Social Security Proposal Raises Revenue and Temporarily Enhances Benefits

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Revenues could serve as a down payment, but enhancements that expire in 5 years could create real problems.

Congressman John Larson (D-CT), Chair of the House Ways and Means Subcommittee on Social Security, recently released his 2021 version of the 2019 Social Security 2100 Act. The earlier version, which was introduced jointly with Senators Richard Blumenthal (D-CT) and Chris Van Hollen (D-MD), retained – and even slightly enhanced – benefits and substantially increased revenues.

On the benefit side, the 2019 legislation offered four enhancements:

- Use the consumer price index for the elderly (CPI-E).

- Raise the first factor in the benefit formula from 90 to 93 percent.

- Increase thresholds for taxation of benefits under the personal income tax.

- Increase the special minimum benefit for those with very low earnings.

To pay for these benefit enhancements and, more importantly, to eliminate the 75-year deficit, the legislation increased income to the program in two significant ways.

- Raise the combined OASDI payroll tax of 12.4 percent by 0.1 percentage point per year until it reaches 14.8 percent in 2043.

- Apply the payroll tax on earnings above $400,000 and on all earnings once the taxable maximum reaches $400,000, with a small offsetting benefit for additional taxes.

The new 2021 version of the legislation – the Social Security 2100 Act: A Sacred Trust – reflects two maxims of the current political climate: 1) no tax increases for those earning less than $400,000; and 2) temporary programs will generate impetus for making them permanent. The result is a bill that produces only about half the revenue as the 2019 proposal – since it is no longer possible to raise the payroll tax rate – and introduces 12 benefit enhancements – the four listed above and 8 additional ones. The key to this proposal, however, is that the enhancements would apply only in the next five years and then disappear.

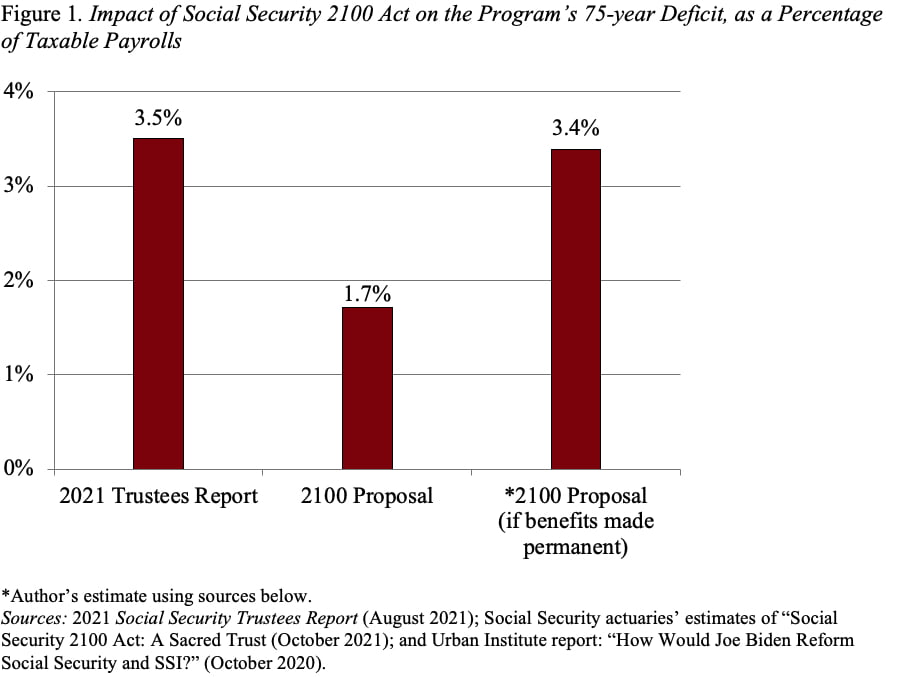

The Social Security actuaries recently “scored” the 2021 version of the Social Security 2100 Act, and concluded that – with only five years of enhancements – it eliminates roughly half of the program’s 75-year deficit. So, one could characterize the proposed legislation as a “down payment” on solving the 75-year problem.

But the proposed enhancements raise serious concerns. Let’s say that the new way of thinking is correct – put goodies on the table for a few years and pressure will build to make them permanent. My back-of-the envelope calculations suggest that making these enhancements permanent would essentially use up all the new money raised (see Figure 1). The program’s deficit would then be back to square one; and the only remaining financing option would be an increase in the payroll tax rate, meaning that the burden on future workers would be substantial.

The alternative, of course, is that the pundits are not correct and Congress does not make the enhancements permanent after five years. In this case, the good news is that the 2100 Act would have made a substantial down payment on eliminating the 75-year deficit. The bad news is that the legislation would have created chaos administratively and in terms of public perceptions. The staff of the Social Security Administration and the agency’s computer capability are already stretched thin; implementing a dozen new provisions would be an enormous challenge. And think about explaining to angry participants why their cost-of-living adjustments suddenly drop when the CPI-E provision expires! Turning provisions on and off will confuse people enormously, and undermine confidence in the program.

In short, I love the Social Security program and want to see additional funding to finance promised benefits. And as a researcher, it would be fun to compare outcomes for people who received enhanced benefits to those who did not. But the Social Security 2100: A Sacred Trust could create more problems than it solves.