Social Security Disability Rolls Are Declining

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Nobody seems to know just why.

A colleague was looking into doing a project on Social Security’s Disability Insurance (DI) program, so it forced me to take a look. If you listened to conversations on DI, you would get the impression that the problem is out of control and the highest national priority is getting these people off the rolls and back to work.

Indeed, for most of the last 35 years, the disability rolls were soaring. Three factors explain the steady increase. First, legislation passed in 1984 broadened the definition of disability and provided applicants and medical providers with greater opportunity to influence the decision process. Second, the population was aging, so the baby boom generation ‘aged into’ the higher incidence rates following the 1984 reforms. Third, the secular rise in female labor force participation increased the fraction of women eligible by their work history for disability benefits and they too aged into the higher incidence rates.

These factors behind rising rolls are not likely to occur again. The aging of the workforce has slowed with the baby boom moving into retirement, and women’s labor force participation has levelled off.

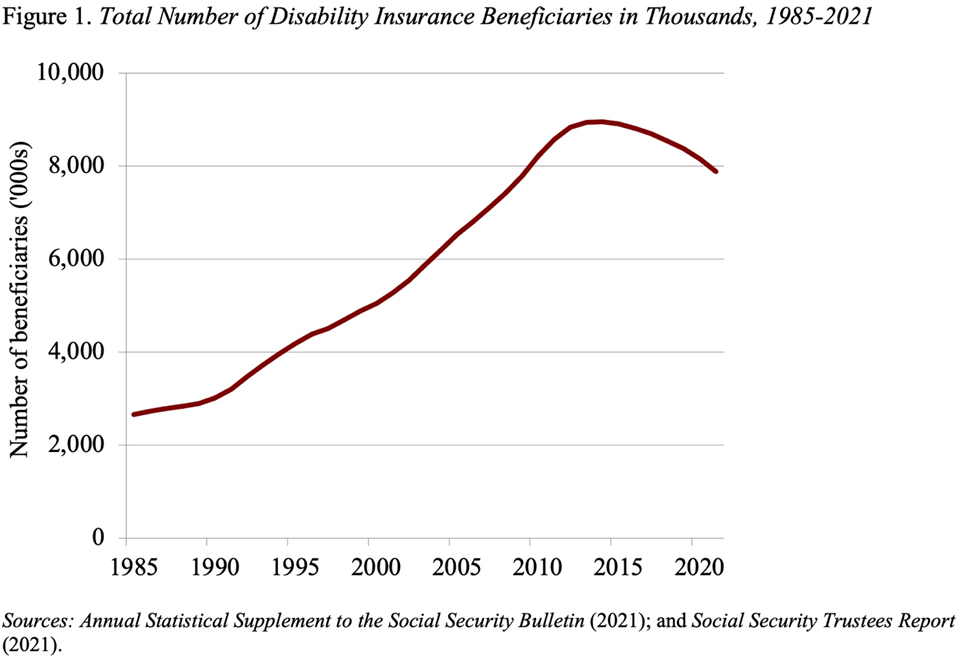

Indeed, recent data suggest that the trajectory of the program has shifted. After peaking in 2014, the stock of beneficiaries has been declining (see Figure 1). Note, we’re not talking about percentages here; these data refer to the absolute number of people. Fewer people are receiving DI benefits today than in 2014.

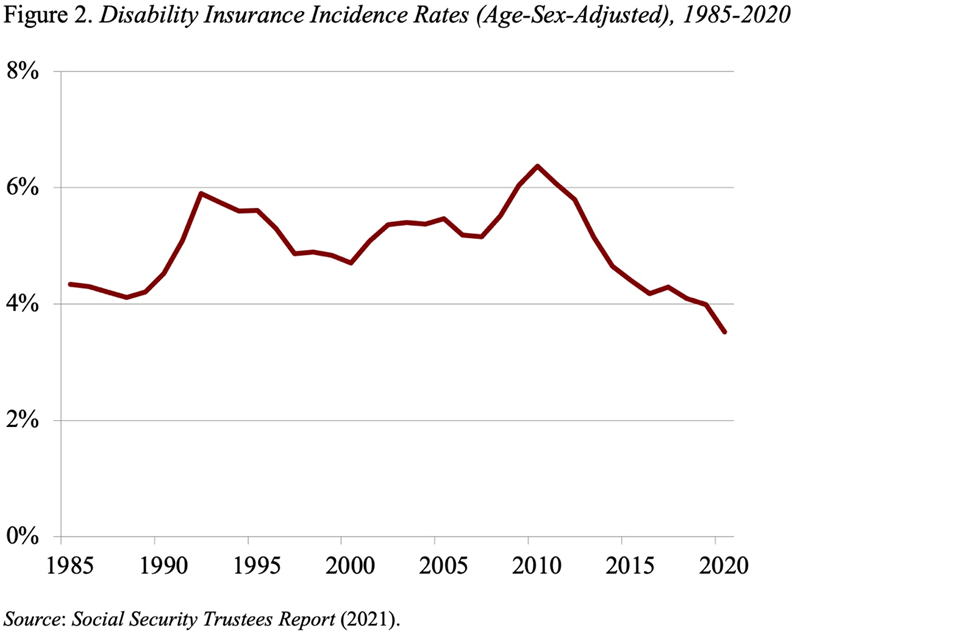

The total number on the rolls consists of those already receiving benefits and new awards. The increase in life expectancies continues to put some upward pressure on the number of beneficiaries, but in recent years that pressure has been more than offset by the declining incidence rate (see Figure 2). (The incidence rate is the number of new beneficiaries as a percentage of the disability-insured population.)

No one quite knows why the incidence rate has declined. The list of possible factors include:

- business cycle factors;

- easier access to health care in the wake of the Affordable Care Act;

- a shift away from more physically demanding industries;

- the closing of some field offices, even before COVID; and

- new policies and procedures.

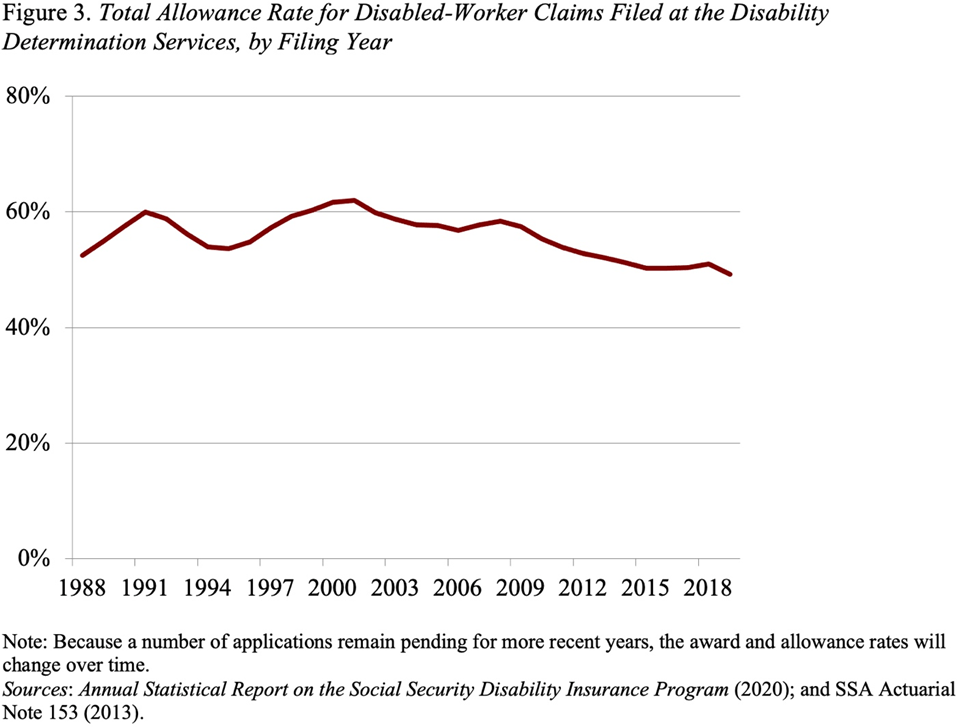

Some evidence suggests that the latter may be important. Beginning in 2009, the Social Security Administration implemented a number of changes in the training of the Administrative Law Judges who decide the DI applications. New monitoring focused on judges with allowance rates or denial rates far from the average; a “How Am I Doing?” tool allowed staff and judges to track their performance; and fewer cases per judge allowed more time for consideration. In the wake of that initiative, the allowance rate – the percentage of applications approved – has trended down from 57 percent in 2009 to 49 percent in 2019 (see Figure 3).

Add on top of all this, Social Security offices closed for COVID in 2020 and are just reopening this month.

Perhaps, at this point, the appropriate concern should be whether those who need the help are getting it, rather than trying to get those on the rolls off.