Social Security Is a Great Equalizer

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Social Security dramatically reduces inequality between white and minority retirement wealth.

A forthcoming study by two of my colleagues, Wenliang Hou and Geoff Sanzenbacher, looks at retirement wealth by race. They defined wealth broadly to include assets in retirement plans (including defined benefit plans), non-retirement plan assets, housing wealth, and Social Security benefits. They used data from the Health and Retirement Study, a biannual survey that follows households over age 50. In the case of defined benefit plans and Social Security, the authors created a “wealth” variable by projecting future benefits, discounting those benefits to age 65, and then prorating them to the worker’s age at the time of the survey. They focused on wealth for households ages 51-56.

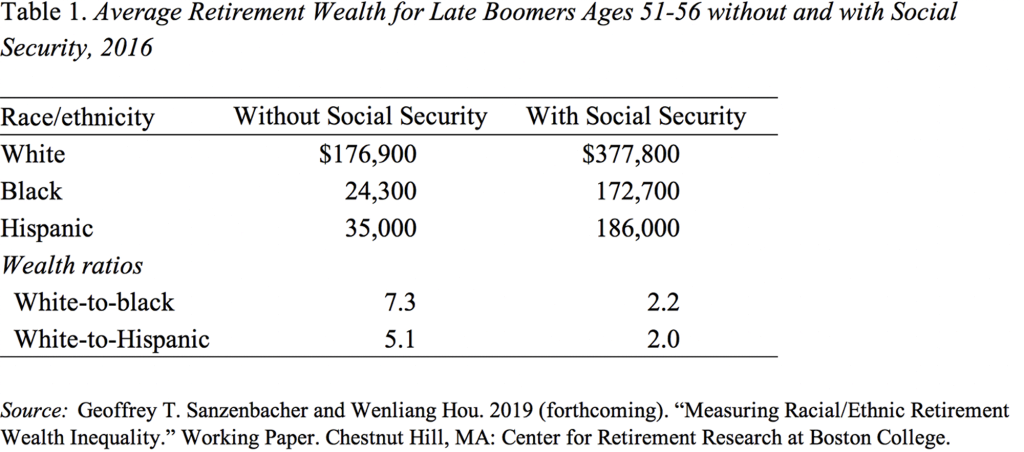

The results are shown in Table 1. Without Social Security, the wealth of white households was 7 times that of Black households and 5 times that of Hispanic households. Add in Social Security and the disparity for both Black and Hispanic households is reduced to 2 to 1.

The reason that Social Security has such a powerful effect is that the program is universal and its benefit formula is progressive. A universal program allows minority workers to build up credits as they move from job to job. This constancy differs from employer-sponsored retirement plans, where minorities often work for employers that do not provide coverage. A progressive benefit formula provides much higher benefits relative to earnings for low-wage workers than for their high-wage counterparts. Since Blacks and Hispanics earn significantly less than white workers, they receive a much higher percentage of their pre-retirement earnings in Social Security benefits.

Trends over time have generally shown little variation in the ratio of white-to-minority wealth ratios. Specifically, the 1992-2010 HRS cohorts mostly displayed only small changes in retirement wealth inequality. More recently, however, a decline in retirement wealth for white households between 2010 and 2016 has narrowed the racial/ethnic gaps in retirement wealth.

No one would argue that white households having twice as much retirement wealth as Blacks and Hispanics is an acceptable outcome. But it is important to remember how much worse the situation would be without Social Security.