The Social Security Deficit Explained

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

The bulk of the 2017 deficit was expected, the surprises have been more or less offsetting.

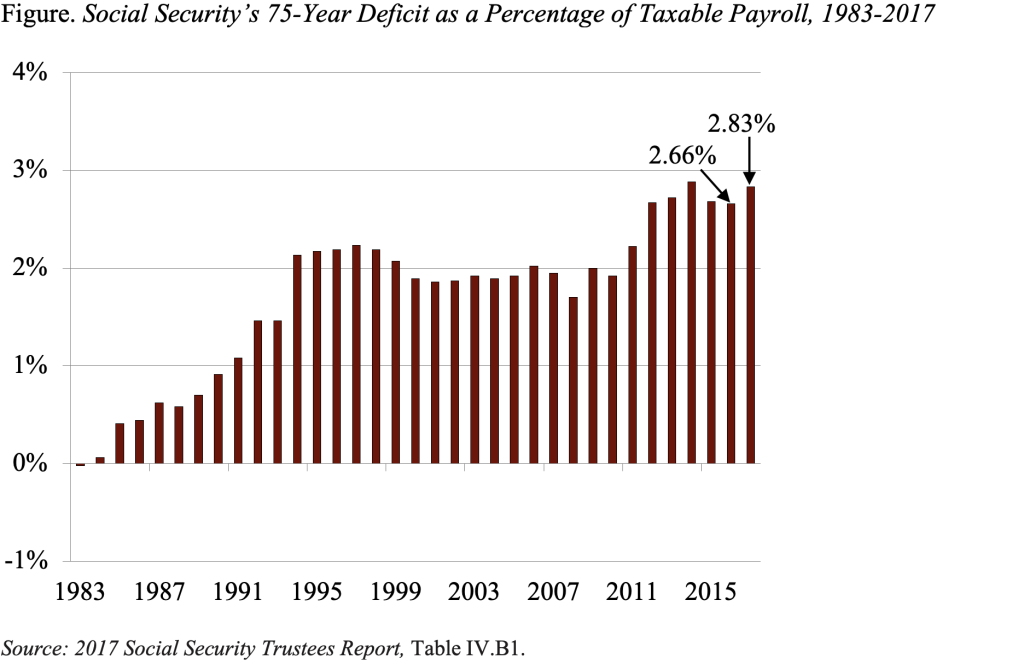

The 2017 Trustees Report says that the Social Security program faces a deficit over the next 75 years equal to 2.83 percent of taxable payrolls. That figure means that if payroll taxes were raised immediately by 2.83 percentage points – 1.42 percentage points each for the employee and the employer – the government would be able to pay the current package of benefits for everyone who reaches retirement age through 2091, with a one-year reserve at the end.

Figure 1 puts the 2017 deficit in perspective. In 1983 – the last year for any major legislation – the Trustees projected was a small surplus over the 75-year period (1983-2057). Almost immediately after that legislation, however, deficits appeared and increased markedly in the early 1990s, then dipped for a while, and then rose to around 2.7 percent where it has remained in the last six years.

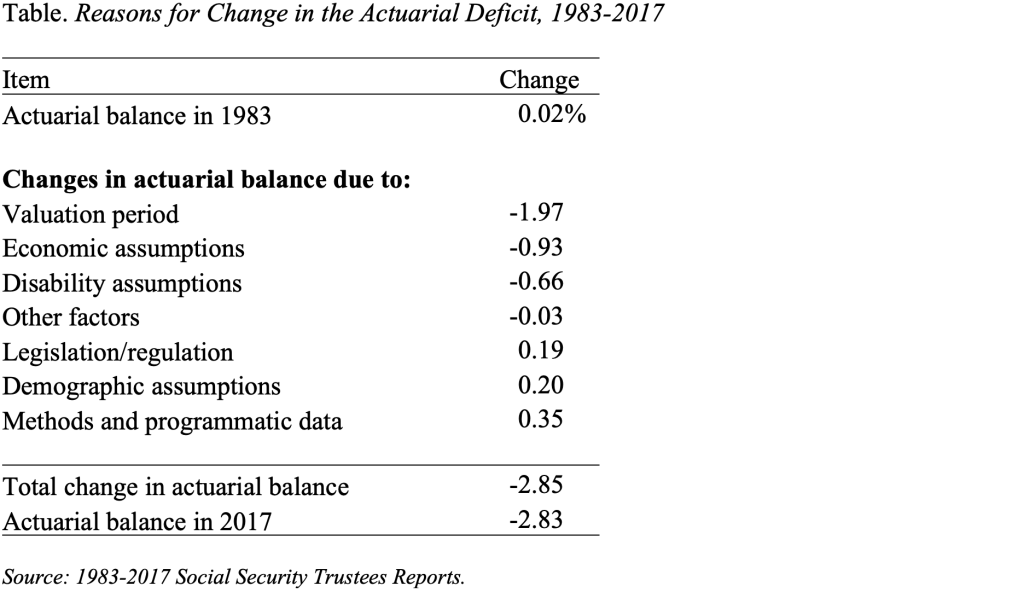

The question is why the program moved from a 75-year surplus of 0.02 percent of taxable payroll in 1983 to today’s 75-year deficit of 2.83 percent. As shown in the table below, the major reason for this swing is the impact of changing the valuation period. That is, the 1983 Report looked at the system’s finances over the period 1983-2057; the projection period for the 2017 Report is 2017-2091. Since Social Security costs are rising with the retirement of the baby boom, each time the valuation period moves out one year it picks up a year with a large negative balance. This moving the period forward is responsible for the bulk of today’s deficit – 1.97 of the 2.83 percent of taxable payroll.

The remainder of the increased actuarial deficit over the past 34 years is due to worsening of economic assumptions – primarily a decline in assumed productivity growth, the impact of the Great Recession, and increases in disability rolls. Offsetting the negative factors has been a reduction in the actuarial deficit due to changes in demographic assumptions – primarily higher mortality for women, minor legislative and regulatory changes, and methodological improvements.

The important point is that the surprises have been more or less offsetting, while the bulk of the deficit was expected.