Tag: IRA

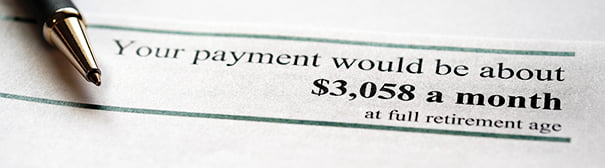

The U.S. Social Security Administration reported a few years ago that half of retirees get at least half of their income from their monthly checks. For lower-income retirees, the benefits constitute almost all of their income. Yet Americans have only a vague understanding of how this crucial program works – one of many obstacles on…

But that doesn’t mean we should change the contribution limits. The technology associated with payroll-deduction IRAs is making it easier and cheaper for employers to enroll their employees in these accounts. That’s wonderful. At any given time, roughly half of private sector workers – primarily those at small companies and the relatively lower paid –…