Social Security in the Cross Hairs: Overestimating the Deficit

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

New estimates make the problem sound insoluble.

My sense is that Social Security may be at risk after the November elections. Critics are writing op-eds saying that benefits – relative to previous earnings – are very high, and the Congressional Budget Office (CBO) has come out with an astounding estimate of the 75-year deficit. The stage is being set for benefit reductions. Cutting benefits would be a huge mistake, given that half the private sector workforce does not participate in an employer-sponsored retirement plan and that those lucky enough to participate in a 401(k) have combined 401(k)/IRA balances of $111,000 as they approach retirement. Therefore, it is very important to take a hard look at the emerging characterization of the Social Security program. This blog focuses on the 75-year deficit.

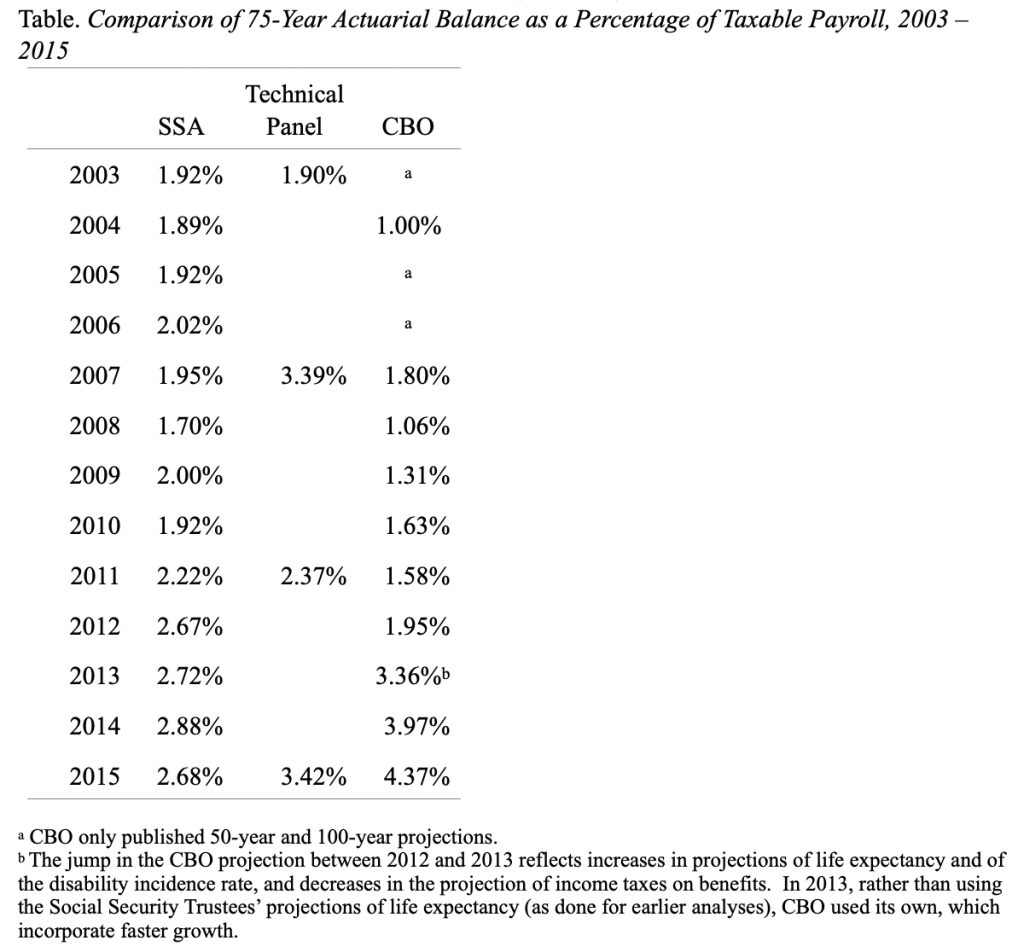

The 75-year deficit is the difference between the income rate and the cost rate. The income rate is calculated by adding the current trust fund balance to the present discounted value of scheduled taxes and then dividing by the present discounted value of taxable payroll over the 75-year period. The cost rate is the present discounted value of scheduled benefits divided by the same payroll number. In 2015, the Social Security Trustees Report had an estimated deficit equal to 2.68 percent of taxable payroll. That figure means that if payroll taxes were raised immediately by 2.68 percentage points – 1.34 percentage points each for the employee and the employer – the government would be able to pay the current package of benefits for everyone who reaches retirement age at least through 2089.

Is 2.68 a reasonable number? Every four years, Social Security establishes a Technical Panel to evaluate the Trustees’ projections. I chaired the Technical Panel in 2015, and we concluded that the Trustees’ assumptions unequivocally were reasonable.

That said, we offered our preferred alternative for a number of assumptions. Specifically, the Technical Panel suggested: 1) more rapid mortality improvement, which means that people will live longer and receive more total Social Security benefits; lower fertility, which reduces the population at working ages relatively to the elderly population; and lower interest rates, which mean that revenues and benefits are discounted by a lower number. These cost-increasing changes raised the 2.68 percent deficit in the 2015 Trustees Report to 3.42 percent. (The net increase would have been lower if the Panel had quantified the impact of assumed greater labor force participation.)

I think my liberal friends are disappointed that the Panel adopted assumptions that increased the 75-year deficit by such a large amount. But I look at it this way. The Panel pulled no punches, ignored the cost implications when making its recommendations, and the worst that it could do is to increase the long-run deficit by 0.7 percentage point.

My experience with the Technical Panel makes it very difficult to understand the new CBO deficit estimate of 4.37 percent. The CBO report cites three main reasons for the difference between the Trustees’ and CBO’s estimates (2.68 percent versus 4.37 percent): mortality improvement, disability incidence, and interest rates. But the Technical Panel increased mortality improvement significantly and reduced the interest rate, as well as reducing the fertility rate and did not come close to the CBO number (see Table).

Policymakers should view the reasonable range as between the Trustees and the 2015 Technical Panel (2.68 percent and 3.42 percent). In other words, the Trustees’ assumptions are reasonable, and the Technical Panel’s recommendations are reasonable. Only time will tell which of us comes closer.