State and Local Pension Funding Improved in 2014

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Despite dire predictions from Illinois and New Jersey, the funded status of public plans as a group increased from 72 to 74 percent.

The Center for Retirement Research at Boston College just released a 2014 update of the funded status of the 150 state and local plans in the Public Plans Database. For the first time since the financial crisis of 2008, funding improved, with the aggregate funded ratio rising from 72 to 74 percent under the old Governmental Accounting Standards Board accounting standards (GASB 25).

The year 2014 was always going to be a pivotal one for the funded status of public pension plans because, under the old GASB 25 accounting standards, the disastrous stock market performance of 2009 rotates out of the smoothing calculations for the majority of plans that use a five-year averaging period.

But 2014 also became pivotal because it was the first year that plan sponsors reported under GASB’s new accounting standards for their financial disclosures. The new GASB 67 standards involve two major changes. First, assets are reported at market value rather than actuarially smoothed. Second, in cases when assets are projected to fall short of future benefits, liabilities are valued using a “blended” discount rate.

Although GASB standards apply to financial reporting only, when GASB 25 was in effect, most plans also used the same standards for funding purposes. Under GASB 67, however, plans are now using separate standards for reporting and funding. For reporting in their financial documents, all plans in our sample that have released 2014 data adopted the market valuation of assets as required by GASB 67, but only seven plans determined it necessary to use a significantly lower blended discount rate. For funding purposes – that is, in plans’ actuarial valuations – they maintained the traditional approach used under GASB 25 of smoothed assets and expected long-run returns for discounting. The 74-percent funded ratio reported above is based on GASB 25 and therefore consistent with data for earlier years.

The other piece of good news pertains to annual contributions. Again, one technical note. The new GASB standards replaced the Annual Required Contribution (ARC) with the Actuarially Determined Employer Contribution (ADEC). Both the ARC and the ADEC equal the normal cost – the present value of the benefits accrued in a given year – plus a payment to amortize the unfunded liability, generally over 20-30 years. Although the ARC and ADEC have some conceptual differences, they are nearly identical for the plans in our database.

The good news is that, despite the fact that the required contributions relative to payrolls continue to climb, plan sponsors are contributing more of the required amount – 88 percent in 2014, up from 82 percent in 2013.

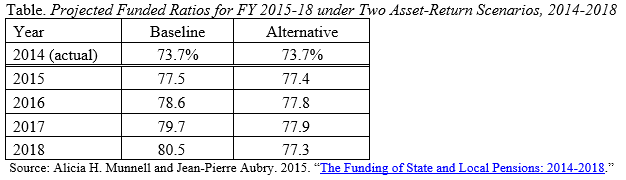

Looking beyond 2014, we make projections for the next five years under two return scenarios. Public pensions currently hold more than half of their assets in equities and about 70 percent in risky assets. While most plans assume portfolio returns of 7.6 percent nominal (implying nominal stock returns are at least 9.6 percent), many investment firms – such as Bridgewater, Goldman Sachs, and GMO – project nominal returns for a balanced portfolio of between 4 and 5 percent. To address uncertainty about the future performance of plan assets, our baseline projection is designed to yield an overall return on portfolios close to that assumed by most plans. The alternative scenario assumes portfolio returns are 3 percent below plans’ assumed return – 4.6 percent nominal.

The projected funded ratios are shown in the Table. After 2014, if plans achieve their assumed return, funded ratios keep climbing as asset growth continues to exceed assumed liability growth. If, instead, returns are at the lower rates predicted by the investment firms, funding grows for the next year and then levels off.