The U.S. Should Have a “Pension Registry”

Alicia H. Munnell is a columnist for MarketWatch and senior advisor of the Center for Retirement Research at Boston College.

And we are in striking distance of having one.

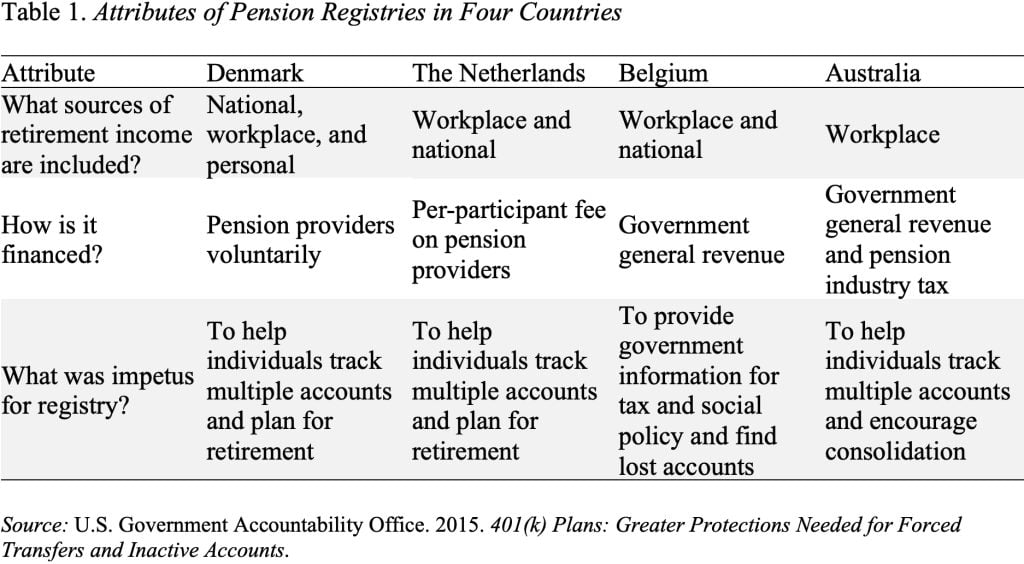

American workers are extremely mobile, and when they leave their jobs many may not know that they are entitled to vested benefits in a defined benefit plan and others do not specify what should be done with the savings in their 401(k) plan. Balances can be forgotten or lost. To avoid these types of problems, many other countries, such as The Netherlands, Australia, and Denmark, provide consolidated online information for participants on all their workforce retirement accounts, and Belgium began doing the same in 2016. These pension registries, which include information on both active and inactive accounts, are helpful not only to participants, but also to plan administrators who use them to locate missing participants and eliminate outstanding liabilities.

The United States does not have a pension registry. Interestingly, the Social Security Administration (SSA) already compiles data on undistributed vested pension benefits for employees who have left a job, using information it receives from the Internal Revenue Service and the Department of Labor. This “Potential Private Retirement Benefits Information,” with data on both defined benefit and defined contribution plans for over 33 million people, includes the name of the plan where a participant may have savings, the plan administrator’s name and address, the participant’s savings balance, and the year that the plan reported savings left behind. SSA sends this information when an individual files for Social Security benefits. The information can be requested earlier, but SSA received only about 760 requests in 2013. SSA apparently does not promote the availability of the information; nor does the agency consolidate information on accounts from several employers to provide beneficiaries with a single statement.

In a 2015 report, the Government Accountability Office recommended that SSA make information on potential vested benefits from prior jobs more accessible to individuals before retirement, perhaps sending consolidated information with the Social Security Statement when it is issued every five years. SSA disagreed with the recommendation, because of concern that it would place the agency in the position of having to answer legal questions about private plans, a task for which SSA lacks the expertise.

I am very sympathetic with SSA’s reluctance to take on any more administrative duties, given the sharp cuts to its budget in recent years. At the same time, it seems crazy to have this information available in one place, not advertise it, and only make it available to people when they claim their benefits and then not in a consolidated form. I have claimed my benefits and don’t remember ever receiving such a form. Indeed, if I did get one, I likely would have thrown it out not knowing what it was.

The stalemate in Congress has made it impossible to accomplish even the simplest tasks. The United States should have a pension registry and we are in striking distance of establishing one. All we need is a little leadership and a little funding.