Surging U.S. Centenarian Population Requires Action

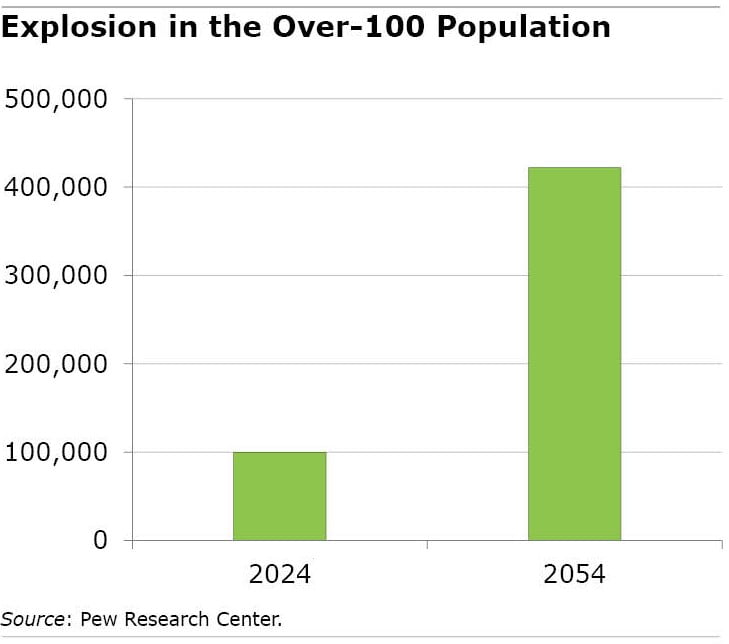

The growth in the over-100 population is gob-smacking. In 30 years, Pew reports that the number of U.S. centenarians will quadruple to more than 400,000. To get a sense of what this will mean, picture every resident in Tampa, Fla., being over 100. In 1950, only 2,300 people in the entire country were.

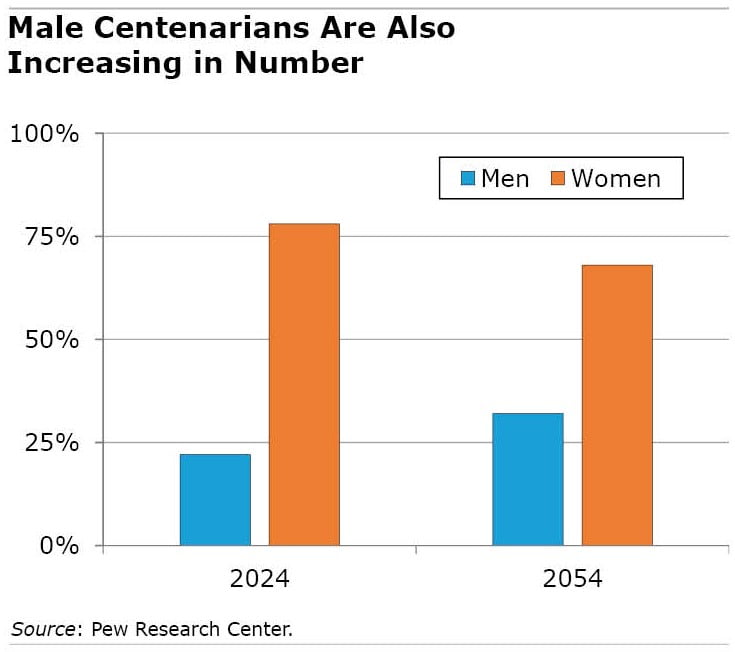

Most centenarians today are women and will be in the future but men are also living longer. Men will make up about a third of them in 2054, up from a fifth currently, according to Pew.

The rapid growth in the over-100 population is part of a larger trend of an aging nation, which creates three pressing policy concerns.

First, all these old people are going to need a lot more caregivers. Daughters usually take care of their aging parents. But someone who lives to 100 might either outlive their children or their children might be too old to care for them.

The systems currently in place are already under strain as baby boomers increasingly need care. Caregiving is difficult, low-paid work. Job openings for in-home aides are going unfilled, and staff turnover at nursing homes and assisted living facilities is a chronic problem.

Another issue is the financial drain on individuals of an extremely long retirement. Already, about four in 10 workers today workers today are not on track with their 401(k) savings and may experience a drop in their standard of living when they retire.

Amid rising longevity, many older workers are taking steps to improve their retirement outlook by working longer to save more and hold out for a larger monthly Social Security benefit. But even if someone delays retiring until 70 and then lives to 90 or 100, they will need enough savings to cover two or three decades.

Finally, unless policymakers act, the Social Security trust fund is expected to be depleted in the 2030s, and the payroll taxes paid by workers will provide only about three-fourths of the revenues required to cover retirees’ benefits.

Social Security’s fiscal problems will have to be addressed at the same time that the Medicare program is being increasingly burdened by the cost of medical care for the growing elderly population.

These fiscal problems with be compounded by fertility declines. As more people live to 90, 100 or beyond, there will be fewer and fewer workers funding each retiree. This is a problem throughout developed countries and not just in the United States.

Meeting the growing need for caregivers, doing more to encourage retirement saving, and repairing Social Security’s and Medicare’s finances – these are pressing issues that Congress needs to address. The clock is ticking.

Squared Away writer Kim Blanton invites you to follow us @SquaredAwayBC on X, formerly known as Twitter. To stay current on our blog, join our free email list. You’ll receive just one email each week – with links to the two new posts for that week – when you sign up here. This blog is supported by the Center for Retirement Research at Boston College.

Comments are closed.

For Steve Goss, chief actuary of the Social Security Administration, 300,000 centenarians is a rounding error. What matters is the dependency ratio. Here we have two pieces of good news. First, the increase in longevity has stalled, and some socioeconomic groups are actually dying at younger ages. Second, average Social Security claim ages are increasing. Offsetting this, the fertility rate appears to be declining. Although you can take comfort that there is no longer a mewling brat in seat 13C on the plane, in the future, that mewling brat will not be around to pay your benefits.

In the retirement and estate planning communities, this is known as the “Silver Tsunami” and the vast majority of people are unprepared.

While centenarians are attention-grabbing, our entire “non-system” of elder care needs attention. People who should know better assume Medicare will pay for nursing home care, which it does not except for short-term rehab. Aides typically earn minimum wage whether they work in nursing homes or do home care, so there is enormous turnover. The burden of care falls on families who may live far away and need to work. The time to change this must start now!

My wife and I are 68 years old. We have two adult children. One is 50 years and the other male is 40 years old, and one granddaughter, 23 years old. We have long come to the realization that neither of our adult children, nor our adult granddaughter will more than likely not, ever become a caregiver to us. I cannot offer an explanation why our children will never play an active role in caregiving, other than, it’s not in their DNA. Although, myself and my wife played active roles in being a caregiver to our parents and grandparents, until the very end-of-life. That is how we were both reared. Being a caregiver severely impairs ones ability to save and earn maximum income. As a result, we only became able to save money and invest in our later years. It is rather concerning, how will we be able to sustain ourselves, without caregiving assistance, as our physical and mental abilities decline? Honestly, I have been saving for a humanoid service robot. Once they become available in the consumer market. I believe it will be our best chance for continuing to live independently.

The current paradigm is outdated, broken, corrupted, completely dysfunctional and completely unable to meet what is known to happen let alone all the unknown ( war, national bankruptcy … Are we not already bankrupt?).

The only solution is to completely decentralize and make every citizen an owner of dividend paying securities. A second income. Same as rich people.

In one generation all these problems will subside and deprivation, as has been for almost all human history, will disappear. Capital homestead.

As written above, Social Security and Medicare will be in fiscal trouble in the coming years. Meanwhile, many seniors or workers contemplating retirement have little-to-no savings, believing that they can live on Social Security alone. That’s not to mention that liabilities that many will have from unsustainable debt payments on high interest credit cards. And all of this is the “third rail” of politics, no-one in Congress dares even whisper about it as it’s a doomed political future for anyone (and possibly their party) that does.

Meanwhile, Congress can hardly pass muster on a month’s Federal spending authority, let alone address major issues like this.