recession, the difference in the claiming behavior between the two groups was no longer statistically significant. During COVID, health did not appear to be a deciding factor either during the boom or the recession.

Two explanations for the surprising results are possible. First, reporting poor health is likely correlated with other variables in the equation such as education, wealth, and income, and therefore has no independent effect. Alternatively, because COVID allowed people to work from home, those in poor health may not have needed to exit the labor force.

Wealth

In the case of wealth, the hypothesis that the booming stock and housing markets during the COVID Recession would enable wealthier workers to claim early appears to hold. Specifically, before and during the Great Recession and in the pre-COVID boom, workers who had a defined contribution (DC) retirement plan were less likely to claim early than workers without a plan. During the COVID Recession, as the stock market recovered, those with a DC plan were no more or less likely to claim early than those without a plan. That is, the relative likelihood of claiming early for those with a plan had increased.

Unemployment Insurance

Also, as predicted, the greatly expanded unemployment insurance benefits during COVID appear to have changed the claiming behavior of those in the lowest earnings group. Prior to the Great Recession, workers in the lowest tercile of the earnings distribution were more likely than those in the highest tercile to retire early. The increased generosity of UI benefits did not seem to disproportionately affect early claiming for low earners during the Great Recession, as they experienced proportionately similar increases in UI replacement rates as those in the top earnings tercile.

The COVID story, when the additional $600 in weekly UI benefits replaced a much higher share of earnings for low-wage workers than for higher-wage workers, was quite different. Whereas, workers in the lowest tercile were much more likely than those in the highest tercile to claim early before the COVID Recession, once the expanded payments became available that pattern no longer held. That is, the claiming behavior of the earners in the lowest tercile was not statistically different from those in the top tercile. The same pattern was evident for the middle tercile compared to the top tercile.

Overall Effects

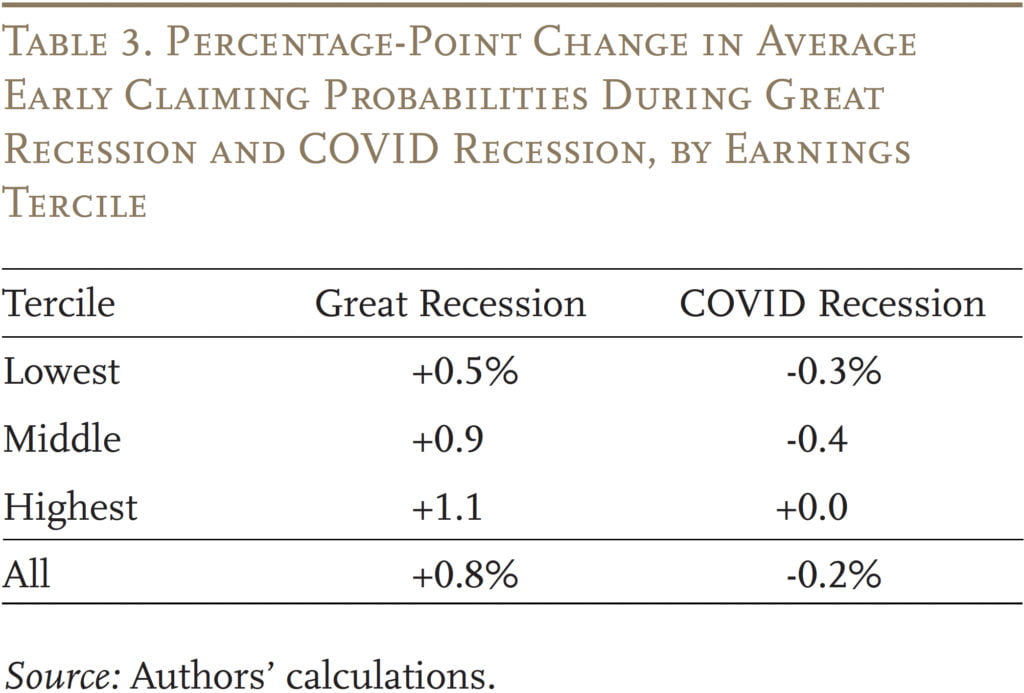

Although the discussion above focuses on changes in relative likelihoods, the hazard model makes it possible to trace out the full claiming trajectory of older workers to calculate actual changes in the probabilities of claiming early. The results show that high unemployment rates during the Great Recession led to a 0.8 percentage-point increase in early claiming, while the COVID Recession led to an actual decrease (see Table 3).14This finding is consistent with data from Social Security’s Annual Statistical Supplement. The decline was led by low and middle earners responding to the high UI replacement rates that made it more attractive to stay in the labor force than claim Social Security. Thus, the expanded UI benefits not only helped workers in their immediate situation but also assured them slightly higher monthly Social Security benefits throughout retirement.

Conclusion

In early 2020, the COVID Recession seemed like it would result in an increase in early claiming, similar to the Great Recession. However, pretty quickly, the COVID Recession turned out to be very different. It was spurred by a health crisis to which older workers were much more susceptible, though the results did not suggest any change in early claiming behavior in response. The findings do support the notion that the unprecedented gains in the stock and housing markets allowed some advantaged groups to retire early. On the other hand, the unprecedented expansion and generosity of UI payments enabled many lower paid workers to stay in the labor market, delay claiming, and preserve their Social Security. Overall, the competing effects more than canceled each other out and led to a slight decline in early claiming and more secure retirements.

References

Alon, Titan, Matthias Doepke, Jane Olmstead-Rumsey, and Michèle Tertilt. 2020. “The Impact of COVID-19 on Gender Equality.” Working Paper 26947. Cambridge, MA: National Bureau of Economic Research.

Borjas, George J. and Hugh Cassidy. 2020. “The Adverse Effect of the COVID-19 Labor Market Shock on Immigrant Employment.” IZA DP No. 13277. Bonn, Germany: IZA – Institute of Labor Economics.

Chen, Anqi and Alicia H. Munnell. 2021. “Pre-COVID Trends in Social Security Claiming.” Issue in Brief 21-9. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Chen, Anqi, Siyan Liu, and Alicia H. Munnell. 2022. “How Does COVID-Induced Early Retirement Compare to the Great Recession?” Working Paper 2022-12. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Chetty, Raj, John N. Friedman, Nathaniel Hendren, Michael Stepner, et al. 2020. “How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data.” Working Paper 27431. Cambridge, MA: National Bureau of Economic Research.

Clark, Robert L., Annamaria Lusardi, and Olivia S. Mitchell. 2020. “Financial Fragility during the COVID-19 Pandemic.” Working Paper 28207. Cambridge, MA: National Bureau of Economic Research.

Federal Reserve Bank of St. Louis. Federal Reserve Economic Data, 2022. St. Louis, MO.

Goda, Gopi Shah, et al. 2021. “The Impact of COVID-19 on Older Workers’ Employment and Social Security Spillovers.” Working Paper 29083. Cambridge, MA: National Bureau of Economic Research.

Quinby, Laura, Matthew S. Rutledge, and Gal Wettstein. 2021. “How Has COVID-19 Affected the Labor Force Participation of Older Workers?” Working Paper 2021-11. Chestnut Hill, MA: Center for Retirement Research at Boston College.

University of Michigan. Health and Retirement Study, 2004-2010 and 2016-2020. Ann Arbor, MI.

U.S. Social Security Administration. 2021. Annual Statistical Supplement. Washington, DC.

Whittaker, Julie M. and Kateline P. Isaacs. 2021. “Current Status of Unemployment Insurance (UI) Benefits: Permanent-Law Programs and COVID-19 Pandemic Response.” R46687. Washington, DC: Congressional Research Service.

Appendix

Endnotes

- 1Chen, Liu, and Munnell (2022).

- 2Quinby, Rutledge, and Wettstein (2021).

- 3The Pandemic Unemployment Assistance program temporarily provided unemployment benefits to people unable to work for reasons related to COVID who were not usually eligible for unemployment assistance, including the self-employed, independent contractors, and those with limited work. This program paid for up to 39 weeks of unemployment benefits between January 27, 2020 and December 31, 2020.

- 4The Families First Coronavirus Response Act which was signed into law on March 18, 2020, provided $4.7 billion in additional funding to state governments to administer unemployment programs and to fund benefit payments.

- 5This legislation increased the total number of weeks available for unemployment benefits from 50 to 79 for self-employed people and other unemployed people deemed ineligible for state UI benefits; increased eligibility for benefits from 24 to 53 weeks for those who exhausted their benefits; and continued the $300 per week supplement. It also exempted the first $10,200 in 2020 unemployment benefits from federal income tax for households with incomes below $150,000 per year. However, 25 states opted to terminate temporary pandemic UI programs by June or July 2021. See Whittaker and Isaacs (2021).

- 6Clark, Lusardi, and Mitchell (2020); Borjas and Cassidy (2020); Chetty et al. (2020).

- 7Alon et al. (2020).

- 8The trend was largely flat: the average 12-month retirement rate before the pandemic (through March 2020) was 12 percent, compared to 13 percent post-pandemic. Moreover, the only group that saw a statistically significant increase in retirement was workers ages 70 and over. See Quinby, Rutledge, and Wettstein (2021) and Goda et al. (2021).

- 9Early claimers can also be defined only as people who claim at the earliest possible age, age 62. We include the group that claims after 62 but before their FRA for two reasons. The first is that the share of older workers who claim at age 62 has been declining for several decades and is only representative of about a third of older workers’ claiming decisions (see Chen and Munnell 2021). In fact, claiming at all ages before the FRA has been declining in recent decades. Second, including those who claim at all ages before the FRA allows for a larger sample size for later empirical analysis.

- 10Earlier waves of the HRS are also used for information on pre-62 characteristics of some respondents.

- 11The sample excludes individuals who receive Social Security Disability Insurance (SSDI) at any time, since their retirement benefit claiming age is pre-determined (it occurs automatically at their FRA) and is not going to respond to macroeconomic conditions; individuals not linked to administrative claiming data who self-report claiming before age 62, as this is due to survivor benefits or reporting error; and individuals with no claiming information at all.

- 12For both hazard models, the marginal effects, rather than the coefficients, are reported because of the nonlinearity of the probit mode. The marginal effect is the derivative of the claiming probability with respect to a variable evaluated at each variable’s mean. The Delta Method is used to calculate the standard errors. We also report interaction effects and standard errors that account for the nonlinearity.

- 13The variable used in the analysis is whether the individual reports being in poor health, although the equations were also estimated for being in poor or fair health and the results were the same.

- 14This finding is consistent with data from Social Security’s Annual Statistical Supplement.