State Initiatives Will Restore IRAs to Their Original Mission

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

Currently IRAs don’t increase retirement saving; balances are rollovers from employer plans.

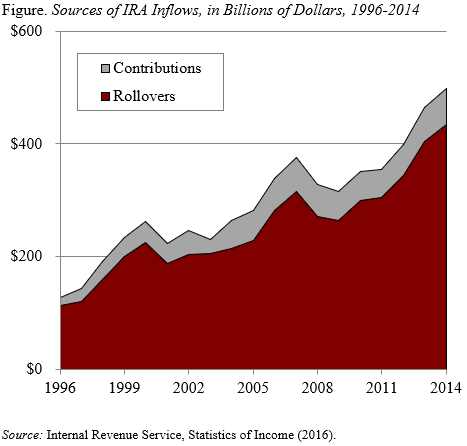

Individual Retirement Accounts (IRAs) were introduced in 1974 under the Employee Retirement Income Security Act. The goal was to enable those without pension coverage in employer-sponsored plans to save in a tax-deferred fashion. IRAs now hold almost half of total private retirement assets, but they do little to increase national saving. Most of the growth in IRA assets is driven by rollovers from employer-sponsored retirement plans. In 2014, contributions represented just 13 percent of new money flowing into IRAs (see Figure).

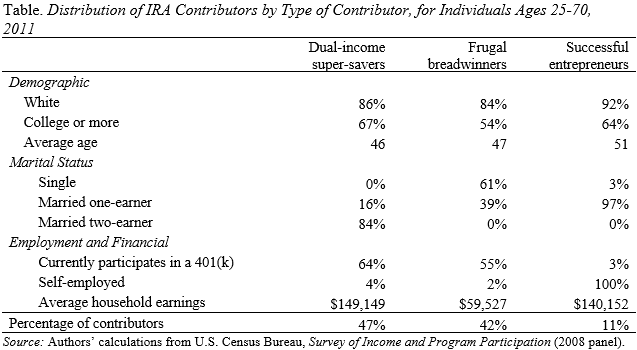

Moreover, more than half of those contributing to an IRA are also contributing to a 401(k) plan. As you can see in the Table, contributors fall into three major groups. The first group, “dual-income super-savers,” consists of married individuals largely in two-earner, higher-earning households that are often contributing to a 401(k). The second group, “frugal breadwinners,” consists of middle-income, one-earner households – either single individuals or one-earner married couples – that also tend to contribute to a 401(k). The third group, “successful entrepreneurs,” consists of higher-income, self-employed individuals who are not currently contributing to a 401(k) plan. Taking these three groups combined, less than half of the 14 percent of households contributing to an IRA are using IRAs as their major savings vehicle.

The bottom line is that today’s IRAs are primarily a receptacle for rollovers from employer plans, and among those contributing, the majority are also currently contributing to an employer plan. It is time to turn IRAs back into an active savings vehicle by auto-enrolling those without an employer plan into these accounts, with the ability to opt out. Ideally, such an auto-IRA policy would be a federal government initiative. But, absent federal action, a number of states have stepped into the breach. Despite Congress throwing sand in the wheels of the state efforts, Oregon and Illinois are proceeding ahead. These efforts will turn IRAs back into the vehicles they were designed to be.